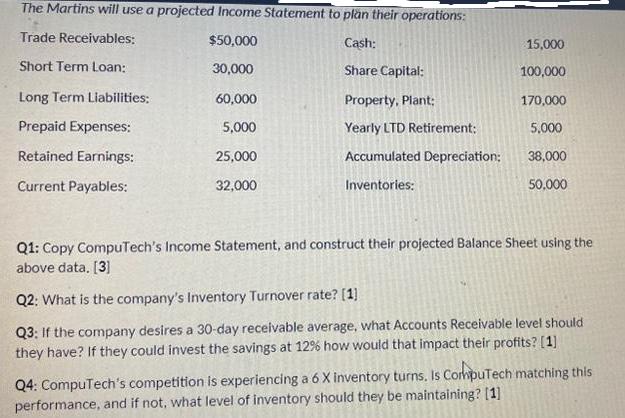

Question: The Martins will use a projected Income Statement to plan their operations: Trade Receivables: $50,000 Cash: Short Term Loan: 30,000 Share Long Term Liabilities:

The Martins will use a projected Income Statement to plan their operations: Trade Receivables: $50,000 Cash: Short Term Loan: 30,000 Share Long Term Liabilities: Prepaid Expenses: Retained Earnings: Current Payables: 60,000 5,000 25,000 32,000 Capital: Property, Plant: Yearly LTD Retirement: Accumulated Depreciation: Inventories: 15,000 100,000 170,000 5,000 38,000 50,000 Q1: Copy CompuTech's Income Statement, and construct their projected Balance Sheet using the above data. [3] Q2: What is the company's Inventory Turnover rate? [1] Q3: If the company desires a 30-day receivable average, what Accounts Receivable level should they have? If they could invest the savings at 12% how would that impact their profits? [1] Q4: CompuTech's competition is experiencing a 6 X inventory turns. Is CompuTech matching this performance, and if not, what level of inventory should they be maintaining? [1]

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Q1 To construct the projected Balance Sheet we need CompuTechs Income Statement Since the Income Sta... View full answer

Get step-by-step solutions from verified subject matter experts