Question: The Mechanical Components Division manager asks you to recommend a make/buy decision on a major automotive subassembly that is currently purchased externally for a total

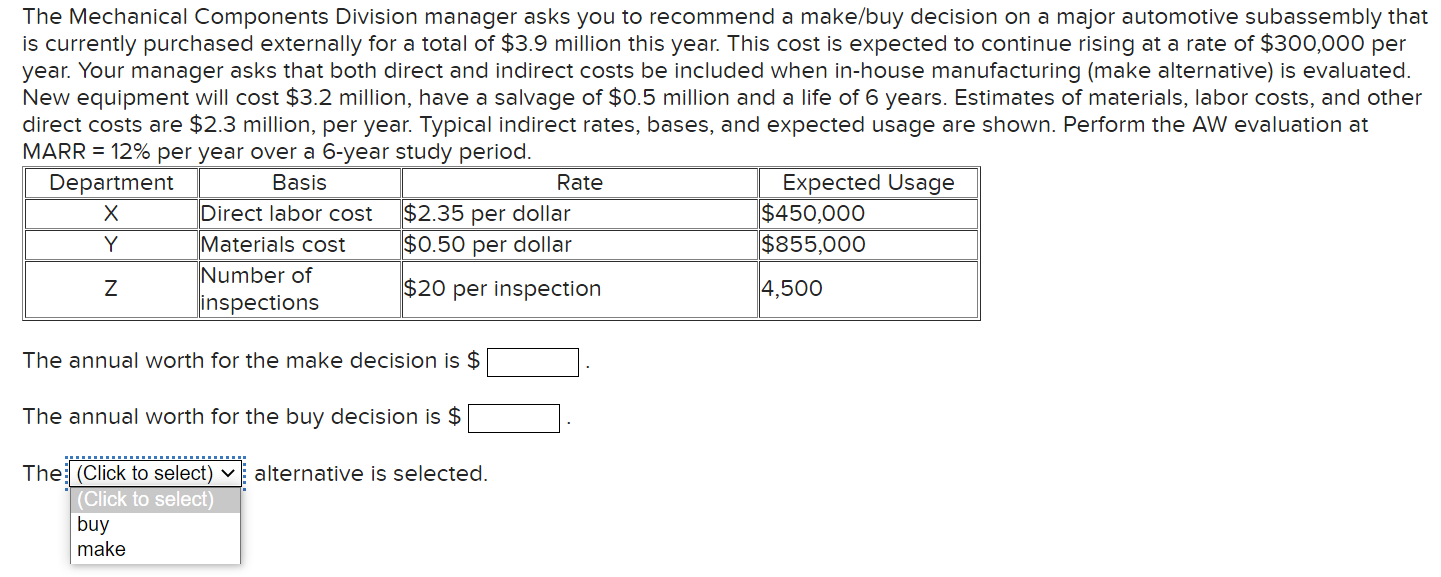

The Mechanical Components Division manager asks you to recommend a make/buy decision on a major automotive subassembly that is currently purchased externally for a total of $3.9 million this year. This cost is expected to continue rising at a rate of $300,000 per year. Your manager asks that both direct and indirect costs be included when in-house manufacturing (make alternative) is evaluated. New equipment will cost $3.2 million, have a salvage of $0.5 million and a life of 6 years. Estimates of materials, labor costs, and other direct costs are $2.3 million, per year. Typical indirect rates, bases, and expected usage are shown. Perform the AW evaluation at MARR =12% per vear over a 6 -vear study period. The annual worth for the make decision is \$ The annual worth for the buy decision is $ The alternative is selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts