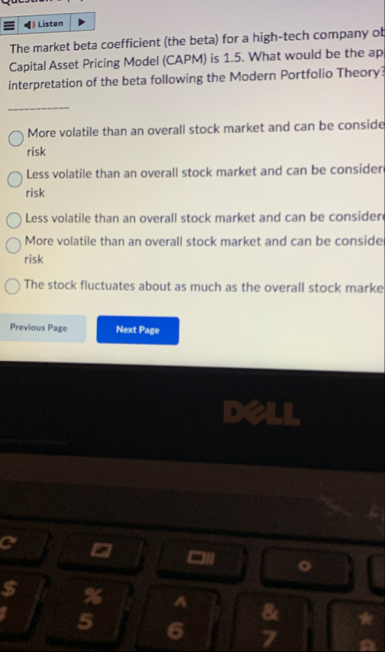

Question: The market beta coefficient ( the beta ) for a high - tech company ot Capital Asset Pricing Model ( CAPM ) is 1 .

The market beta coefficient the beta for a hightech company ot Capital Asset Pricing Model CAPM is What would be the ap interpretation of the beta following the Modern Portfolio Theory

More volatile than an overall stock market and can be conside risk

Less volatile than an overall stock market and can be consider risk

Less volatile than an overall stock market and can be consider

More volatile than an overall stock market and can be conside risk

The stock fluctuates about as much as the overall stock marke

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock