Question: The lender will consider making you a loan on the apartment complex you are looking to purchase. The lender has agreed to give you a

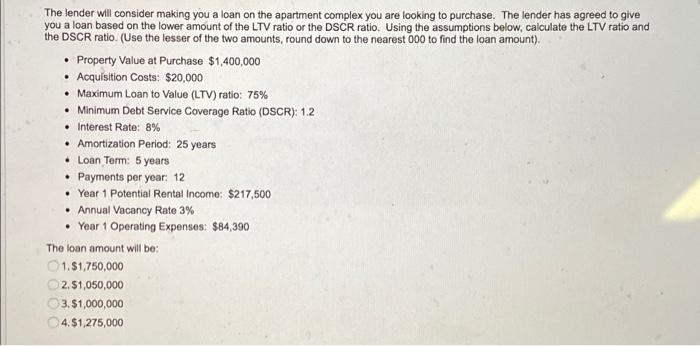

The lender will consider making you a loan on the apartment complex you are looking to purchase. The lender has agreed to give you a loan based on the lower amount of the LTV ratio or the DSCR ratio. Using the assumptions below, calculate the LTV ratio and the DSCR ratio. (Use the lesser of the two amounts, round down to the nearest 000 to find the loan amount). Property Value at Purchase $1,400,000 Acquisition Costs: $20,000 Maximum Loan to Value (LTV) ratio: 75% Minimum Debt Service Coverage Ratio (DSCR): 1.2 Interest Rate: 8% Amortization Period: 25 years Loan Term: 5 years Payments per year: 12 Year 1 Potential Rental Income: $217,500 Annual Vacancy Rate 3% Year 1 Operating Expenses: $84,390 The loan amount will be 1.S1,750,000 2.51,050,000 3. $1,000,000 4.$1,275,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts