Question: The law firm Michelli & Rousso received from a large corporate client an annual retainer fee of $84,000 on March 2, 2020. The fee is

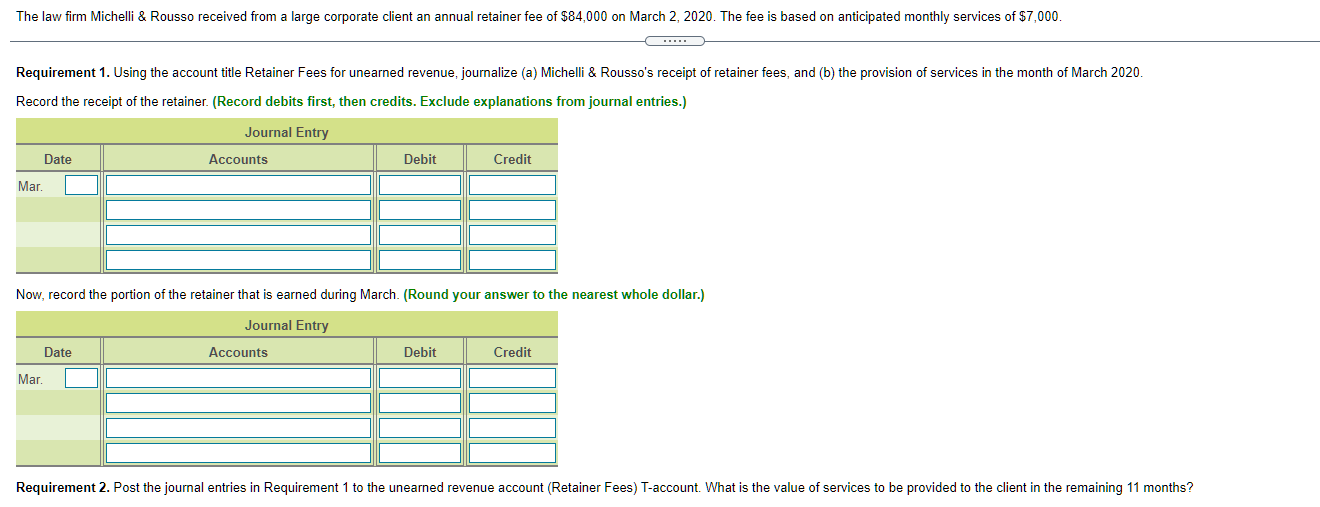

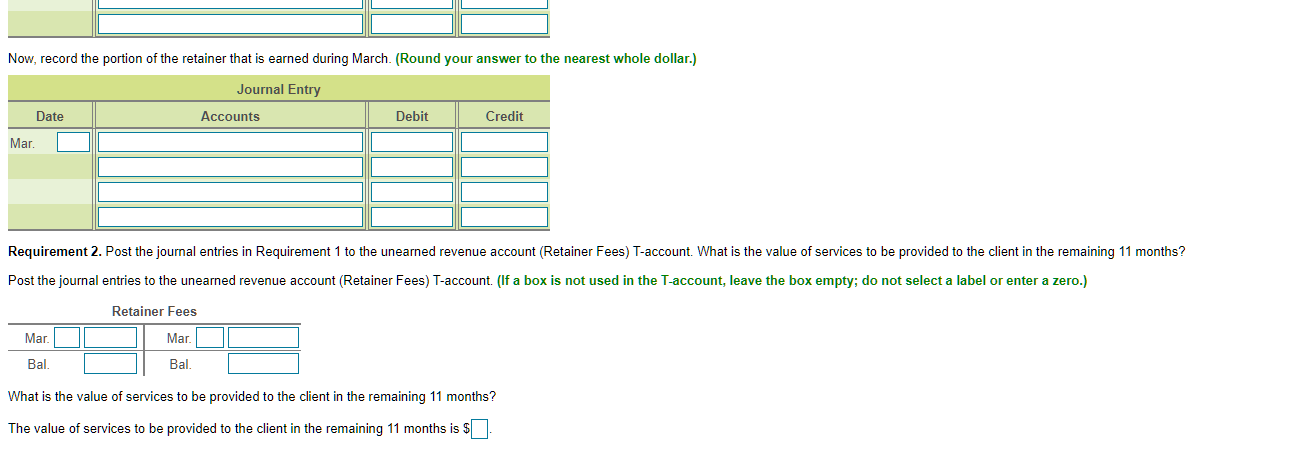

The law firm Michelli & Rousso received from a large corporate client an annual retainer fee of $84,000 on March 2, 2020. The fee is based on anticipated monthly services of $7,000. . Requirement 1. Using the account title Retainer Fees for unearned revenue, journalize (a) Michelli & Rousso's receipt of retainer fees, and (b) the provision of services in the month of March 2020. Record the receipt of the retainer. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit Mar. Now, record the portion of the retainer that is earned during March. (Round your answer to the nearest whole dollar.) Journal Entry Date Accounts Debit Credit Mar. Requirement 2. Post the journal entries in Requirement 1 to the unearned revenue account (Retainer Fees) T-account. What is the value of services to be provided to the client in the remaining 11 months? Now, record the portion of the retainer that is earned during March. (Round your answer to the nearest whole dollar.) Journal Entry Date Accounts Debit Credit Mar. Requirement 2. Post the journal entries in Requirement 1 to the unearned revenue account (Retainer Fees) T-account. What is the value of services to be provided to the client in the remaining 11 months? Post the journal entries to the unearned revenue account (Retainer Fees) T-account. (If a box is not used in the T-account, leave the box empty; do not select a label or enter a zero.) Retainer Fees Mar. Mar. Bal. Bal What is the value of services to be provided to the client in the remaining 11 months? The value of services to be provided to the client in the remaining 11 months is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts