Question: The main problem I am having trouble with is question C. In preparing the long-term financial plan, THis Corp's chief financial officer, Mr. Johnson, has

The main problem I am having trouble with is question C.

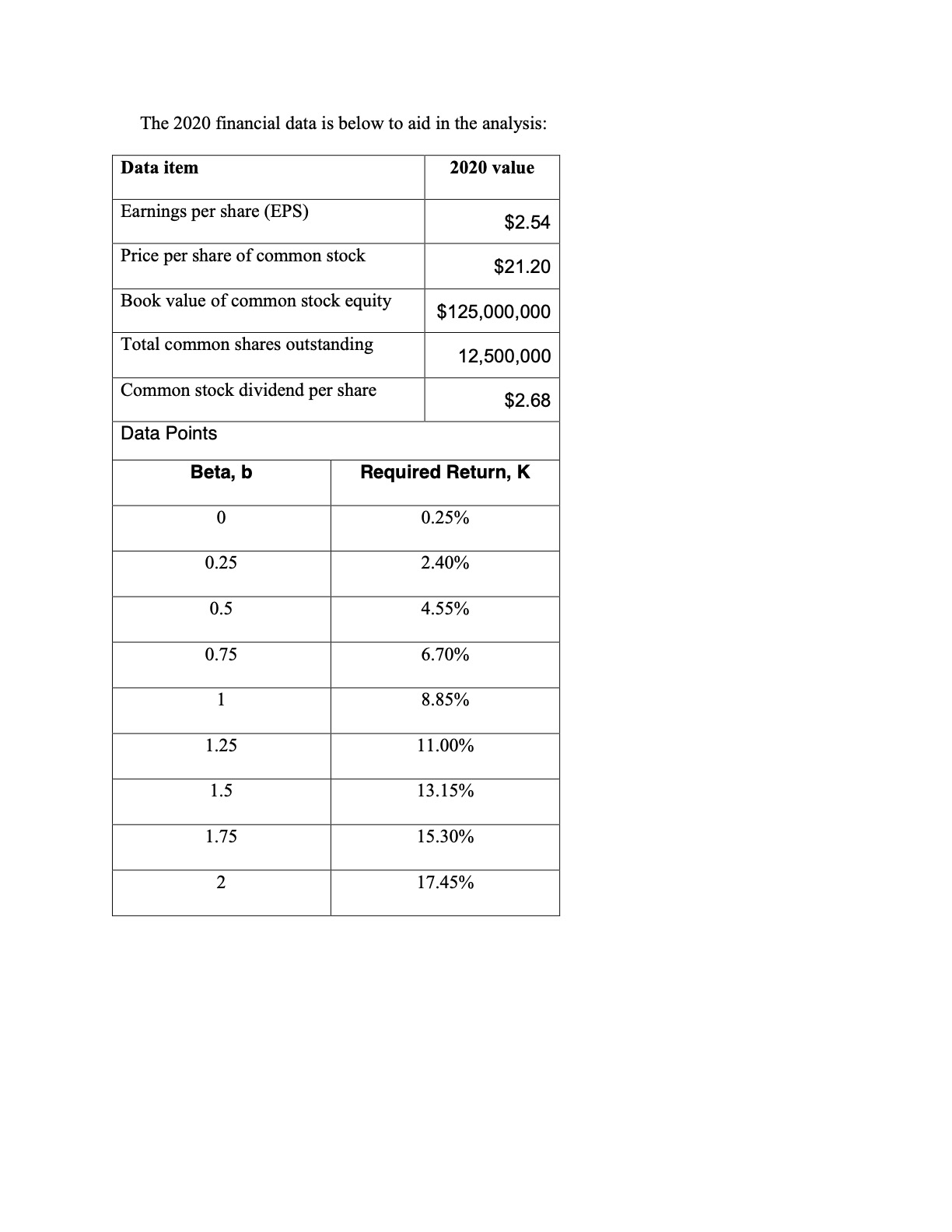

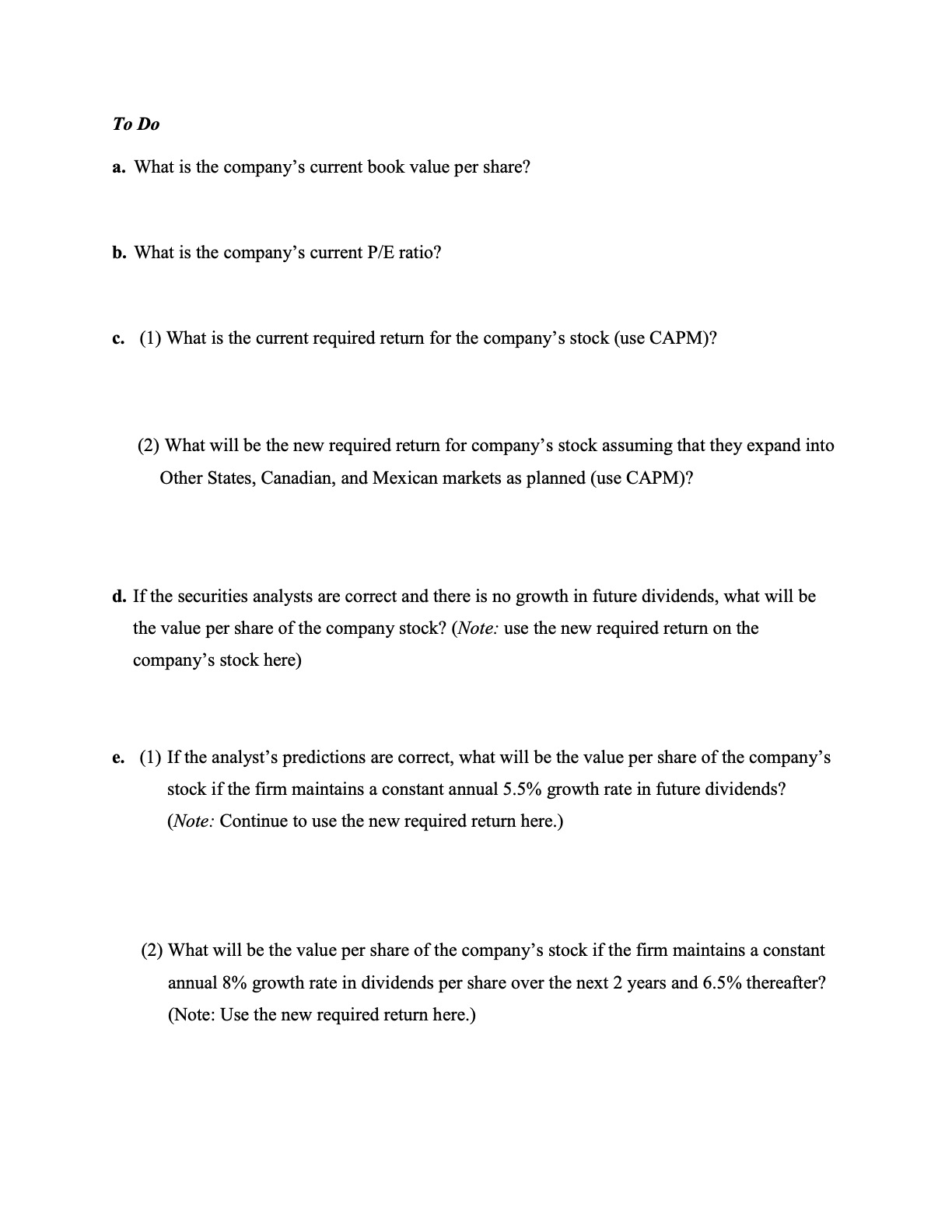

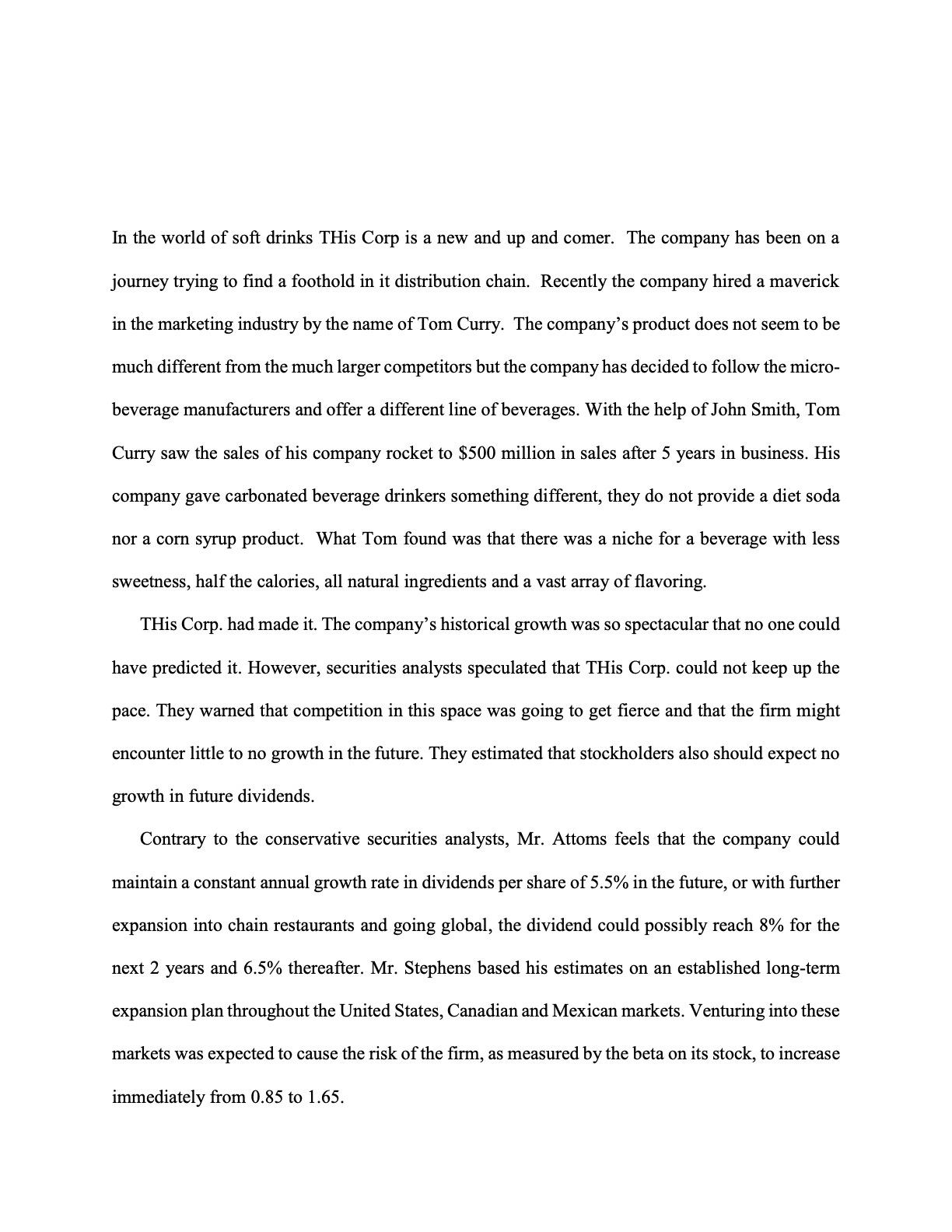

In preparing the long-term financial plan, THis Corp's chief financial officer, Mr. Johnson, has assigned a junior financial analyst, Scot Robonson, to evaluate the firm's current stock price. He has asked Scot to consider the conservative predictions of the securities analysts and the aggressive predictions of the company president.The 2020 nancial data is below to aid in the analysis: Data item 2020 value Eamings per share (BPS) $2.54 Price per share of common stock $21 20 Book value of common stock equity $125,000,000 Total common shares outstanding 12,500,000 Common stock dividend per share $253 Data Points Beta, b Required Return, K 0 0.25% 0.25 2.40% 0.5 4.55% 0.75 6.70% 1 8.85% 1.25 1 1.00% 1.5 13.15% 1.75 15.30% 2 17.45% To Do a. What is the company's current book value per share? b. What is the company's current PIE ratio? c. (1) What is the current required return for the company's stock (use CAPM)? (2) What will be the new required return for company's stock assan that they expand into Other States, Canadian, and Mexican markets as planned (use CAPM)? d. If the securities analysts are correct and there is no growth in future dividends, what will be the value per share of the company stock? (Note: use the new required return on the company's stock here) e. (1) If the analyst's predictions are correct, what will be the value per share of the company's stock if the rm maintains a constant annual 5.5% growth rate in future dividends? (Note: Continue to use the new required return here.) (2) What will be the value per share of the company's stock if the rm maintains a constant annual 8% growth rate in dividends per share over the next 2 years and 6.5% thereafter? (Note: Use the new required return here.) In the world of soft drinks TI-Iis Corp is a new and up and comer. The company has been on a journey trying to nd a foothold in it distribution chain. Recently the company hired a maverick in the marketing industry by the name of Tom Curry. The company's product does not seem to be much different from the much larger competitors but the company has decided to follow the micro- beverage manufacturers and offer a different line of beverages. With the help of John Smith, Tom Curry saw the sales of his company rocket to $500 million in sales after 5 years in business. His company gave carbonated beverage drinkers something different, they do not provide a diet soda nor a corn syrup product. What Tom found was that there was a niche for a beverage with less sweetness, half the calories, all natural ingredients and a vast array of avoring. THis Corp. had made it. The company's historical growth was so spectacular that no one could have predicted it. However, securities analysts speculated that THis Corp. could not keep up the pace. They warned that competition in this space was going to get erce and that the rm might encounter little to no growth in the future. They estimated that stockholders also should expect no growth in future dividends. Contrary to the conservative securities analysts, Mr. Attoms feels that the company could maintain a constant annual growr rate in dividends per share of 5.5% in the future, or with further expansion into chain restaurants and going global, the dividend cOuld possibly reach 8% for the next 2 years and 6.5% thereafter. Mr. Stephens based his estimates on an established long-term expansion plan throughout the United States, Canadian and Mexican markets. Venturing into these markets was expected to cause the risk of the rm, as measured by the beta on its stock, to increase immediately from 0.85 to 1.65