Question: The main difference between economic value added (EVA) and accounting net income is that O a. the cost of capital with EVA depends on the

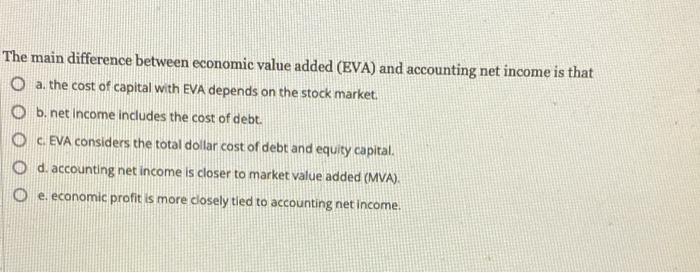

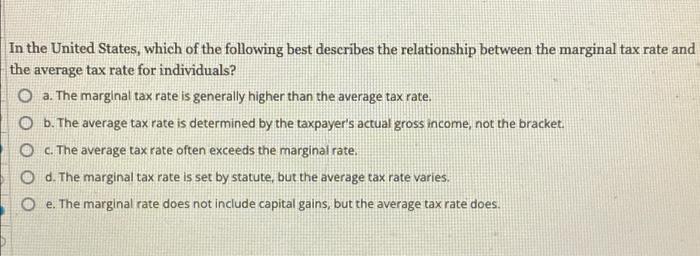

The main difference between economic value added (EVA) and accounting net income is that O a. the cost of capital with EVA depends on the stock market. O b. net income includes the cost of debt. O c. EVA considers the total dollar cost of debt and equity capital. d. accounting net income is closer to market value added (MVA), O e. economic profit is more closely tied to accounting net income. In the United States, which of the following best describes the relationship between the marginal tax rate and the average tax rate for individuals? O a. The marginal tax rate is generally higher than the average tax rate. O b. The average tax rate is determined by the taxpayer's actual gross income, not the bracket. c. The average tax rate often exceeds the marginal rate. d. The marginal tax rate is set by statute, but the average tax rate varies. e. The marginal rate does not include capital gains, but the average tax rate does

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts