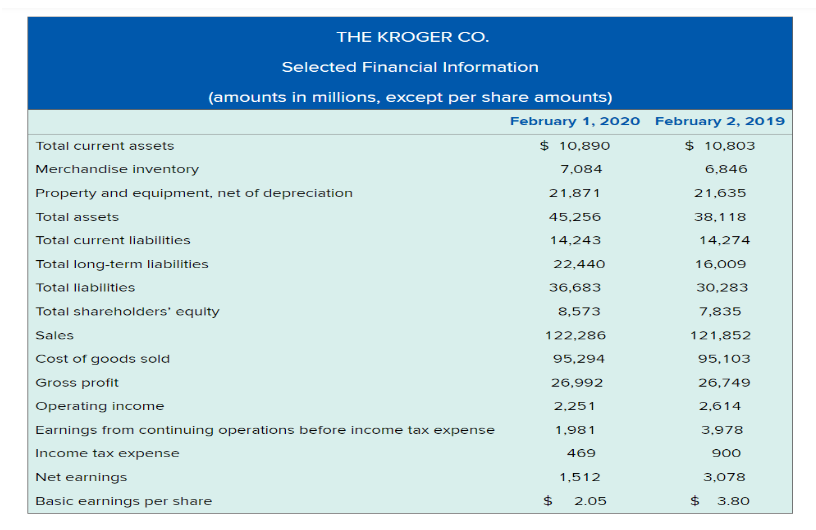

Question: THE KROGER CO . Selected Financial Information ( amounts in millions, except per share amounts ) PUBLIX SUPER MARKETS, INC. Selected Financial Information ( amounts

THE KROGER CO

Selected Financial Information

amounts in millions, except per share amounts PUBLIX SUPER MARKETS, INC.

Selected Financial Information

amounts in millions except per share data

December December Required

a Compute the following ratios for the companies' most recent fiscal years: Note some

amounts are different from the printed text version EXCEL MUST BE USED FOR

CALCULATIONS USING THE EXCEL TEMPLATE PROVIDED IN CANVAS. IT IS

IMPORTANT THAT I BE ABLE TO SEE YOUR WORK.

Current ratio.

Average days to sell inventory. Use average inventory.

Debt to assets ratio.

Return on investment. Use average assets and use "earnings from continuing operations"

rather than "net earnings."

Gross margin percentage.

Asset turnover. Use average assets.

Net margin. Use "earnings from continuing operations" rather than "net earnings."

Plant assets to longterm debt ratio.

b Which company appears to be more profitable? Explain your answer and identify which ratios

from Requirement a you used to reach your conclusion.

c Which company appears to have the higher level of financial risk? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.

d Which company appears to be charging higher prices for its goods? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.

e Which company appears to be the more efficient at using its assets? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.Required

a Compute the following ratios for the companies most recent fiscal years: Note some

amounts are different from the printed text version EXCEL MUST BE USED FOR

CALCULATIONS USING THE EXCEL TEMPLATE PROVIDED IN CANVAS. IT IS

IMPORTANT THAT I BE ABLE TO SEE YOUR WORK.

Current ratio.

Average days to sell inventory. Use average inventory.

Debt to assets ratio.

Return on investment. Use average assets and use earnings from continuing operations

rather than net earnings.

Gross margin percentage.

Asset turnover. Use average assets.

Net margin. Use earnings from continuing operations rather than net earnings.

Plant assets to longterm debt ratio.

b Which company appears to be more profitable? Explain your answer and identify which ratios

from Requirement a you used to reach your conclusion.

c Which company appears to have the higher level of financial risk? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.

d Which company appears to be charging higher prices for its goods? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.

e Which company appears to be the more efficient at using its assets? Explain your answer and

identify which ratios from Requirement a you used to reach your conclusion.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock