Question: The Johnsons Decide how to Manage Their Risks Several years have passed since the Johnsons were married, and their financial affairs have become more complicated.

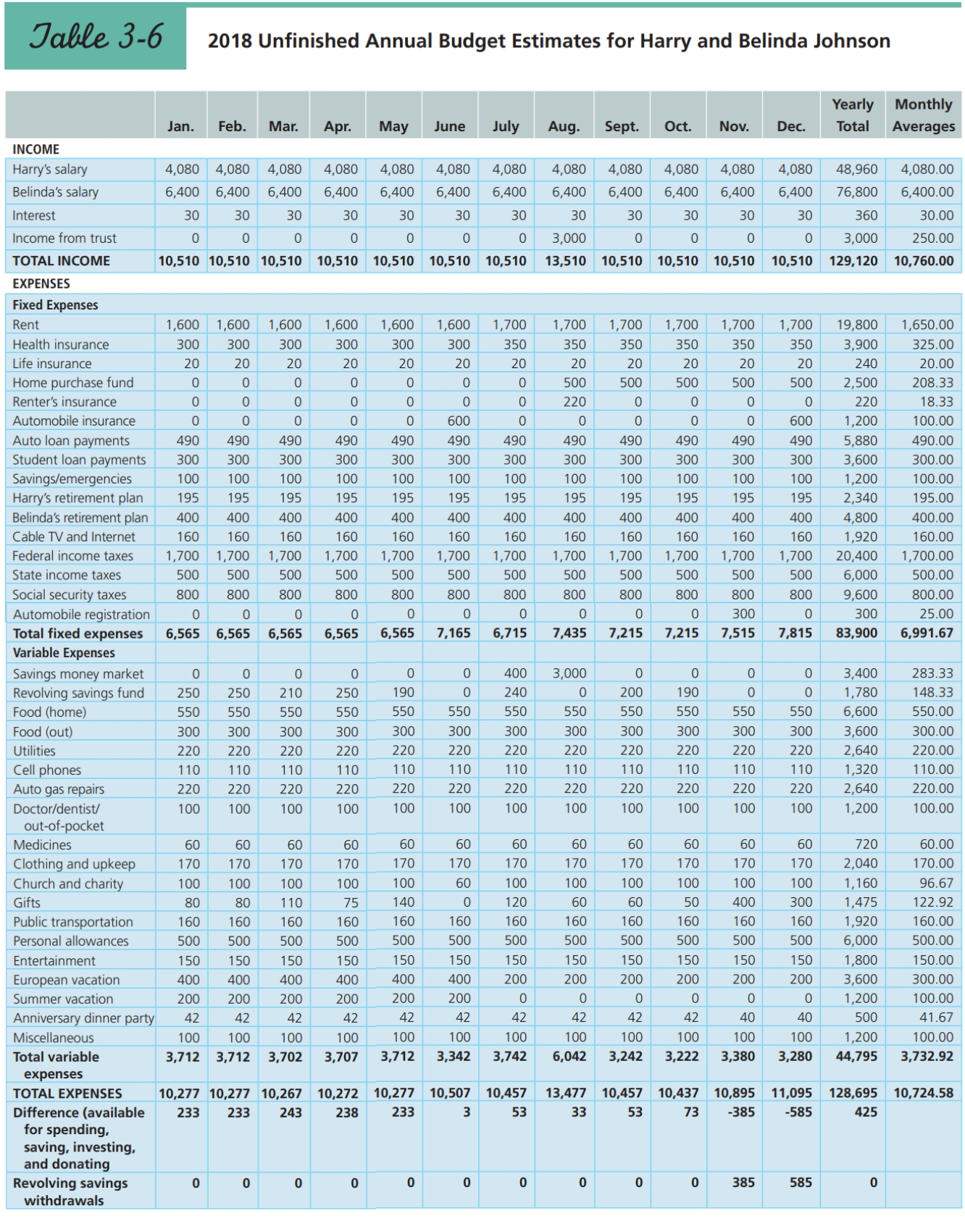

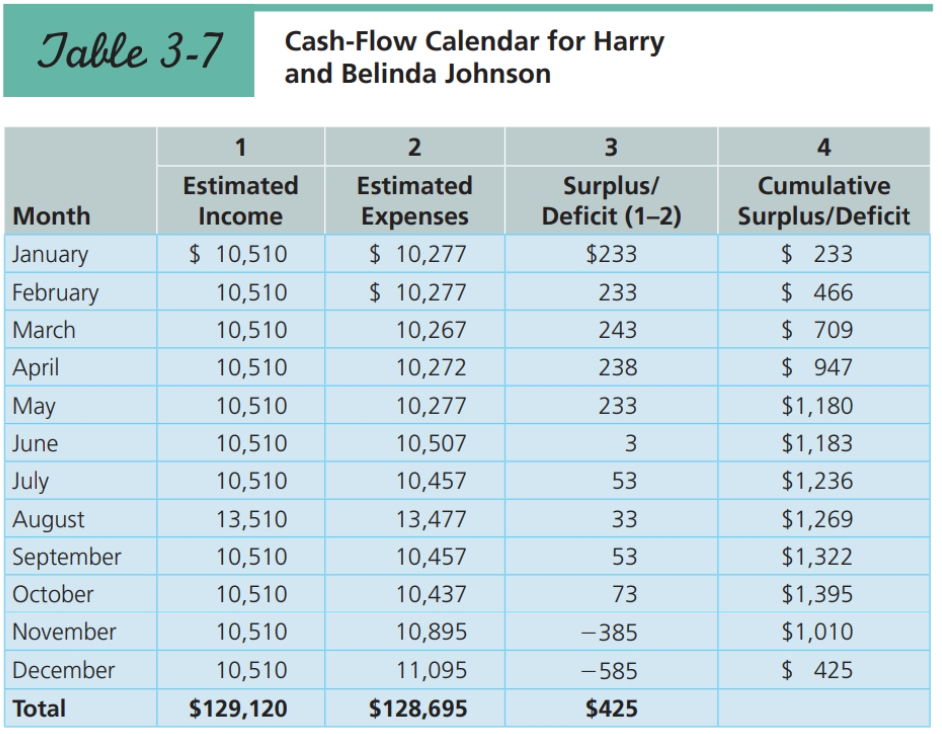

The Johnsons Decide how to Manage Their Risks Several years have passed since the Johnsons were married, and their financial affairs have become more complicated. They recently purchased a $200,000 condominium that has added only about $400 per month to their housing expenses. And they have purchased a second used car for $12,000. As a result of these changes, Harry and Belinda realize that they now face greater risks in their financial affairs. They have decided to review their situation with an eye toward managing their risks more effectively. Use the steps in the risk-management process, their net worth and income and expense statements in Table 3-6 and Table 3-7 to answer the following questions:

a. What are Harry and Belindas major sources of risk from home and automobile ownership, and what is the potential magnitude of loss from each? b. Given the choices listed in Step 3 of the risk-management process (Choose How to Handle Your Risk of Loss), how should the Johnsons handle the sources of risk listed in part a?

a. What are Harry and Belindas major sources of risk from home and automobile ownership, and what is the potential magnitude of loss from each? b. Given the choices listed in Step 3 of the risk-management process (Choose How to Handle Your Risk of Loss), how should the Johnsons handle the sources of risk listed in part a?

Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Yearly Monthly Total Averages Aug. Sept. Oct. Nov. Dec. 4,080 4,080 4,080 4,080 4,080 48,960 4,080.00 6,400 6,400 6,400 6,400 6,400 76,800 6,400.00 30 30 30 30 30 360 30.00 3,000 0 0 0 0 3,000 250.00 13,510 10,510 10,510 10,510 10,510 129,120 10,760.00 1,700 350 20 500 220 0 490 300 1,700 350 20 500 0 0 490 300 1,700 350 20 500 0 0 490 300 100 195 400 160 1,700 500 800 0 7,215 1,700 350 20 500 0 0 490 300 100 195 400 160 1,700 500 800 0 1,700 350 20 500 0 600 490 300 100 195 400 160 1,700 500 800 100 100 19,800 3,900 240 2,500 220 1,200 5,880 3,600 1,200 2,340 4,800 1,920 20,400 6,000 9,600 300 83,900 1,650.00 325.00 20.00 208.33 18.33 100.00 490.00 300.00 100.00 195.00 400.00 160.00 1,700.00 500.00 800.00 25.00 6,991.67 195 160 195 400 160 1,700 500 800 0 7,435 400 160 1,700 500 800 300 7,515 800 0 7,215 7,815 Jan. Feb. Mar. Apr. May June July INCOME Harry's salary 4,080 4,080 4,080 4,080 4,080 4,080 4,080 Belinda's salary 6,400 6,400 6,400 6,400 6,400 6,400 6,400 Interest 30 30 30 30 30 30 30 Income from trust 0 0 0 0 0 0 0 TOTAL INCOME 10,510 10,510 10,510 10,510 10,510 10,510 10,510 EXPENSES Fixed Expenses Rent 1,600 1,600 1,600 1,600 1,600 1,600 1,700 Health insurance 300 300 300 300 300 300 350 Life insurance 20 20 20 20 20 20 20 Home purchase fund 0 0 0 0 0 0 0 Renter's insurance 0 0 0 0 0 0 Automobile insurance 0 0 0 0 600 0 Auto loan payments 490 490 490 490 490 490 490 Student loan payments 300 300 300 300 300 300 300 Savings/emergencies 100 100 100 100 100 100 100 Harry's retirement plan 195 195 195 195 195 195 195 Belinda's retirement plan 400 400 400 400 400 400 400 Cable TV and Internet 160 160 160 160 160 160 Federal income taxes 1,700 1,700 1,700 1,700 1,700 1,700 1,700 State income taxes 500 500 500 500 500 500 500 Social security taxes 800 800 800 800 800 800 Automobile registration 0 0 0 0 0 0 0 Total fixed expenses 6,565 6,5 6,56 6,56 6,565 7,165 6,715 Variable Expenses Savings money market 0 0 0 0 0 0 400 Revolving savings fund 250 250 210 250 190 0 240 Food (home) 550 550 550 550 550 550 550 Food (out) 300 300 300 300 300 300 300 Utilities 220 220 220 220 220 220 220 Cell phones 110 110 110 110 110 110 110 Auto gas repairs 220 220 220 220 220 220 Doctor/dentist/ 100 100 100 100 100 100 100 out-of-pocket Medicines 60 60 60 60 60 60 60 Clothing and upkeep 170 170 170 170 170 170 170 Church and charity 100 100 100 100 100 60 100 Gifts 80 80 110 75 140 0 120 Public transportation 160 160 160 160 160 160 Personal allowances 500 500 500 500 500 500 500 Entertainment 150 150 150 150 150 150 150 European vacation 400 400 400 400 400 400 200 Summer vacation 200 200 200 200 200 200 0 Anniversary dinner party 42 42 42 42 42 42 42 Miscellaneous 100 100 100 100 100 100 100 Total variable 3,712 3,712 3,702 3,707 3,712 3,342 3,742 expenses TOTAL EXPENSES 10,277 10,277 10,267 10,272 10,277 10,507 10,457 Difference (available 233 233 243 238 233 3 53 for spending, saving, investing, and donating Revolving savings 0 0 0 0 0 0 0 withdrawals 0 0 0 190 550 0 3,000 0 550 300 220 110 220 100 0 200 550 300 220 110 300 220 110 220 100 550 300 220 110 0 550 300 220 110 220 100 3,400 1,780 6,600 3,600 2,640 1,320 2,640 1,200 283.33 148.33 550.00 300.00 220.00 110.00 220.00 100.00 220 220 220 100 100 60 170 60 170 100 50 160 500 60 170 100 60 160 500 150 200 0 100 60 160 500 150 200 0 42 100 6,042 60 170 100 400 160 500 150 200 160 60 170 100 300 160 500 150 200 720 2,040 1,160 1,475 1,920 6,000 1,800 3,600 1,200 500 1,200 44,795 60.00 170.00 96.67 122.92 160.00 500.00 150.00 300.00 100.00 41.67 100.00 3,732.92 0 150 200 0 42 100 3,222 0 40 42 100 3,242 100 3,380 40 100 3,280 10,724.58 13,477 10,457 10,437 10,895 11,095 128,695 33 53 73 -385 -585 425 0 0 0 385 585 0 Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson 1 2 4 3 Surplus/ Deficit (1-2) $233 Month Cumulative Surplus/Deficit $ 233 233 $ 466 243 $ 709 238 233 Estimated Income $ 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13,510 10,510 10,510 10,510 10,510 $129,120 January February March April May June July August September October November December Estimated Expenses $ 10,277 $ 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 $128,695 3 53 $ 947 $1,180 $1,183 $1,236 $1,269 $1,322 $1,395 $1,010 33 53 73 -385 $ 425 -585 $425 Total Table 3-6 2018 Unfinished Annual Budget Estimates for Harry and Belinda Johnson Yearly Monthly Total Averages Aug. Sept. Oct. Nov. Dec. 4,080 4,080 4,080 4,080 4,080 48,960 4,080.00 6,400 6,400 6,400 6,400 6,400 76,800 6,400.00 30 30 30 30 30 360 30.00 3,000 0 0 0 0 3,000 250.00 13,510 10,510 10,510 10,510 10,510 129,120 10,760.00 1,700 350 20 500 220 0 490 300 1,700 350 20 500 0 0 490 300 1,700 350 20 500 0 0 490 300 100 195 400 160 1,700 500 800 0 7,215 1,700 350 20 500 0 0 490 300 100 195 400 160 1,700 500 800 0 1,700 350 20 500 0 600 490 300 100 195 400 160 1,700 500 800 100 100 19,800 3,900 240 2,500 220 1,200 5,880 3,600 1,200 2,340 4,800 1,920 20,400 6,000 9,600 300 83,900 1,650.00 325.00 20.00 208.33 18.33 100.00 490.00 300.00 100.00 195.00 400.00 160.00 1,700.00 500.00 800.00 25.00 6,991.67 195 160 195 400 160 1,700 500 800 0 7,435 400 160 1,700 500 800 300 7,515 800 0 7,215 7,815 Jan. Feb. Mar. Apr. May June July INCOME Harry's salary 4,080 4,080 4,080 4,080 4,080 4,080 4,080 Belinda's salary 6,400 6,400 6,400 6,400 6,400 6,400 6,400 Interest 30 30 30 30 30 30 30 Income from trust 0 0 0 0 0 0 0 TOTAL INCOME 10,510 10,510 10,510 10,510 10,510 10,510 10,510 EXPENSES Fixed Expenses Rent 1,600 1,600 1,600 1,600 1,600 1,600 1,700 Health insurance 300 300 300 300 300 300 350 Life insurance 20 20 20 20 20 20 20 Home purchase fund 0 0 0 0 0 0 0 Renter's insurance 0 0 0 0 0 0 Automobile insurance 0 0 0 0 600 0 Auto loan payments 490 490 490 490 490 490 490 Student loan payments 300 300 300 300 300 300 300 Savings/emergencies 100 100 100 100 100 100 100 Harry's retirement plan 195 195 195 195 195 195 195 Belinda's retirement plan 400 400 400 400 400 400 400 Cable TV and Internet 160 160 160 160 160 160 Federal income taxes 1,700 1,700 1,700 1,700 1,700 1,700 1,700 State income taxes 500 500 500 500 500 500 500 Social security taxes 800 800 800 800 800 800 Automobile registration 0 0 0 0 0 0 0 Total fixed expenses 6,565 6,5 6,56 6,56 6,565 7,165 6,715 Variable Expenses Savings money market 0 0 0 0 0 0 400 Revolving savings fund 250 250 210 250 190 0 240 Food (home) 550 550 550 550 550 550 550 Food (out) 300 300 300 300 300 300 300 Utilities 220 220 220 220 220 220 220 Cell phones 110 110 110 110 110 110 110 Auto gas repairs 220 220 220 220 220 220 Doctor/dentist/ 100 100 100 100 100 100 100 out-of-pocket Medicines 60 60 60 60 60 60 60 Clothing and upkeep 170 170 170 170 170 170 170 Church and charity 100 100 100 100 100 60 100 Gifts 80 80 110 75 140 0 120 Public transportation 160 160 160 160 160 160 Personal allowances 500 500 500 500 500 500 500 Entertainment 150 150 150 150 150 150 150 European vacation 400 400 400 400 400 400 200 Summer vacation 200 200 200 200 200 200 0 Anniversary dinner party 42 42 42 42 42 42 42 Miscellaneous 100 100 100 100 100 100 100 Total variable 3,712 3,712 3,702 3,707 3,712 3,342 3,742 expenses TOTAL EXPENSES 10,277 10,277 10,267 10,272 10,277 10,507 10,457 Difference (available 233 233 243 238 233 3 53 for spending, saving, investing, and donating Revolving savings 0 0 0 0 0 0 0 withdrawals 0 0 0 190 550 0 3,000 0 550 300 220 110 220 100 0 200 550 300 220 110 300 220 110 220 100 550 300 220 110 0 550 300 220 110 220 100 3,400 1,780 6,600 3,600 2,640 1,320 2,640 1,200 283.33 148.33 550.00 300.00 220.00 110.00 220.00 100.00 220 220 220 100 100 60 170 60 170 100 50 160 500 60 170 100 60 160 500 150 200 0 100 60 160 500 150 200 0 42 100 6,042 60 170 100 400 160 500 150 200 160 60 170 100 300 160 500 150 200 720 2,040 1,160 1,475 1,920 6,000 1,800 3,600 1,200 500 1,200 44,795 60.00 170.00 96.67 122.92 160.00 500.00 150.00 300.00 100.00 41.67 100.00 3,732.92 0 150 200 0 42 100 3,222 0 40 42 100 3,242 100 3,380 40 100 3,280 10,724.58 13,477 10,457 10,437 10,895 11,095 128,695 33 53 73 -385 -585 425 0 0 0 385 585 0 Table 3-7 Cash-Flow Calendar for Harry and Belinda Johnson 1 2 4 3 Surplus/ Deficit (1-2) $233 Month Cumulative Surplus/Deficit $ 233 233 $ 466 243 $ 709 238 233 Estimated Income $ 10,510 10,510 10,510 10,510 10,510 10,510 10,510 13,510 10,510 10,510 10,510 10,510 $129,120 January February March April May June July August September October November December Estimated Expenses $ 10,277 $ 10,277 10,267 10,272 10,277 10,507 10,457 13,477 10,457 10,437 10,895 11,095 $128,695 3 53 $ 947 $1,180 $1,183 $1,236 $1,269 $1,322 $1,395 $1,010 33 53 73 -385 $ 425 -585 $425 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts