Question: The IRC Section 199A deduction is designed to give some taxpayers who operate a trade or business directly on Schedule C (or through a flow-through

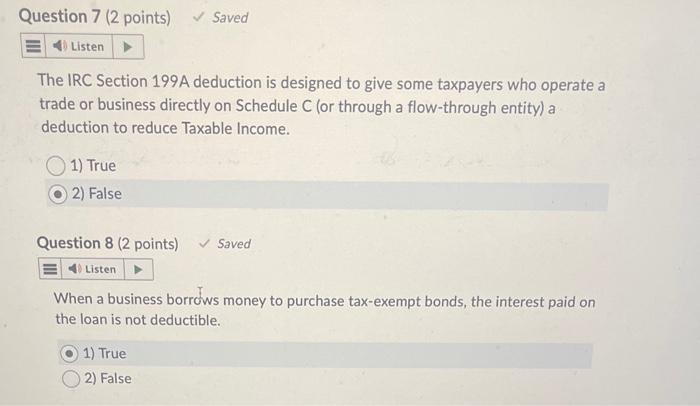

The IRC Section 199A deduction is designed to give some taxpayers who operate a trade or business directly on Schedule C (or through a flow-through entity) a deduction to reduce Taxable Income. 1) True 2) False Question 8 ( 2 points) Saved When a business borrows money to purchase tax-exempt bonds, the interest paid on the loan is not deductible. 1) True 2) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts