Question: The machine exchanged for the 12% note is custom-made so that no customary cash price is available with which to work backwards to find the

The machine exchanged for the 12% note is custom-made so that no customary cash price is available with which to work backwards to find the implicit rate. In such case how to impute and account interest rate?

How can I use financial calculator(TI) to get $666,633?

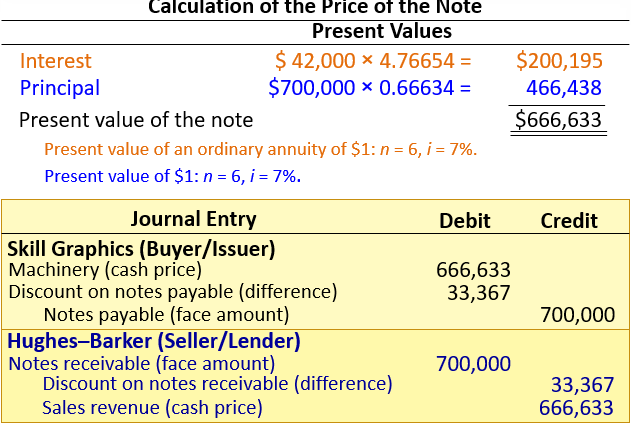

Calculation of the Price of the Note Interest Principal Present value of the note Present Values $ 42,000 4.76654 = $700,000 0.66634 $200,195 466,438 $666,633 Present value of an ordinary annuity of $1: n = 6,-7% Present value of $1: n = 6,-7%. Journal Entry Debit Credit Skill Graphics (Buyer/Issuer) Machinery (cash price) Discount on notes payable (difference) 666,633 33,367 Notes payable (face amount) 700,000 Hughes-Barker (Seller/Lender) Notes receivable (face amount) 700,000 Discount on notes receivable (difference) Sales revenue (cash price) 33,367 666,633

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts