Question: The learning outcomes assessed in this coursework include: 3. Prepare and explain accounting information and financial statements for small organisations operating within the not-for-profit sector

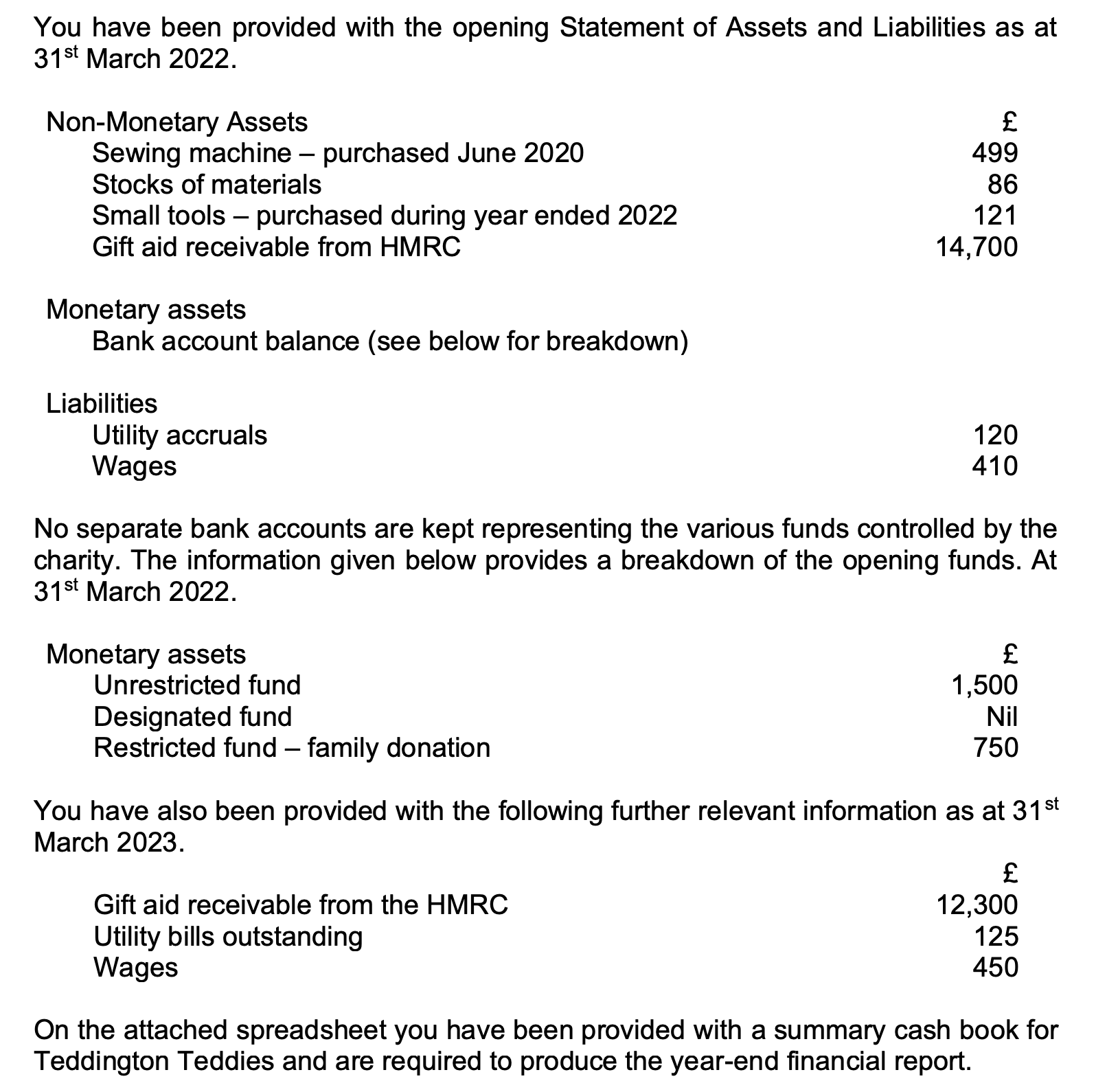

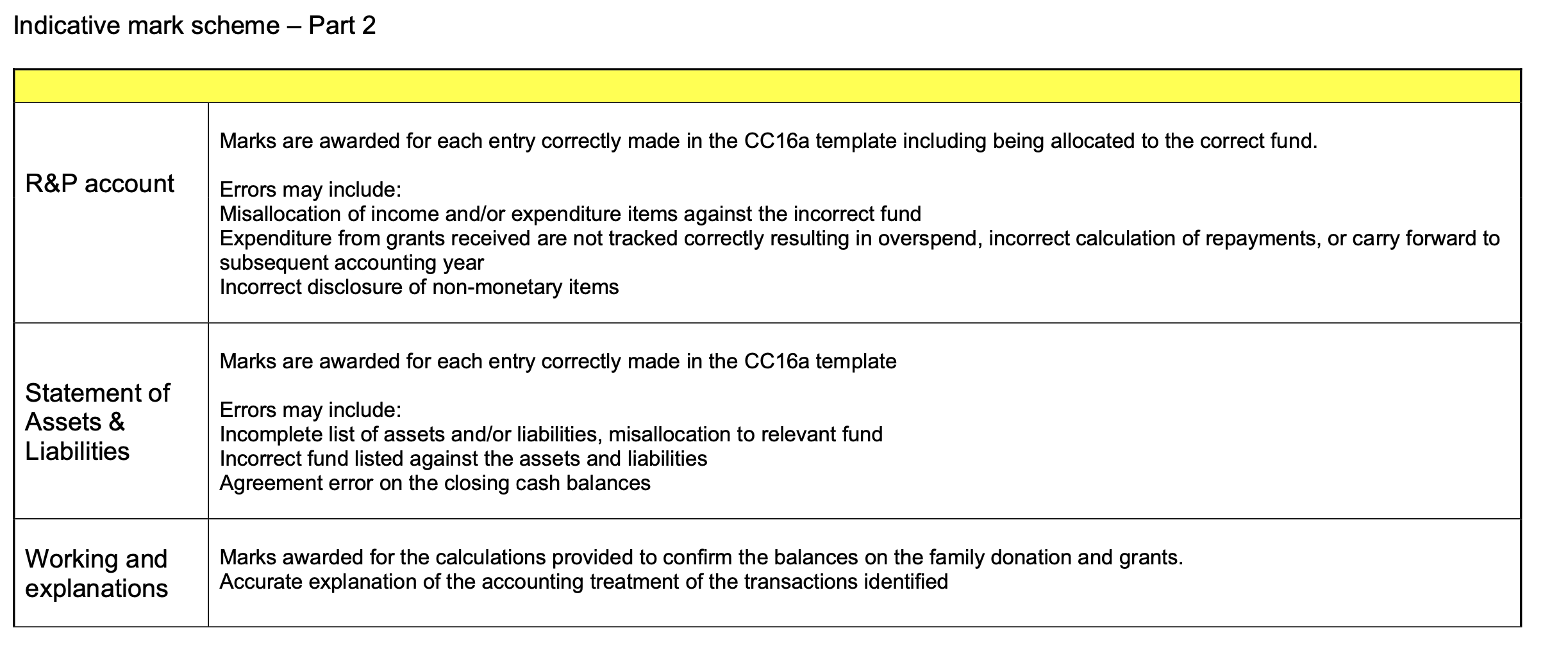

The learning outcomes assessed in this coursework include: 3. Prepare and explain accounting information and financial statements for small organisations operating within the not-for-profit sector You work as a trainee accountant in an accountancy practice which specialises in accounting for charities. One of their clients is a charity that makes and donates teddy bears to sick children staying in hospitals or hospices: Teddington Teddies, which is registered with the Charities Commission for England and Wales (CCEW). You have been instructed by your manager to prepare, using the Charity Commission's template: CC16a, the receipts and payments account, for the year ending 31st March 2023 and a statement of assets and liabilities as at 31st March 2023. Teddington Teddies receives its income in various forms: donations from the public, legacies in wills, grants from funding bodies and receipts from fund raising activities. To be able to make the teddy bears, the charity also receives toy fur, buttons, stuffing, thread, etc from local and national haberdashery stores free of charge, usually from end-of-line stock which can not be sold in their stores. Although on occasions the charity does need to purchase some materials. You should also enter the following transactions onto the CC16a receipts and payments return. Two years ago, the family of a child who received one of the bears made a donation to assist with covering the costs of buying small tools and consumables. Any underspent funds could be retained by the charity to spend in future years. The charity has also received two grants: 1) to purchase a new sewing machine - any underspend of the grant for the sewing machine was required to be repaid to the funding provider 2) to help with the payment of overheads: electricity, rent, rates, etc You have been provided with the opening Statement of Assets and Liabilities as at 31st March 2022. Non-Monetary Assets Monetary assets Bank account balance (see below for breakdown) Liabilities \begin{tabular}{lr} Utility accruals & 120 \\ Wages & 410 \end{tabular} No separate bank accounts are kept representing the various funds controlled by the charity. The information given below provides a breakdown of the opening funds. At D1st A 1amah nnon You have also heen nrovided with the followind further relevant information as at 31st On the attached spreadsheet you have been provided with a summary cash book for Teddington Teddies and are required to produce the year-end financial report. a) You should prepare the following statements: - Statement of receipts and payments for the year ending 31st March 2023 - Statement of assets and liabilities as at 31st March 2023 using the CCEW CC16a template provided. (50 marks) b) You should prepare a written explanation, including supporting calculations, to inform the Board of Trustees how entries have been made to the financial statements for the following transactions. 1) The closing balance on the family donation. 2) The amount to be repaid on the grant for the sewing machine 3) How the opening and closing electricity and wages costs have been dealt with (10 marks) Note: this is a fictitious scenario and therefore the effect of COVID-19 has been ignored. Indicative mark scheme - Part 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts