Question: the middle paragraph the first options are accept/reject, then lost/added, then accept/reject, and loses/adds. You are evaluating a proposed project for your company. The project

the middle paragraph the first options are accept/reject, then lost/added, then accept/reject, and loses/adds.

the middle paragraph the first options are accept/reject, then lost/added, then accept/reject, and loses/adds.

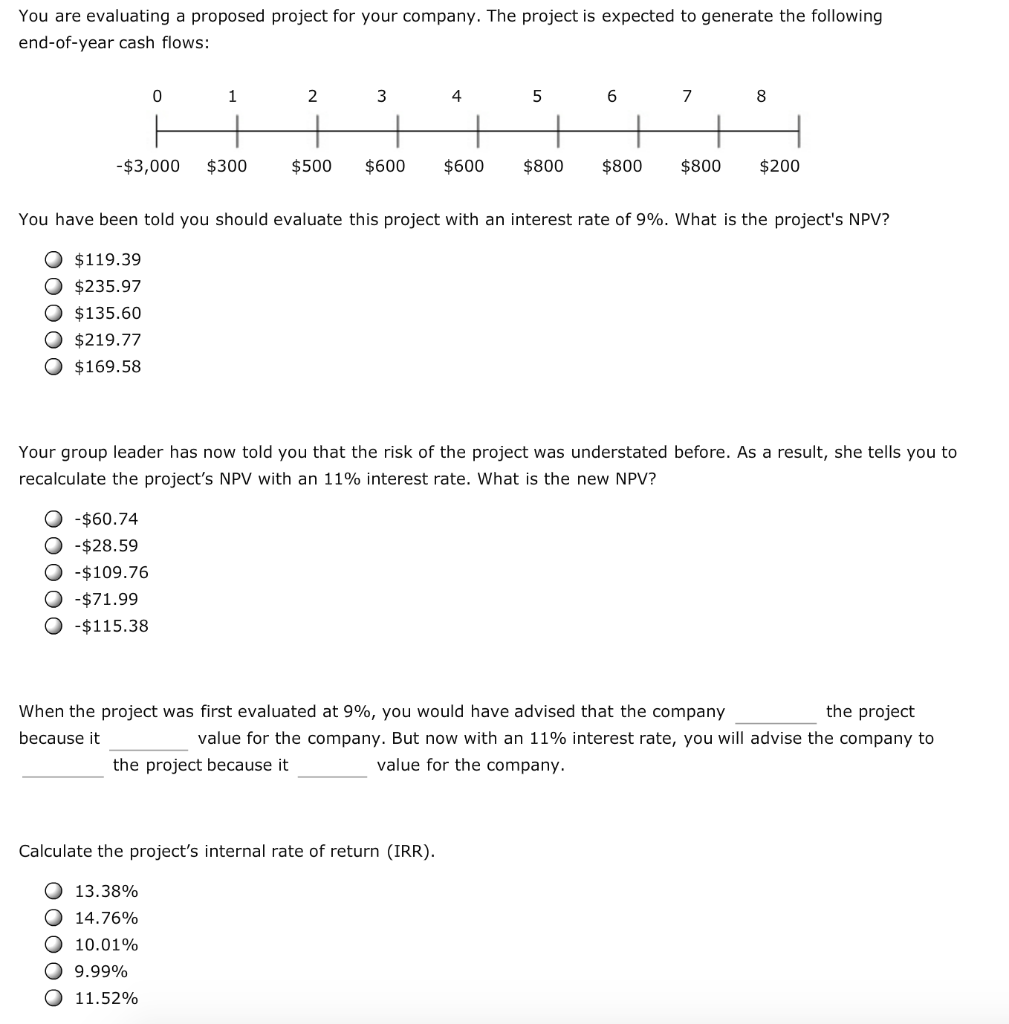

You are evaluating a proposed project for your company. The project is expected to generate the following end-of-year cash flows: 10 1 2 3 4 6 7 -$3,000 $300 $500 $600 $600 $800 $800 $800 $200 You have been told you should evaluate this project with an interest rate of 9%. What is the project's NPV? O $119.39 O $235.97 O $135.60 O $219.77 O $169.58 Your group leader has now told you that the risk of the project was understated before. As a result, she tells you to recalculate the project's NPV with an 11% interest rate. What is the new NPV? O -$60.74 O -$28.59 O -$109.76 O -$71.99 O -$115.38 When the project was first evaluated at 9%, you would have advised that the company the project because it value for the company. But now with an 11% interest rate, you will advise the company to value for the company. the project because it Calculate the project's internal rate of return (IRR) O 13.38% 14.76% O 10.01% O 9.99% O 11.52%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts