Question: The management of Python Co is trying to decide which of the two machines to purchase to help with production. Only one of the

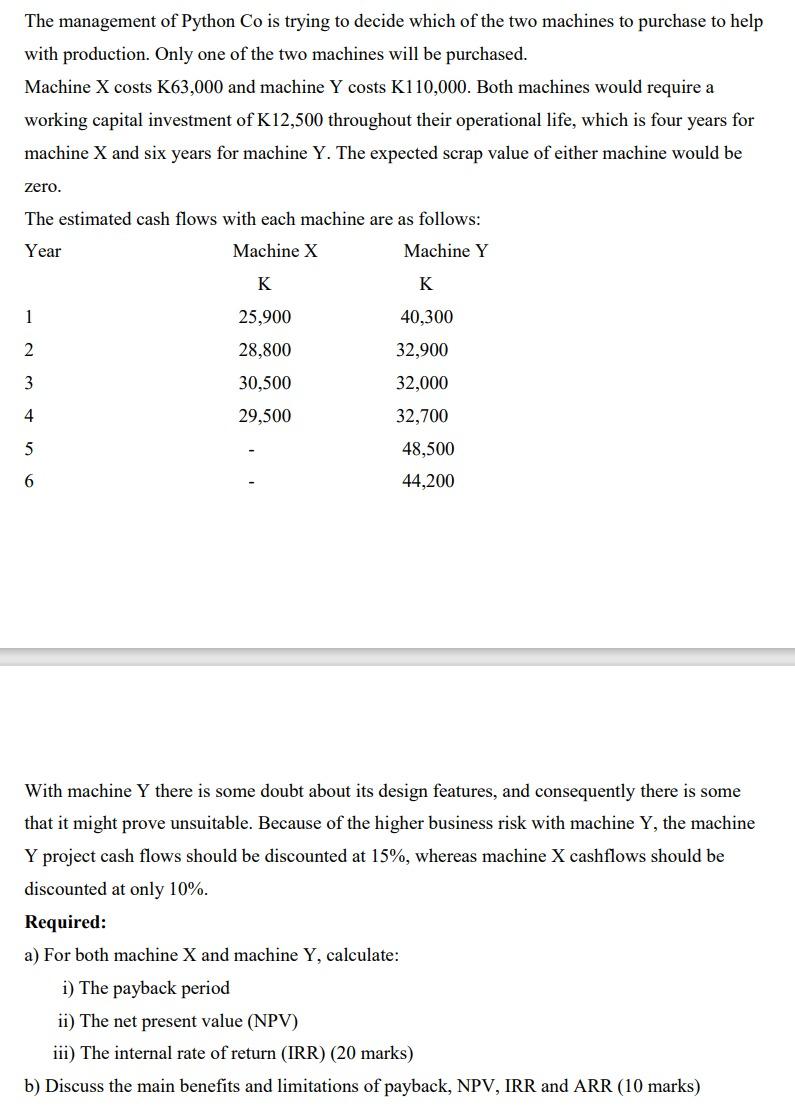

The management of Python Co is trying to decide which of the two machines to purchase to help with production. Only one of the two machines will be purchased. Machine X costs K63,000 and machine Y costs K110,000. Both machines would require a working capital investment of K12,500 throughout their operational life, which is four years for machine X and six years for machine Y. The expected scrap value of either machine would be zero. The estimated cash flows with each machine are as follows: Year Machine X Machine Y K K 1 25,900 40,300 2 28,800 32,900 3 30,500 32,000 29,500 32,700 48,500 6 44,200 With machine Y there is some doubt about its design features, and consequently there is some that it might prove unsuitable. Because of the higher business risk with machine Y, the machine Y project cash flows should be discounted at 15%, whereas machine X cashflows should be discounted at only 10%. Required: a) For both machine X and machine Y, calculate: i) The payback period ii) The net present value (NPV) iii) The internal rate of return (IRR) (20 marks) b) Discuss the main benefits and limitations of payback, NPV, IRR and ARR (10 marks)

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

v a TOTAL CASH OUTFLOW PU... View full answer

Get step-by-step solutions from verified subject matter experts