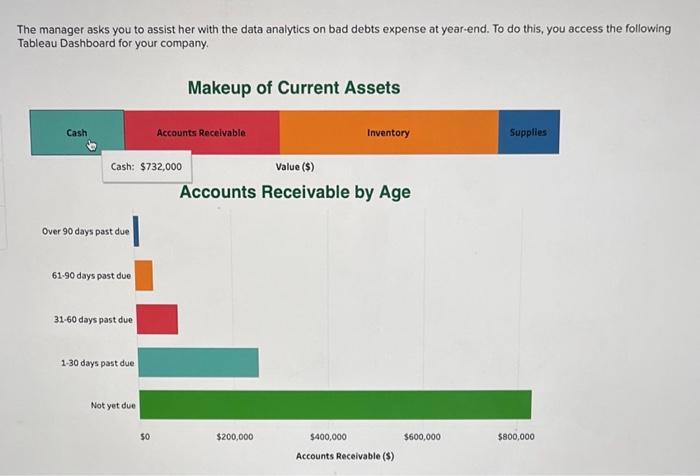

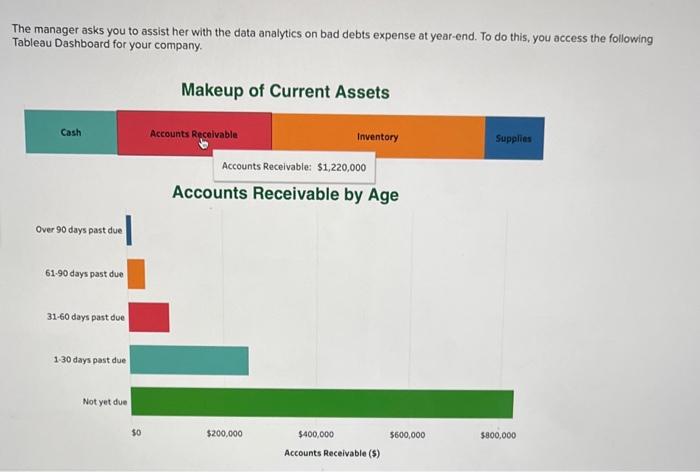

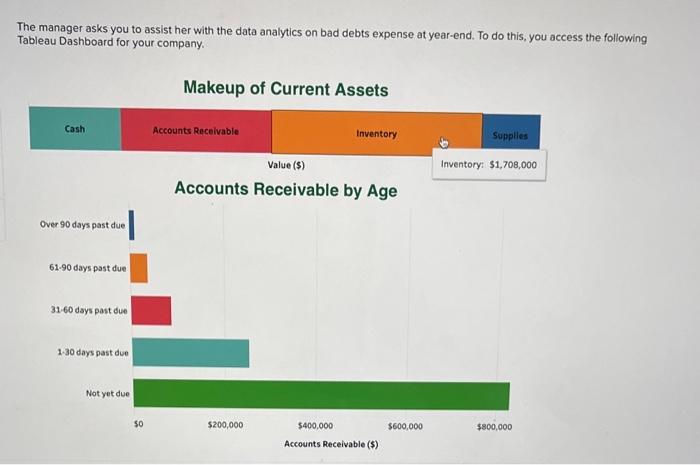

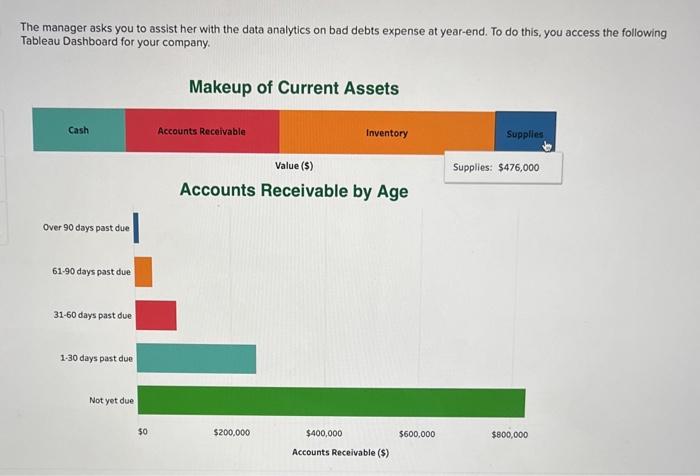

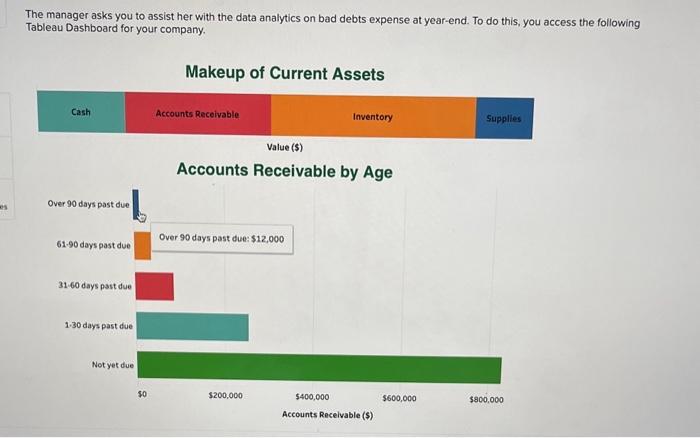

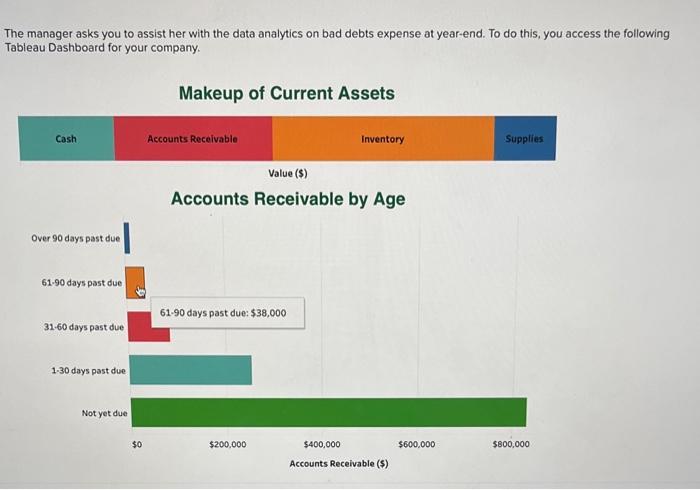

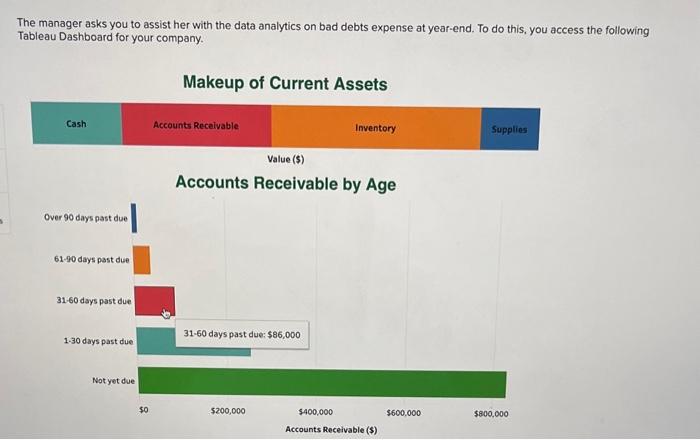

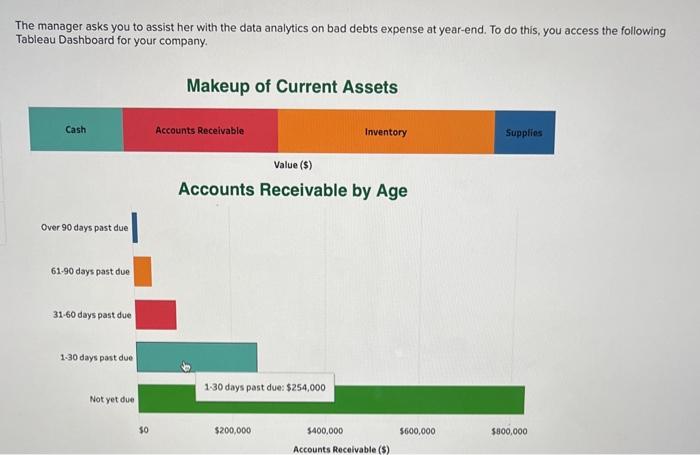

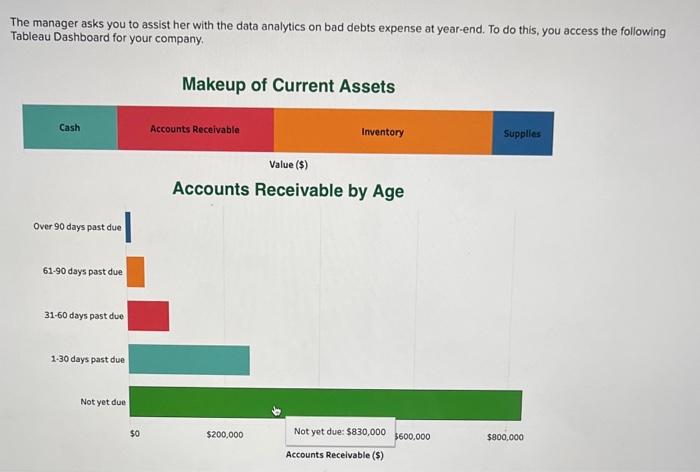

Question: The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau

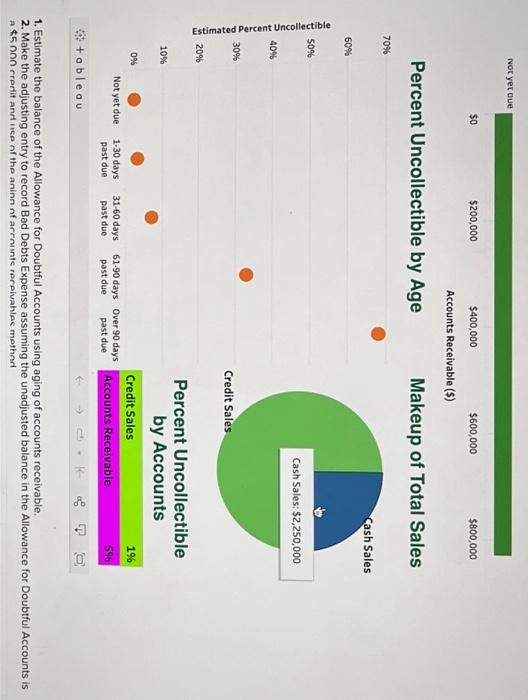

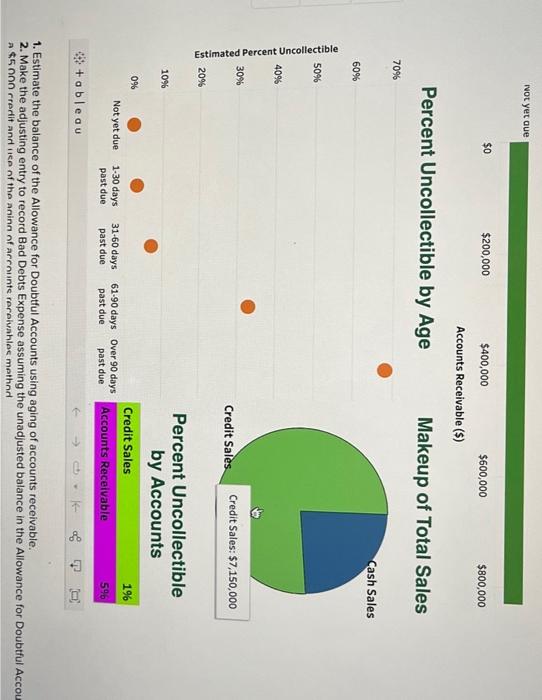

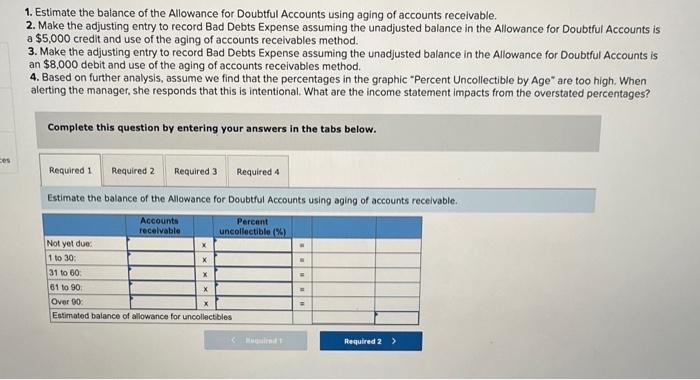

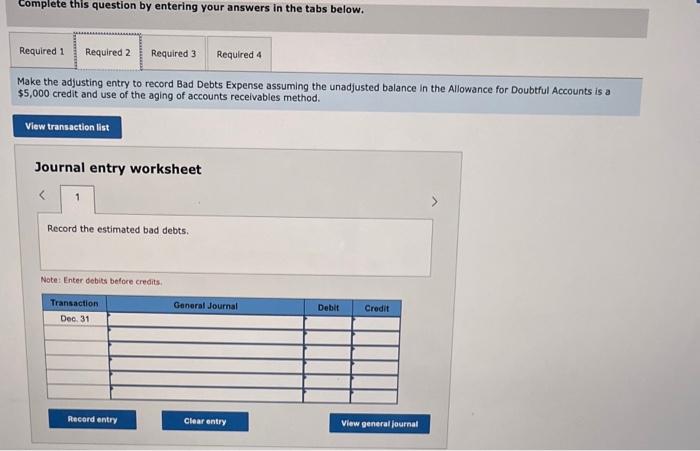

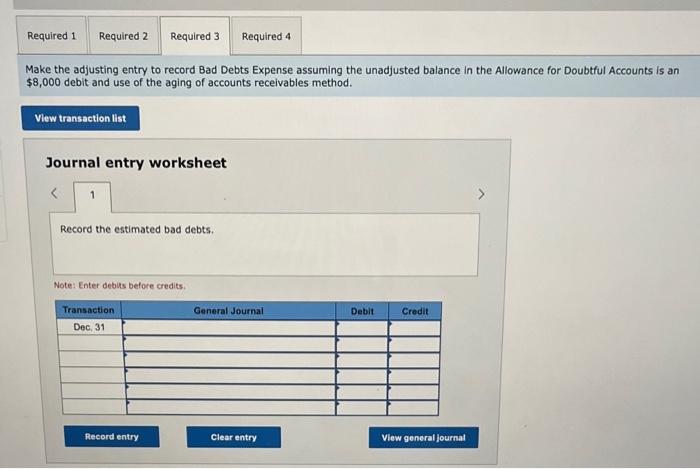

The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeun of Current ccate The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is A $5 onn rrerit and wee of the aninn of areminte rereivahles mathor 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Acco a $5n rredit and ike of the aninn of arrouinte reroluahlos methnd 1. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. 2. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $5,000 credit and use of the aging of accounts recelvables method. 3. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $8,000 debit and use of the aging of accounts receivables method. 4. Based on further analysis, assume we find that the percentages in the graphic "Percent Uncollectible by Age" are too high. When alerting the manager, she responds that this is intentional. What are the income statement impacts from the overstated percentages? Complete this question by entering your answers in the tabs below. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts recelvable. Complete this question by entering your answers in the tabs below. Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is a $5,000 credit and use of the aging of accounts receivables method. Journal entry worksheet Make the adjusting entry to record Bad Debts Expense assuming the unadjusted balance in the Allowance for Doubtful Accounts is an $8,000 debit and use of the aging of accounts receivables method. Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts