Question: The irrigation system a farmer uses ( Option A ) cost $ 1 0 , 0 0 0 eight years ago. It will last another

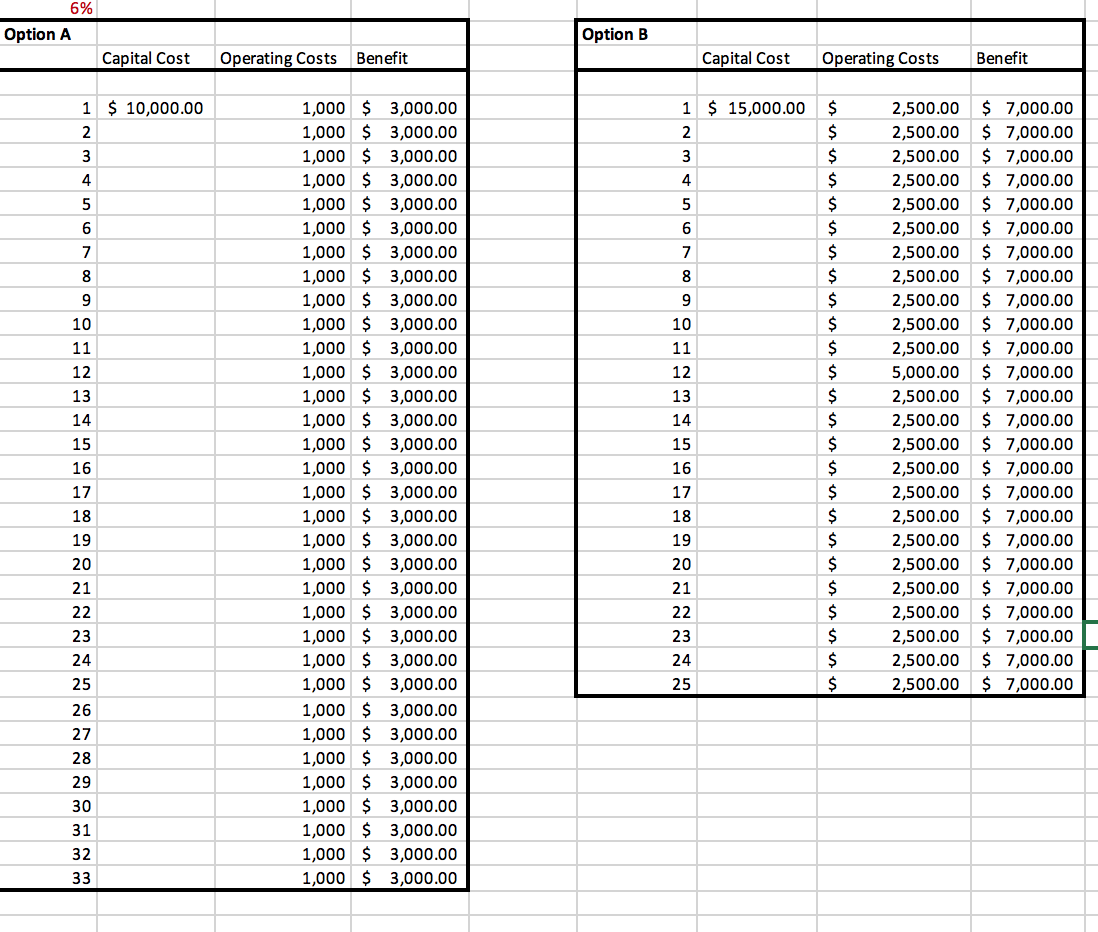

The irrigation system a farmer uses Option A cost $ eight years ago. It will last another years without additional investment. With that system, he produces crops valued at $ per year at a cost of $ per year.

A new system Option B would cost $ to install, but would increase production to $ per year. Operating cost would be $ per year. The farmer would have to refurbish the new system tweleve years after installation at a cost of $

Assume that investment in the new system Option B occurs at the start of the first year, that revenue and operating cost occur at the end of each year and do not change over the twentyfive years, and that both systems have a salvage value of $ at the end of years.

Assume a discount rate.

QUESTIONS:

How should you set up this problem to account for the fact that the existing system is years old? Should the original investment be discounted by years to show this? Attached is an example that assumes that capital investment occurs at the end of Year How should that be revised?

Calculate the Net Present Value for Option A and Option B

Calculate the BenefitCost Ratio for Option A and Option B

Should the farmer replace his existing system? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock