Question: The lists are available options for accounts. Please explain how you came to your answers. Whispering Winds Corporation uses spedal strapping equipment in its packaging

The lists are available options for accounts. Please explain how you came to your answers.

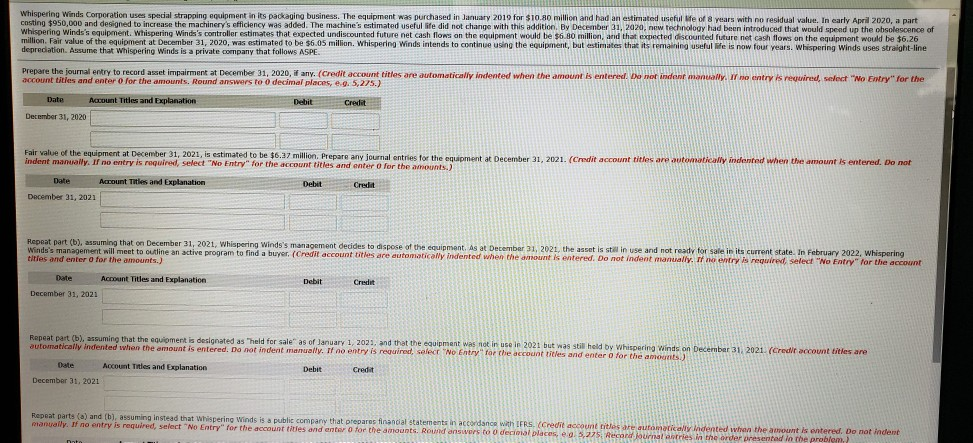

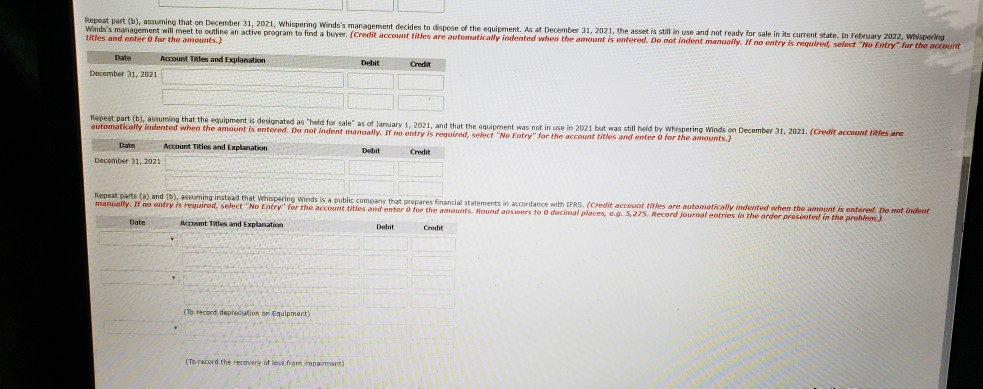

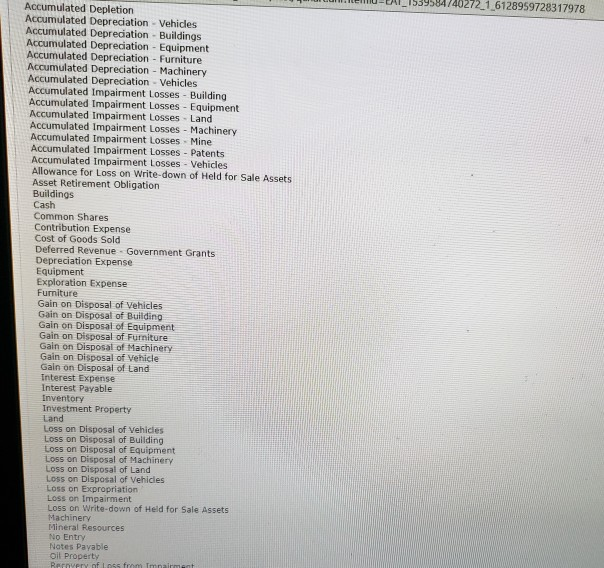

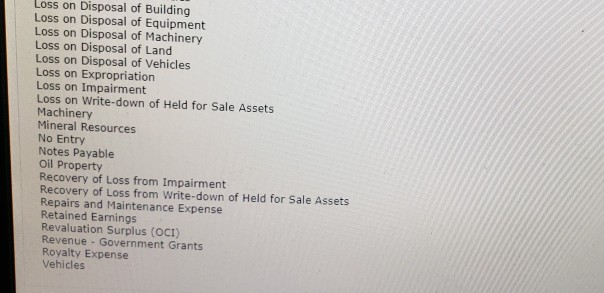

Whispering Winds Corporation uses spedal strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10.50 million and had an estimated useful le of years with no residual value in early April 2020, a part costing $950,000 and designed to increase the machinerys efficiency was added. The machine's estimated useful life did not change with this addition, By December 31, 2020, nuw technology had been introduced that would spend up the obsolescence of Whispering Winds's equipment. Whispering Winds's controlier estimates that expected undiscounted future net cash flow on the equipment would be 56.8 million, and that expected discounted future net cash flows on the equipment would be $6.26 million. Fair value of the equipment at December 31, 2020, was estimated to be $6.05 million. Whispering Winds intends to continue using the equipment, but estimates that its remaining usefulHe is now four years. Whispering Winds uses straight-line depredation. Assume that whispering Winds is a private company that follows ASPE Prepare the journal entry to record asset impairment at December 31, 2020,* any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "Mo Entry for the account titles and enter for the amounts. Round answers to decimal places, e.g. 5,275.) Debit Credit Date Amount Tities and Explanation December 31, 2020 Fair value of the equipment at December 31, 2021, is estimated to be $6.37 million. Prepare any journal entries for the equipment at December 31, 2021. (Credit account titles are automatically indeed when the amount is entered. Do not indent manually. If no entry is required, select "Ne intry for the account titles and enter for the amounts) Acount Titles and Explanation December 31, 2021 Repeat part (b), assuming that on December 31, 2021, Whispering Winds's management decides to dispose of the mont. As at December 31, 2021, the asset is still in use and not ready for sale in its current state. In February 2022, whispering Winds's management will meet to outline an active program to find a buyer. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If ne entry required select "No Entry for the account titles and enter for the amounts) Date Account Tries and Explanation Deber December 31, 2021 Repeat part (b), assuming that the equipment is designated as "held for sale as of January 1, 2023, and that the equipment was not in use le 2021 but was still held by Whispering winds on December 312021 (Cred automatically indented when the amount is entered. Do not indent manually. If entry is required, select "No Entry for the accountitles and enter for the amounts) countries are Date Account Titles and Explanation Debet December 31, 2021 Repeat parts (a) and (b), assuming instead that whispering Winds is a public company that prepares financial statements in accordance with IFRS, Credit account iter unamatically indented when the amount is entered. De nat indent manually. If no entry is required select "No Entry for the account thies avid enter for the amounts. Round answers to decinal places, eg: 3,225 Recantournaltres in the order presentad in the robin Repeat part (b), assuming that on December 31, 2021, Whispering Winds's management decides to dispose of the equipment. As at December 31, 2021, the asset is still in use and not ready for sale in its current state. In February 2022, Whispeving Wind's management will meet to outline an active program to find a buyer. (Credit account files are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts) Account Titles and Explanation December 31, 2021 Repeat part (b) asuming that the equipment is designated as held for sale as of January 1, 2021, and that the equipment was not in use in 2021 but was still held by Whispering Winds on December 31, 2021. (Credit account ttles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No ftry" for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation December 31, 2021 Repeat parts (a) and (b), assuming instead that whispering Winds is a public company that prepares financial statements in accordance with IFRS. (Credit account s are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amount Hound answers to deca Nac 5 .225. Record journal entries in the order presented in the prom ) Act Titles and Explanation (To record depreciation on Equipment) To record the recovery of loss from E NUAI_1539584740272 1 6128959728317978 M Accumulated Depletion Accumulated Depreciation - Vehicles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Accumulated Depreciation - Machinery Accumulated Depreciation Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Vehicles Allowance for Loss on Write-down of Held for Sale Assets Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Exploration Expense Furniture Gain on Disposal of Vehicles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture Gain on Disposal of Machinery Gain on Disposal of Vehicle Gain on Disposal of Land Interest Expense Interest Payable Inventory Investment Property Land Loss on Disposal of Vehicles Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Land Loss on Disposal of Vehicles Loss on Expropriation Loss on Impairment Loss on Write-down of Held for Sale Assets Machinery Mineral Resources No Entry Notes Payable Oil Property Revery of Lngsfrmmairment Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Land Loss on Disposal of Vehicles Loss on Expropriation Loss on Impairment Loss on Write-down of Held for Sale Assets Machinery Mineral Resources No Entry Notes Payable Oil Property Recovery of Loss from Impairment Recovery of Loss from Write-down of Held for Sale Assets Repairs and Maintenance Expense Retained Earnings Revaluation Surplus (OCT) Revenue - Government Grants Royalty Expense Vehicles Whispering Winds Corporation uses spedal strapping equipment in its packaging business. The equipment was purchased in January 2019 for $10.50 million and had an estimated useful le of years with no residual value in early April 2020, a part costing $950,000 and designed to increase the machinerys efficiency was added. The machine's estimated useful life did not change with this addition, By December 31, 2020, nuw technology had been introduced that would spend up the obsolescence of Whispering Winds's equipment. Whispering Winds's controlier estimates that expected undiscounted future net cash flow on the equipment would be 56.8 million, and that expected discounted future net cash flows on the equipment would be $6.26 million. Fair value of the equipment at December 31, 2020, was estimated to be $6.05 million. Whispering Winds intends to continue using the equipment, but estimates that its remaining usefulHe is now four years. Whispering Winds uses straight-line depredation. Assume that whispering Winds is a private company that follows ASPE Prepare the journal entry to record asset impairment at December 31, 2020,* any. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "Mo Entry for the account titles and enter for the amounts. Round answers to decimal places, e.g. 5,275.) Debit Credit Date Amount Tities and Explanation December 31, 2020 Fair value of the equipment at December 31, 2021, is estimated to be $6.37 million. Prepare any journal entries for the equipment at December 31, 2021. (Credit account titles are automatically indeed when the amount is entered. Do not indent manually. If no entry is required, select "Ne intry for the account titles and enter for the amounts) Acount Titles and Explanation December 31, 2021 Repeat part (b), assuming that on December 31, 2021, Whispering Winds's management decides to dispose of the mont. As at December 31, 2021, the asset is still in use and not ready for sale in its current state. In February 2022, whispering Winds's management will meet to outline an active program to find a buyer. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If ne entry required select "No Entry for the account titles and enter for the amounts) Date Account Tries and Explanation Deber December 31, 2021 Repeat part (b), assuming that the equipment is designated as "held for sale as of January 1, 2023, and that the equipment was not in use le 2021 but was still held by Whispering winds on December 312021 (Cred automatically indented when the amount is entered. Do not indent manually. If entry is required, select "No Entry for the accountitles and enter for the amounts) countries are Date Account Titles and Explanation Debet December 31, 2021 Repeat parts (a) and (b), assuming instead that whispering Winds is a public company that prepares financial statements in accordance with IFRS, Credit account iter unamatically indented when the amount is entered. De nat indent manually. If no entry is required select "No Entry for the account thies avid enter for the amounts. Round answers to decinal places, eg: 3,225 Recantournaltres in the order presentad in the robin Repeat part (b), assuming that on December 31, 2021, Whispering Winds's management decides to dispose of the equipment. As at December 31, 2021, the asset is still in use and not ready for sale in its current state. In February 2022, Whispeving Wind's management will meet to outline an active program to find a buyer. (Credit account files are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account tities and enter for the amounts) Account Titles and Explanation December 31, 2021 Repeat part (b) asuming that the equipment is designated as held for sale as of January 1, 2021, and that the equipment was not in use in 2021 but was still held by Whispering Winds on December 31, 2021. (Credit account ttles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No ftry" for the account titles and enter for the amounts) Debit Credit Date Account Titles and Explanation December 31, 2021 Repeat parts (a) and (b), assuming instead that whispering Winds is a public company that prepares financial statements in accordance with IFRS. (Credit account s are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amount Hound answers to deca Nac 5 .225. Record journal entries in the order presented in the prom ) Act Titles and Explanation (To record depreciation on Equipment) To record the recovery of loss from E NUAI_1539584740272 1 6128959728317978 M Accumulated Depletion Accumulated Depreciation - Vehicles Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Furniture Accumulated Depreciation - Machinery Accumulated Depreciation Vehicles Accumulated Impairment Losses - Building Accumulated Impairment Losses - Equipment Accumulated Impairment Losses - Land Accumulated Impairment Losses - Machinery Accumulated Impairment Losses - Mine Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Vehicles Allowance for Loss on Write-down of Held for Sale Assets Asset Retirement Obligation Buildings Cash Common Shares Contribution Expense Cost of Goods Sold Deferred Revenue - Government Grants Depreciation Expense Equipment Exploration Expense Furniture Gain on Disposal of Vehicles Gain on Disposal of Building Gain on Disposal of Equipment Gain on Disposal of Furniture Gain on Disposal of Machinery Gain on Disposal of Vehicle Gain on Disposal of Land Interest Expense Interest Payable Inventory Investment Property Land Loss on Disposal of Vehicles Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Land Loss on Disposal of Vehicles Loss on Expropriation Loss on Impairment Loss on Write-down of Held for Sale Assets Machinery Mineral Resources No Entry Notes Payable Oil Property Revery of Lngsfrmmairment Loss on Disposal of Building Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Land Loss on Disposal of Vehicles Loss on Expropriation Loss on Impairment Loss on Write-down of Held for Sale Assets Machinery Mineral Resources No Entry Notes Payable Oil Property Recovery of Loss from Impairment Recovery of Loss from Write-down of Held for Sale Assets Repairs and Maintenance Expense Retained Earnings Revaluation Surplus (OCT) Revenue - Government Grants Royalty Expense Vehicles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts