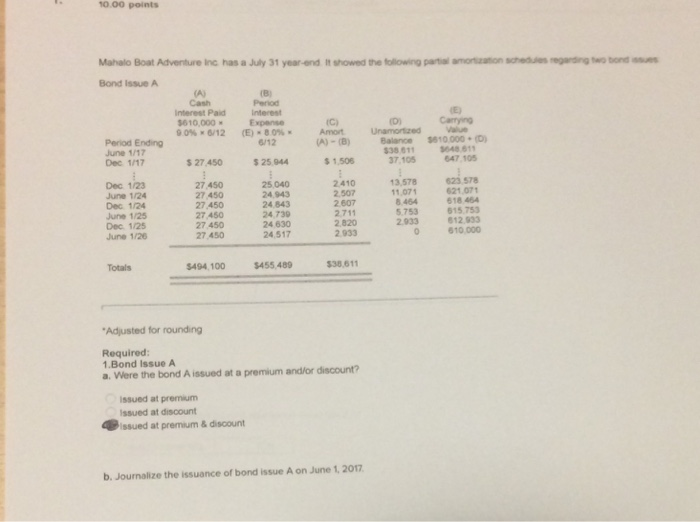

Question: The last time I sent this question, it wasnt completely answered! Thank you for helping this time though. 10.00 points Mahalo Boat Adventure Inc has

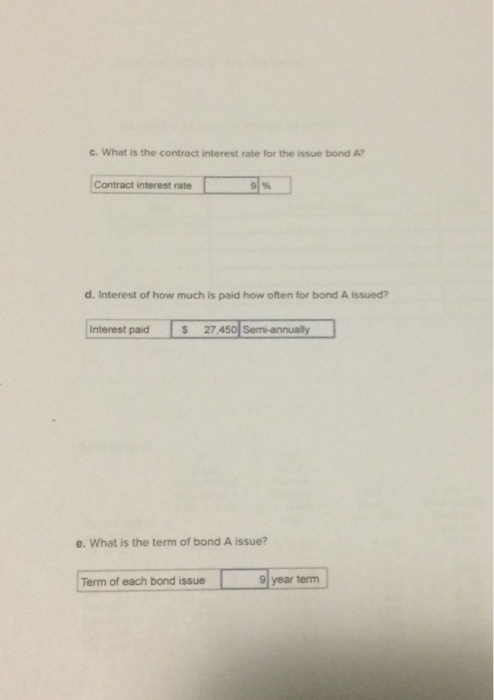

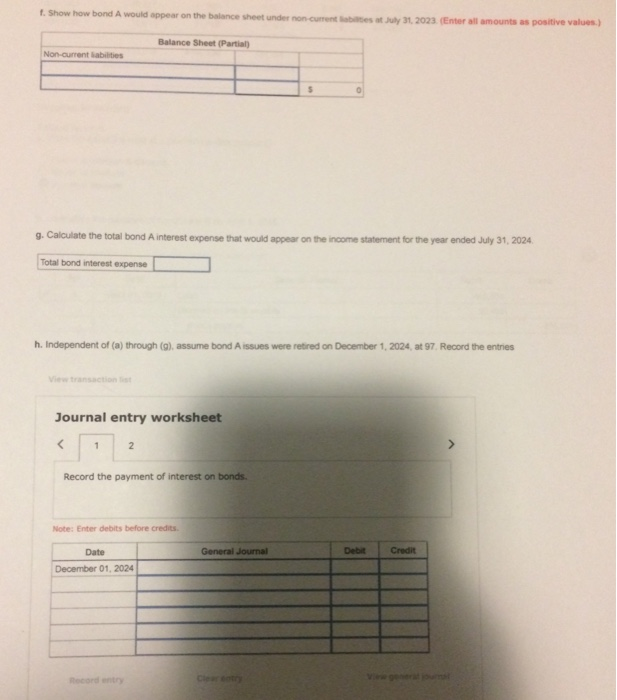

10.00 points Mahalo Boat Adventure Inc has a July 31 year-end it showed the following partial amortization schedues egading two bond sues Bond Issue A interest Paid Interes 610,000Exp 90%x6/12 (E)-80%. Carmying Value Anot Uranoted Period Ending June 1/17 Dec 1/17 )-8 Balance 10 000() 35 611 6/12 648 611 27 450 25 944 $ 1,506 37,105647 105 Dec 1/23 June 1/24 Dec 1/24 June 1/25 Dec. 1/25 June 1/26 27.450 27 450 27 450 27 450 27 450 27 450 25 040 24,943 24.843 24 730 24 630 24 517 13,578 11071 23 578 2.410 2.507 2607 2711 2,820 2.933 8464621 07 5.753 2.933 812.933 18 464 15 75 0610.000 Totals $494,100 $455489 $38,611 Adjusted for rounding Required 1.Bond Issue A a. Were the bond A issued at a premium and/or discount? issued at premium Issued at discount Pissued at premium & discount b. Journalize the issuance of bond issue A on June 1, 2017 C. What is the contract interest rate for the issue bond A? Contract interest rate d. Interest of how much is paid how often for bond A issued? Interest paid S 27450 Sem-nnualy e. What is the term of bond A issue? Term of each bond issue 9 year term A would appear on the balance sheet under non-curent liabilibes at July 31, 2023 (Enter all amounts as positive values.) Balance Sheet (Partial g. Calculate the total bond A interest expense that would appear on the income statement for the year ended July 31, 2024 interest Total bond interest expense h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2024, at 97. Record the entries ew transaction Journal entry worksheet Record the payment of interest on bonds. Note: Enter debits before credits Date General Journal Debit Credit December 01, 2024 cord entry

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts