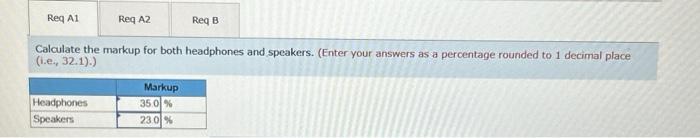

Question: the markup for headphones is wrong. please help. thank you so much! Exercise 9-26 (Algo) Reported Costs and Decisions (LO 9-1) Regular Company produces audio

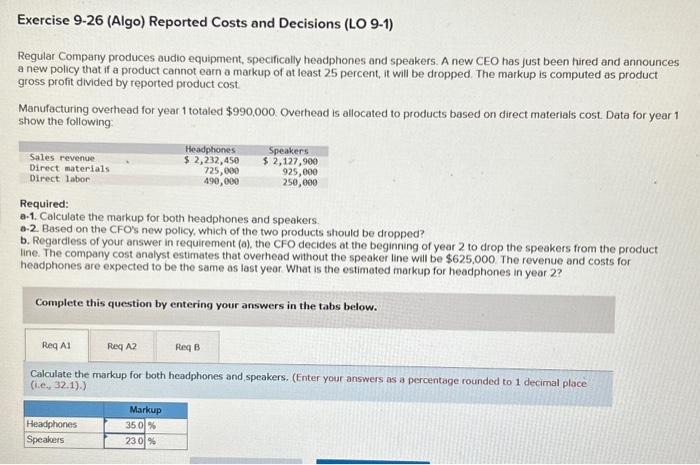

Exercise 9-26 (Algo) Reported Costs and Decisions (LO 9-1) Regular Company produces audio equipment, specifically headphones and speakers. A new CEO has just been hired and announces a new policy that if a product cannot earn a markup of at least 25 percent, it will be dropped. The markup is computed as product gross profit divided by reported product cost Manufacturing overhead for year 1 totaled $990,000. Overhead is allocated to products based on direct materials cost. Data for year 1 show the following Required: a-1. Calculate the markup for both headphones and speakers. a-2. Based on the CFO's new policy, which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the speakers from the product. line. The company cost analyst estimates that overhead without the speaker line will be $625,000. The revenue and costs for headphones are expected to be the same as last yeor. What is the estimated markup for headphones in year 2 ? Complete this question by entering your answers in the tabs below. Calculate the markup for both headphones and,speakers. (Enter your answers as a percentage rounded to 1 decimal place (1.e., 32.1).) Calculate the markup for both headphones and speakers. (Enter your answers as a percentage rounded to 1 decimal place ( i.e., 32.1).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts