Question: The last answer I received was not correct. Guish between a regular Tax Court decision and a memport for your position takes. Assuming that you

The last answer I received was not correct.

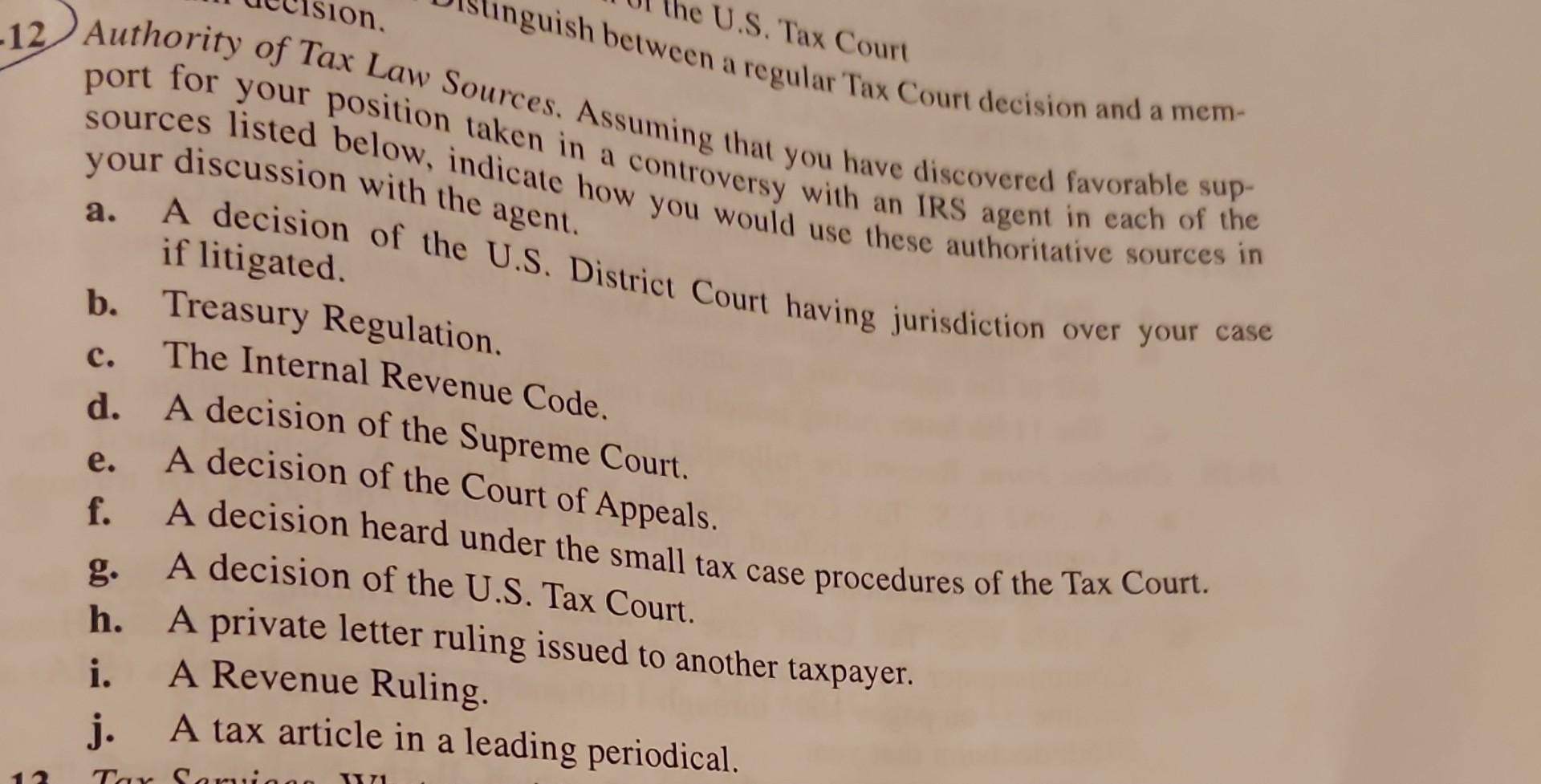

Guish between a regular Tax Court decision and a memport for your position takes. Assuming that you have discovered favorable supsources listed below, indicate how controversy with an IRS agent in each of the your discussion with the agent. if litigated. b. Treasury Regulatio c. The Internal Revenue Code. d. A decision of the Supreme Court. e. A decision of the Court of Appeals. f. A decision heard under the small tax case procedures of the Tax Court. g. A decision of the U.S. Tax Court. h. A private letter ruling issued to another taxpayer. i. A Revenue Ruling. j. A tax article in a leading periodical

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts