Question: The last two pics are for segmented income statement v C alibri Light 11 Open in Desktop App A E B Va Tell me what

The last two pics are for segmented income statement

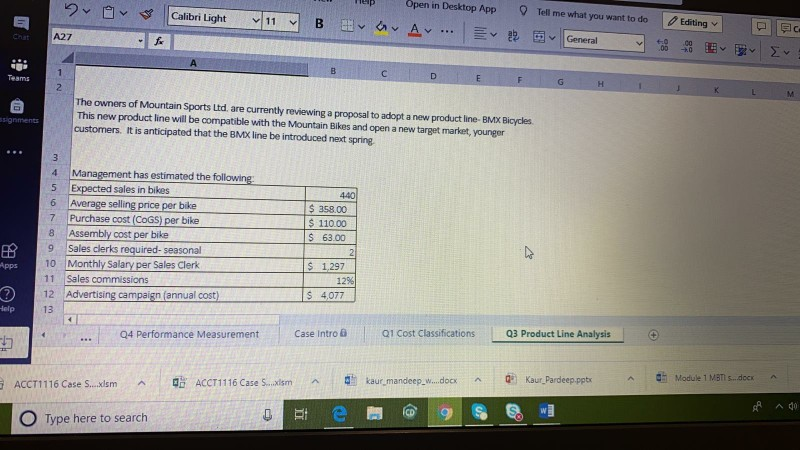

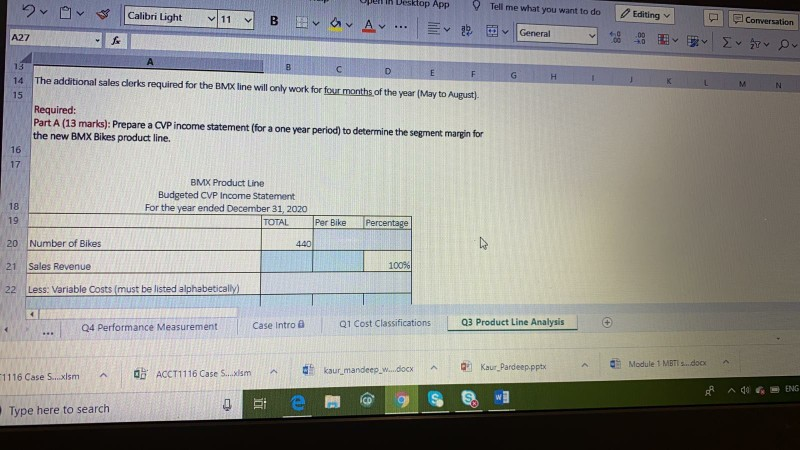

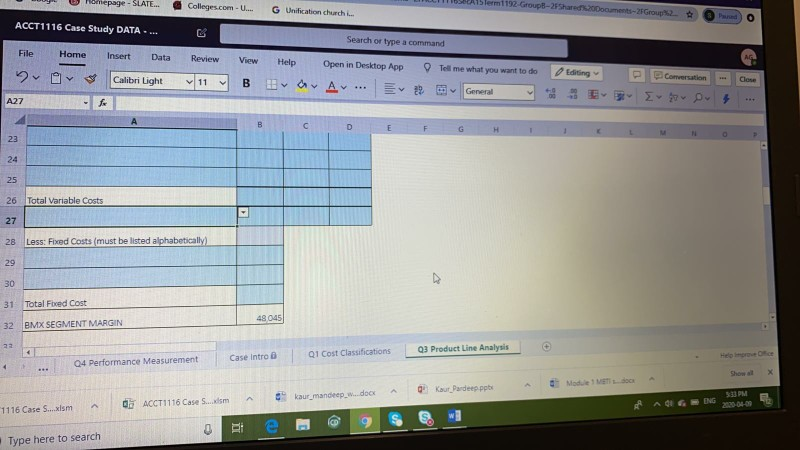

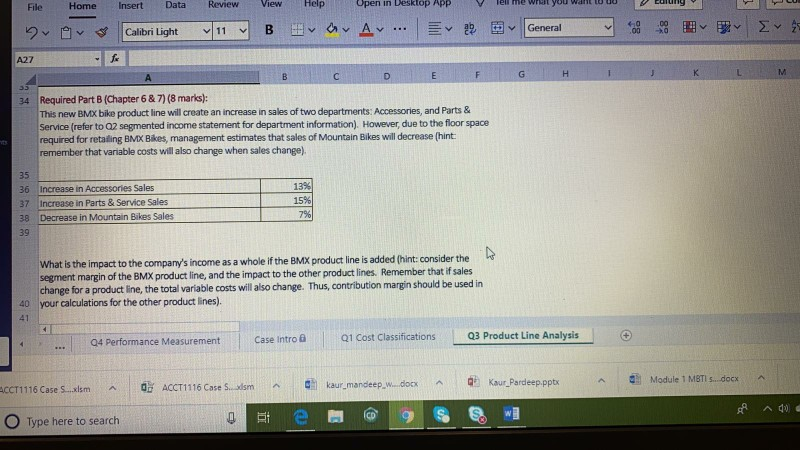

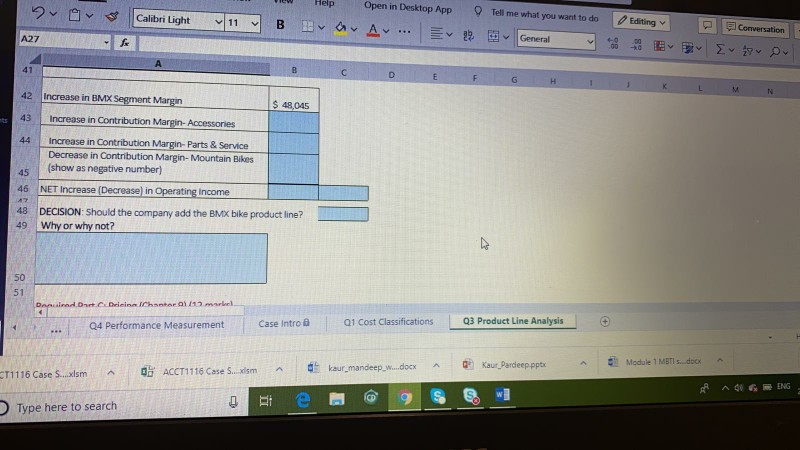

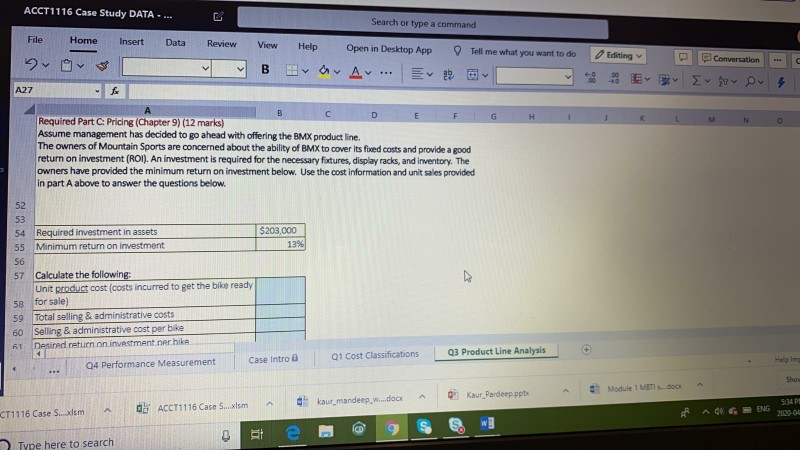

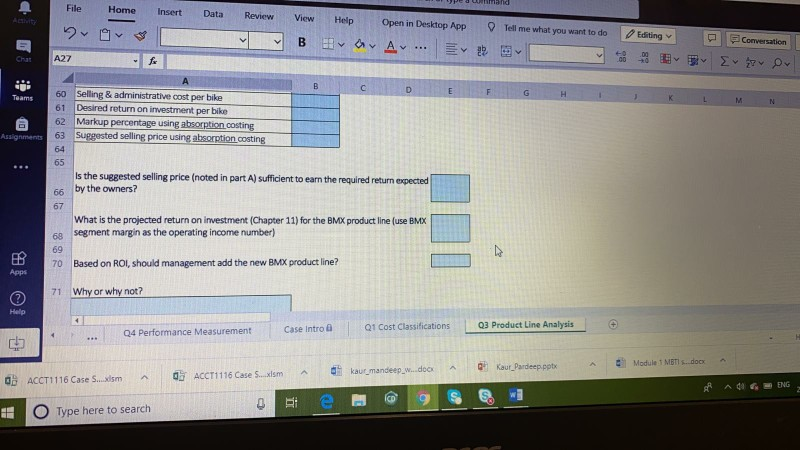

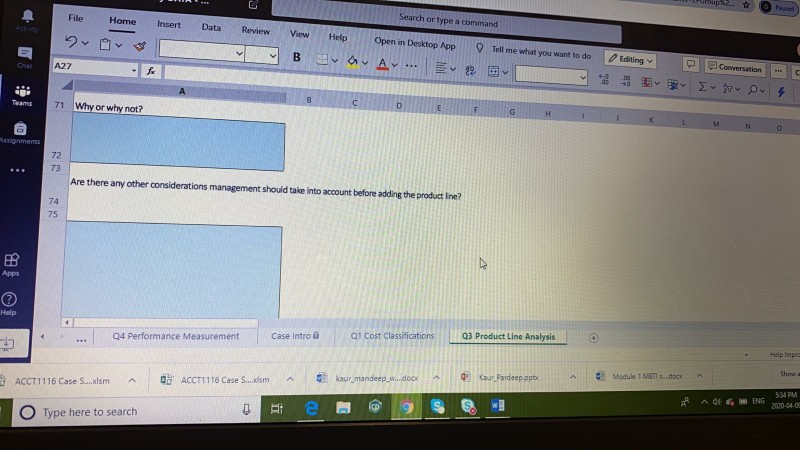

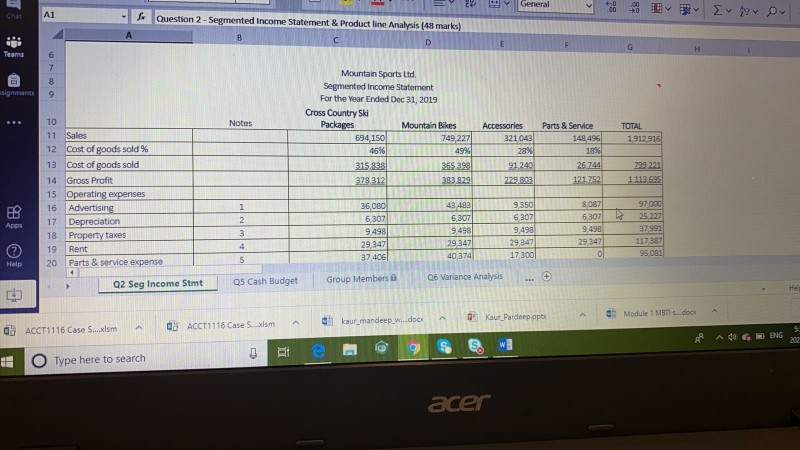

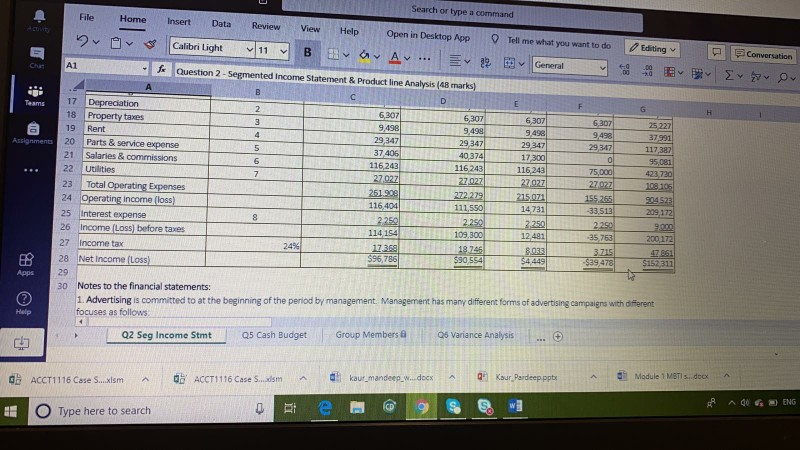

v C alibri Light 11 Open in Desktop App A E B Va Tell me what you want to do G General 12 Editing E 2 A27 C D E F G H I J K L M Teams The owners of Mountain Sports Ltd, are currently reviewing a proposal to adopt a new product line-BMX Bicycles This new product line will be compatible with the Mountain Bikes and open a new target market, younger customers. It is anticipated that the BMX line be introduced next spring guments 4 5 6 7 8 9 440 $ 358.00 $ 110.00 $ 63.00 Management has estimated the following: Expected sales in bikes Average selling price per bike Purchase cost (COGS) per bike Assembly cost per bike Sales clerks required-seasonal Monthly Salary per Sales Clerk Sales commissions Advertising campaign (annual cost) S 1.297 12 4,077 $ Case Intro B Q1 Cost Classifications Q3 Product Line Analysis Q4 Performance Measurement Module 1 MB dock Kaur Pardeep pptx kaur mandeep w....docx ACCT1116 Case ..xlsm ACCT1116 Case S... De CD O Type here to search by v Calibri Light 11 B BY An Desktop App AY ... E Tell me what you want to do General Editing Conversation A27 E e E F The additional sales clerks required for the BMX line will only work for four months of the year (May to August 14 G H I K M N Required: Part A (13 marks): Prepare a CVP income statement (for a one year period) to determine the segment margin for the new BMX Bikes product line. BMX Product Line Budgeted CVP Income Statement For the year ended December 31, 2020 TOTAL Per Bike Percentage Number of Bikes Sales Revenue 100 22 Less: Variable costs (must be listed alphabetically Q4 Performance Measurement Case Intro @ Q1 Cost Classifications _03 Product Line Analysis Module 1 MBTI s...docx 1116 Case S...xlsm 08 ACCT1116 Case S...xlsm a A kaur_Pardeep.pptx kaur_mandeep_W...docx Ad ENG Type here to search U hepage - SLATE Colleges.com Serm 1192 Group-2 G Unification church -Group ACCT1116 Case Study DATA... Search or type a command File Home * View Insert Data Calibri Light fx Review 11 B Help G Open in Desktop App A ... Tell me what you want to do General Editing : Cameration Ez Dw- - Clone A27 Total Variable Costs Less: Fixed Costs must be listed alphabetically 31 Total Fired Cost 49045 32 BMX SEGMENT MARGIN Case Intro 01 Cost Classifications Q3 Product Line Analysis Q4 Performance Measurement Mod a kaur_mandeepw..docx Kaur Pardeep ppte 3:33 PM A ACCT1116 Case Sim 1116 Case S...xlsm d AUG W NG 2009-04-002 S Type here to search insert Data Review View Help Upen in Desktop App y rwme we you want Calibri Light B a Av. General A27 G H I J K L M 34 D E F Required Part B (Chapter 6 & 7) (8 marks): This new BMX bike product line will create an increase in sales of two departments Accessories, and Parts & Service (refer to 2 segmented income statement for department information). However, due to the floor space required for retaling BMX Bikes, management estimates that sales of Mountain Bikes will decrease (hint: remember that variable costs will also change when sales change) 36 Increase in Accessories Sales 37 Increase in Parts & Service Sales 38 Decrease in Mountain Bikes Sales What is the impact to the company's income as a whole if the BMX product line is added (hint:consider the segment margin of the BMX product line, and the impact to the other product lines. Remember that if sales change for a product line, the total variable costs will also change. Thus, contribution margin should be used in your calculations for the other product lines). 40 94 Performance Measurement Case Intro @ 01 Cost Classifications Q3 Product Line Analysis CCT1116 Case S.xlsm o ACCT1116 Case Sam k aur_mandeep_w.docx A k aur_Pardeep.pptx Module 1 MBTI ...docx Type here to search te nep Open in Desktop App av AV ... Iditing Tell me what you want to do General 2 Calibri Light Conversation D 11 B 23 A27 - C D E F 42 Increase in BMX Segment Margin $ 48,045 Increase in Contribution Margin- Accessories Increase in Contribution Margin- Parts & Service Decrease in Contribution Margin- Mountain Bikes (show as negative number) 46 NET Increase Decrease) in Operating income DECISION: Should the company add the BMX bike product line? 49 Why or why not? Q3 Product Line Analysis Dead Out Drisinn Ich m l 04 Performance Measurement Case Intro @ 01 Cost Classifications Module 1 doo docx A Kaur Pardeep.pptx k aurmandeep 06 ACCT1116 Case S.xism A ST1116 Case S...xlsm o tem Type here to search ACCT1116 Case Study DATA.... 6 Search or type a command Data Home Insert 23 Review View Help Open in Desktop App Bay AV... 29 Tell me what you want to do Editing conversation -- EBED A27 G H x L M N o C o E F Required Part C: Pricing (Chapter 9) (12 marks) Assume management has decided to go ahead with offering the BMX product line The owners of Mountain Sports are concerned about the ability of BMX to cover its fixed costs and provide a good return on investment (ROI). An investment is required for the necessary fixtures, display racks, and inventory. The owners have provided the minimum return on investment below. Use the cost information and unit sales provided in part A above to answer the questions below. Required investment in assets Minimum return on investment $203,000 1 396 E 57 Calculate the following: Unit product cost (costs incurred to get the bike ready 58 for sale) 59 Total selling & administrative costs 60 Selling & administrative cost per bike R1 Desired return on investment ner hike Q4 Performance Measurement Case Intro @ 01 Cost Classifications Q3 Product Line Analysis Help me - Module 1 MET Kaur Pardeep pptx kaur_mandeep w....docx QE A doo Shos 534 P! BAAG = ENG 2020-04 CT1116 Case S. dsm 8 ACCT1116 Case S.xlsm e $ wg Type here to search Home Insert File 2 Data Review View Help Open in Desktop App AYA... E Tell me what you want to do B Editing A27 Conversation vor - for D E F Teams G H I J K L M N 989 60 Selling & administrative cost per bike 61 Desired return on investment per bike Markup percentage using absorption costing Suggested selling price using absorption costing Is the suggested selling price (noted in part A) sufficient to earn the required return expected by the owners? 88 98 What is the projected return on investment (Chapter 11) for the BMX product line (use BMX segment margin as the operating income number) Based on ROI, should management add the new BMX product line? Why or why not? Case Intro a 1 Q4 Performance Measurement Q1 Cost Classifications 03 Product Line Analysis A k Module 1 MBTI.docx aur_Pardeep.pptx kaur_mandeep_ .docx 0 ACCT1116 Case S... sm d ACCT1116 Case S.XIMA ANG ENG te @ . O Type here to search mupt Search or type a command Insert Data File Home Dvors A27 - Review v View B v Help Open in Desktop App Hy A v = Tell me what you want to do - Editing 22 Conversation Teams 71 Why or why not? EFGHIJKLMNO a Rigments NR Are there any other considerations management should take into account before adding the productine? Help Q4 Performance Measurement Case Intro @ Q1 Cost Classifications Q3 Product Line Analysis Help Impre ACCT1116 Case S...xism A O ACCT1116 Case S... A kaur_mandeep_w.docx Kaur Pardeep.ppte Module 1 Mondo AG WENG 5:34 PM 2000-04-09 Type here to search =V2 General Question 2 - Segmented Income Statement & Product line Analysis (48 marks Mountain Sports Ltd Segmented Income Statement For the Year Ended Dec 31, 2019 Cross Country Ski Packages Mountain Bikes Accessories Parts & Service TOTAL 694150 749 227 321,043 1 48,496 1912 916 46% 49% 28% 18% 315838 3 6539891240 26744299221 379 312 303 929 229.803 1 21752 1113595 11 Sales 12 Cost of goods sold% 13 Cost of goods sold 14 Gross Profit 15 Operating expenses 16 Advertising AND 17 Depreciation 18 Property taxes 19 Rent 20 Parts & service expense 1 2 3 36080 6, 307 94981 9 3471 37 406 43,489 9 350 9,087 9 7.000 6 ,3076307S6 ,307 25.227 19.498 9,4989,49837991 29347 29347 2 9,347117387 40,374 17300 0 95081 4 2 5 05 Cash Budget Q2 Seg Income Stmt Group Members 06 Variance Analysis ... Module 1 MB dock A dsm ACCT1116 Case S A Kaut Pardeep opte kaur_mandeep_...docx ACCT1116 Case S.xlsma Logo AdG ENG Die w Type here to search acer Editing Conversation Evo Search or type a command File Home Insert Data Review View Help Open in Desktop App Tell me what you want to do Doors Calibri Light 411B B A ... 2 General Al f Question 2 - Segmented Income Statement & Product line Analysis (48 marks) A 17 Depreciation 6307 6 307 6 3071 6307 18 Property taxes 3 9,498 9.4999.4989 .498 19 Rent 4 29,3471 29 3471 2 9347 29347 Parts & service expense 37 406 40374 17300 21 Salaries & commissions 6 116,243 116 2431 116 243 75,000 22 Utilities 7 27022 2702727027 27027 23 Total Operating Expenses 261 908 272.279 215071 1 55 265 Operating Income (loss 116,404 111,5501 1 4731 33 512 Interest expenses 2250 2250 2250 114 154 109 300l 12 481 26 Income (Loss) before taxes 35 753 17.368 8033 3.715 Income tax $39.478 28 Net Income (Loss) 252222 37991 95.000 423 720 108 105 204523 209 172 9,000 200 172 SON 47 951 352 311 30 10 Notes to the financial statements: 1. Advertising is committed to at the beginning of the period by management Management has many different forms of advertising campaigns with different focuses as follows Q2 Seg Income Stmt Q5 Cash Budget Group Members @ 06 Variance Analysis ... + ACCT1116 Case S...xlsm A J ACCT1116 Case S... A kaur_mandeep_W..docx Kaur Pardeep ppts A Module 1 MBTI docx A 40 G A ENG De CD O Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts