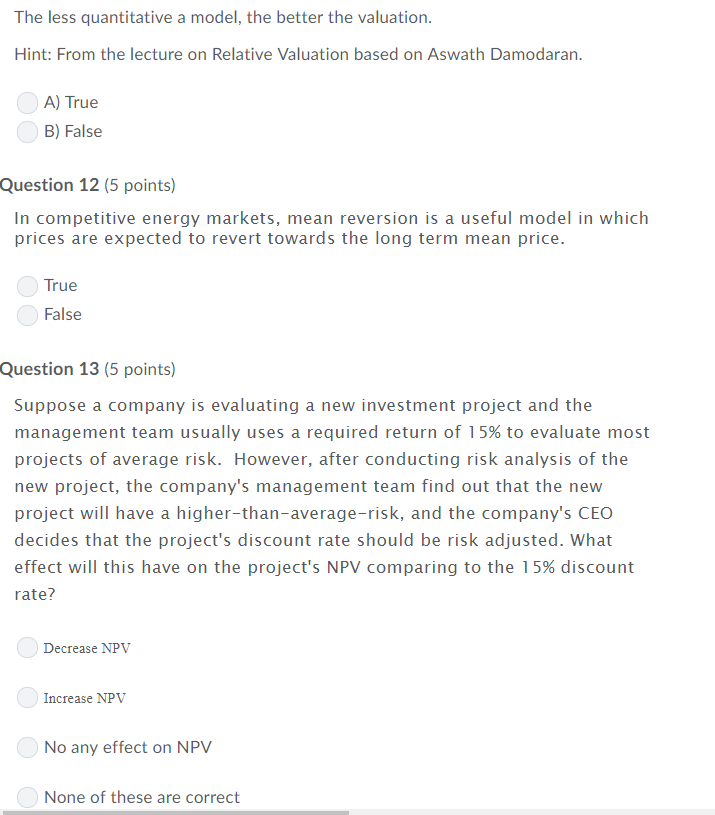

Question: The less quantitative a model, the better the valuation. Hint: From the lecture on Relative Valuation based on Aswath Damodaran. A) True B) False Question

The less quantitative a model, the better the valuation. Hint: From the lecture on Relative Valuation based on Aswath Damodaran. A) True B) False Question 12 (5 points) In competitive energy markets, mean reversion is a useful model in which prices are expected to revert towards the long term mean price. True False Question 13 (5 points) Suppose a company is evaluating a new investment project and the management team usually uses a required return of 15% to evaluate most projects of average risk. However, after conducting risk analysis of the new project, the company's management team find out that the new project will have a higher-than-average-risk, and the company's CEO decides that the project's discount rate should be risk adjusted. What effect will this have on the project's NPV comparing to the 15% discount rate? Decrease NPV Increase NPV No any effect on NPVv None of these are correct The less quantitative a model, the better the valuation. Hint: From the lecture on Relative Valuation based on Aswath Damodaran. A) True B) False Question 12 (5 points) In competitive energy markets, mean reversion is a useful model in which prices are expected to revert towards the long term mean price. True False Question 13 (5 points) Suppose a company is evaluating a new investment project and the management team usually uses a required return of 15% to evaluate most projects of average risk. However, after conducting risk analysis of the new project, the company's management team find out that the new project will have a higher-than-average-risk, and the company's CEO decides that the project's discount rate should be risk adjusted. What effect will this have on the project's NPV comparing to the 15% discount rate? Decrease NPV Increase NPV No any effect on NPVv None of these are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts