Question: The market is predicting a sharp decline in interest rates in the country. Eversmile Bank has equity of $200 million, long-term debt of $344.3 million

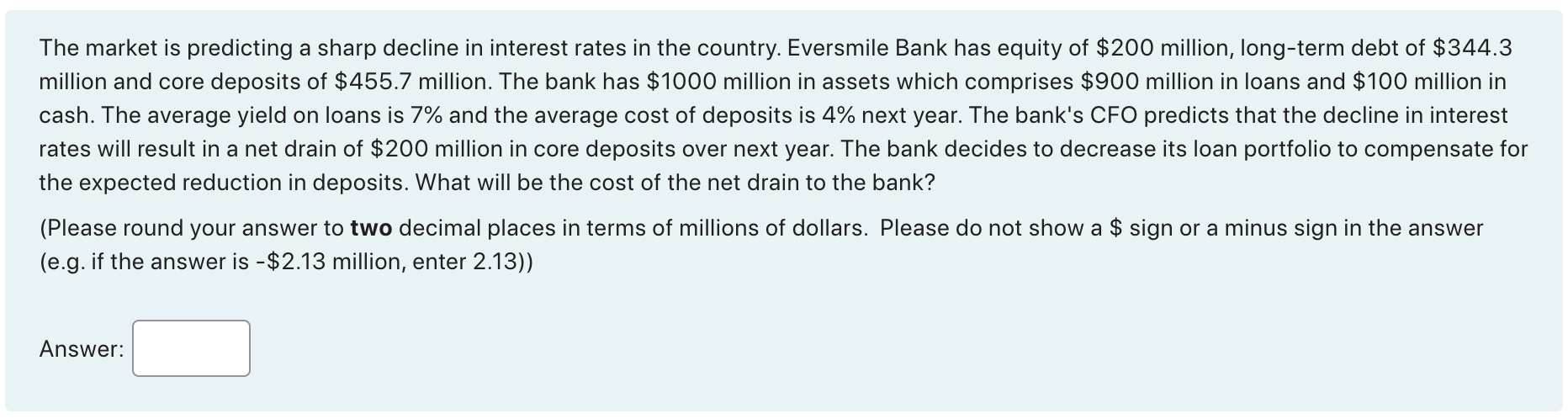

The market is predicting a sharp decline in interest rates in the country. Eversmile Bank has equity of $200 million, long-term debt of $344.3 million and core deposits of $455.7 million. The bank has $1000 million in assets which comprises $900 million in loans and $100 million in cash. The average yield on loans is 7% and the average cost of deposits is 4% next year. The bank's CFO predicts that the decline in interest rates will result in a net drain of $200 million in core deposits over next year. The bank decides to decrease its loan portfolio to compensate for the expected reduction in deposits. What will be the cost of the net drain to the bank? (Please round your answer to two decimal places in terms of millions of dollars. Please do not show a $ sign or a minus sign in the answer (e.g. if the answer is $2.13 million, enter 2.13) )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts