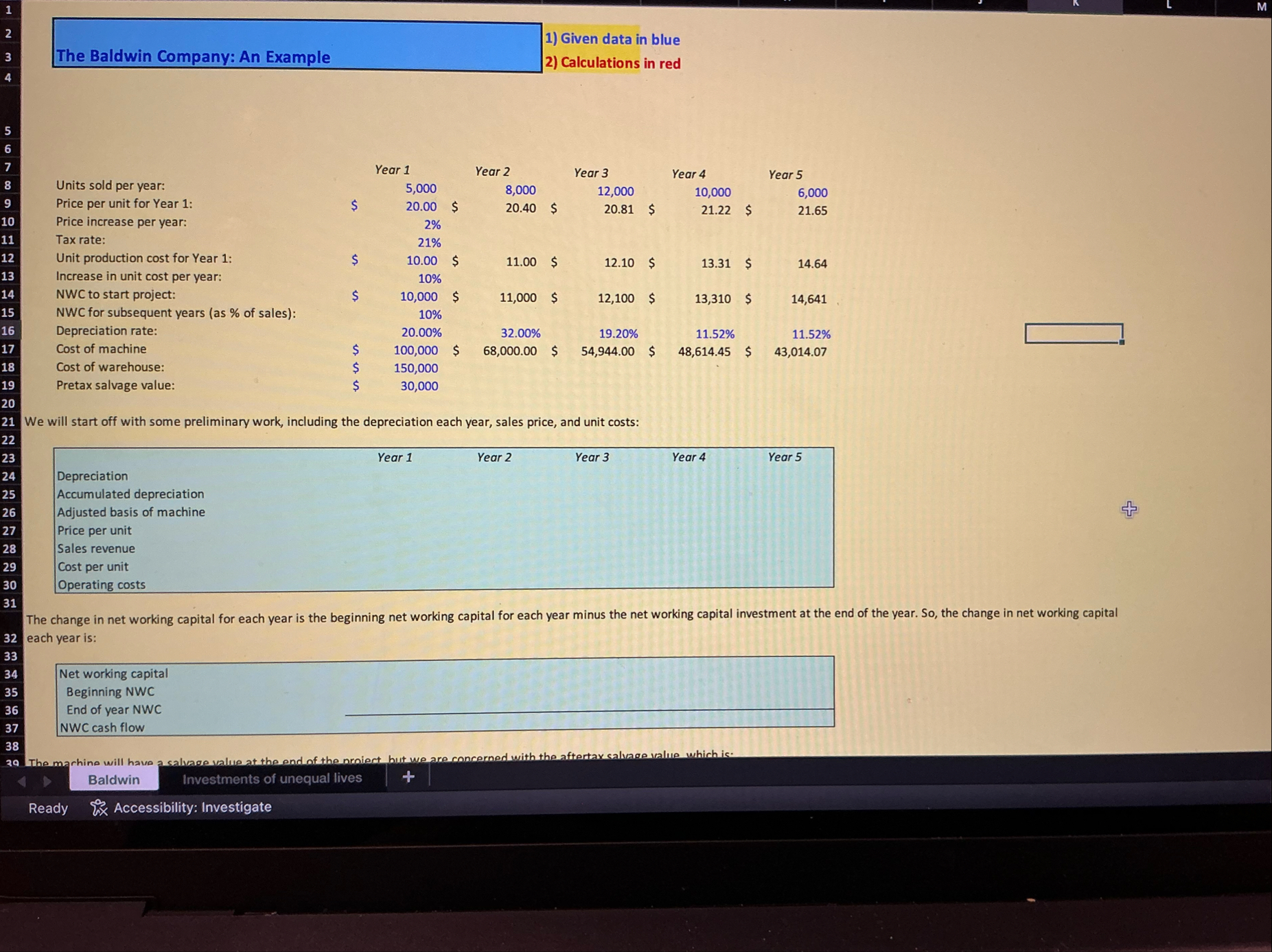

Question: The machine will have a salvage value at the end of the project, but we are concerned with the aftertax salvage value, which is:

The machine will have a salvage value at the end of the project, but we are concerned with the aftertax salvage value, which is:

tablePretax salvage valueTaxes on saleAftertax salvage value

Now we can calculate the proforma income statement for each year Table which will be:

tableOperating costsEarnings before interests and taxesNet income

With this, the incremental cash flows each year, NPV for different interest rates, and IRR for the project are Table :

tableYear Year Year Year Year Year Earnings before interests and taxes DepreciatonCash flow from operations,,,,,,Bowling ball machine,,,,,,WarehouseTotal cash flow of project,,,,,,NPV

A Note about Depreciation

There are actually six MACRS schedules: three five seven and year schedules. The MACRS schedule is calculated using the depreciation according to the double declining balance method, and switching to straightline depreciation when it is more advantageous. The three five seven and year schedules use a factor of when calculating the double declining balance depreciation amount, while the and year schedules use a factor of Excel has a function, VDB which can be used to construct a MACRS table. Below, we have constructed a

MACRS table with all six schedules.

Baldwin

Investments of unequal lives

Ready

Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock