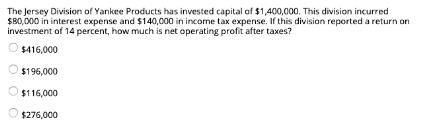

Question: The Jersey Division of Yankee Products has invested capital of $1,400,000. This division incurred S80,000 in interest expense and $140,000 in income tax expense.

The Jersey Division of Yankee Products has invested capital of $1,400,000. This division incurred S80,000 in interest expense and $140,000 in income tax expense. If this division reported a return on investment of 14 percent, how much is net operating profit after taxes? $416,000 $196,000 $116,000 $276,000

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

As we know that Return on investment N... View full answer

Get step-by-step solutions from verified subject matter experts