Question: The key principle to take away from this problem is that even though one party has an absolute advantage in borrowing in to different markets

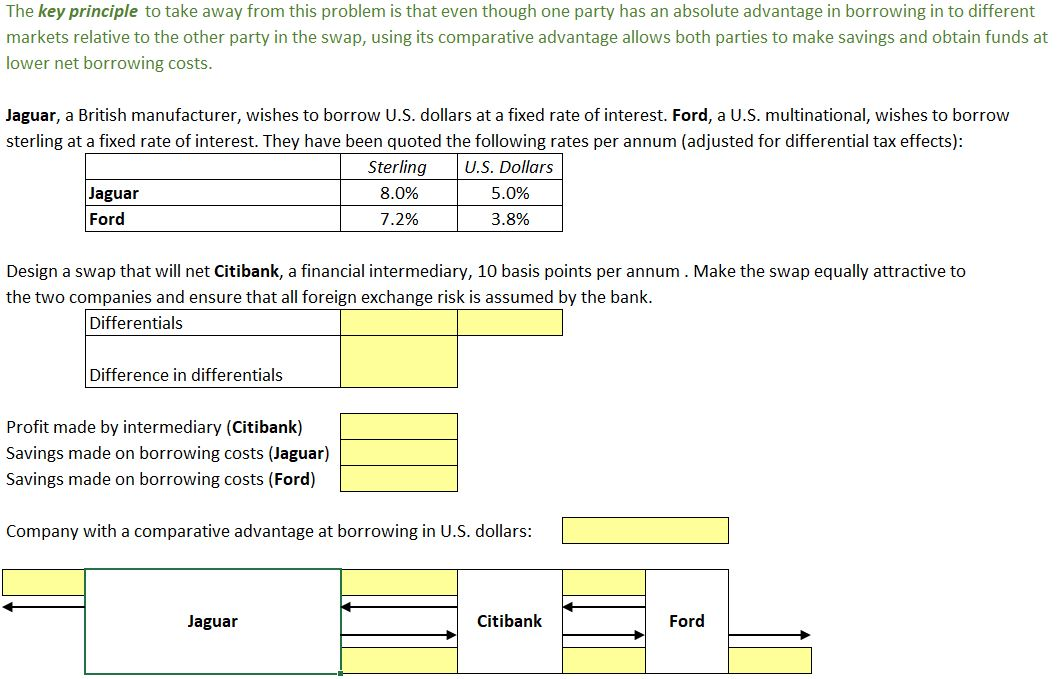

The key principle to take away from this problem is that even though one party has an absolute advantage in borrowing in to different markets relative to the other party in the swap, using its comparative advantage allows both parties to make savings and obtain funds at lower net borrowing costs. Jaguar, a British manufacturer, wishes to borrow U.S. dollars at a fixed rate of interest. Ford, a U.S. multinational, wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects): Sterling U.S. Dollars Jaguar 8.0% 5.0% Ford L 7.2% / 3.8% Design a swap that will net Citibank, a financial intermediary, 10 basis points per annum. Make the swap equally attractive to the two companies and ensure that all foreign exchange risk is assumed by the bank. Differentials Difference in differentials Profit made by intermediary (Citibank) Savings made on borrowing costs (Jaguar) Savings made on borrowing costs (Ford) Company with a comparative advantage at borrowing in U.S. dollars: Jaguar Citibank Ford

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts