Question: The mini case information above, write a 250-500 word recommendation of the financial decisions you propose for this company based on an analysis of its

The mini case information above, write a 250-500 word recommendation of the financial decisions you propose for this company based on an analysis of its capital structure and capital budgeting techniques. Explain why you chose this recommendation.

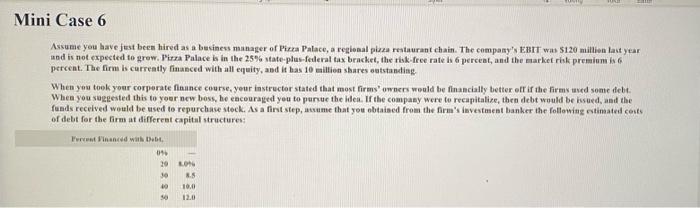

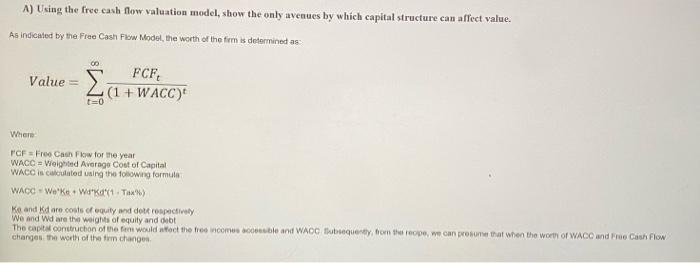

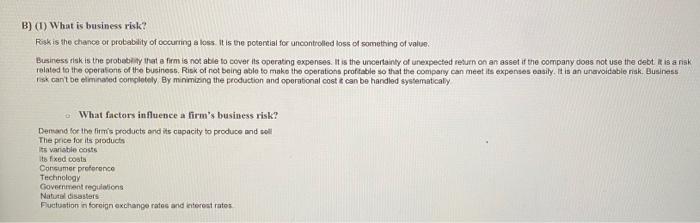

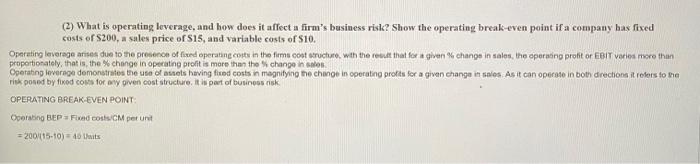

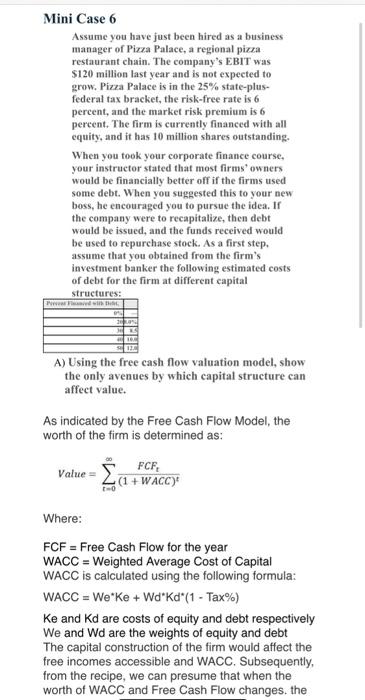

Mini Case 6 Assume you have just been hired as a business manager of Pizza Palace, a regional plzza restaurant chain. The company's EBIT w 5120 million last year and is not expected to grow. Pirza Palace is in the 25% state-plus-federal tax bracket, the free rate is 6 percent, and the market risk premium is 6 percent. The firm is currently financed with all equity, and it has 10 million shares outstanding When you took your corporate finance course, your instructor stated that most firms owners would be financially better offer the firms used some debt. When you suggested this to your new boss, he encouraged you to pursue the idea. Ir the company were to recapitalize, ben debt would be issued, and the funds received would be used to repurchase stock. As a first step, anume that you obtained from the firm's Investment banker the following estimated costs of debt for the firm at different capital structures Prentinand with bl. 04 20. 30 8.5 10.0 12.0 A) Using the free cash flow valuation model, show the only avenues by which capital structure can affect value. As indicated by the Free Cash Flow Model, the worth of the form is determined as 00 Value = FCF (1 + WACC) t=0 Where FCF Free Cash Flow for the year WACC Weighted Average cost of Capital WACO is calculated using the following formula WACC Weke. Wakat. Tax) Ke and Kd are costs of equity and deterospectively We and Wd are the weight of equily and det The capital construction of the fent would want the tree comble and WAOC Subaquery from the rope, we can prosome that when the worth or WACC and Free Cash Flow changes the worth of the fun changes B) (1) What is business risk? Risk is the chance of probability of cocurring a loss. It is the potential for uncontrolled loss of something of value. Business risk is the probability that a firm is not able to cover its operating expenses. It is the uncertainty of unexpected return on an asset if the company does not use the debt leis anak related to the operations of the business, Risk of not being able to make the operations profitable so that the company can meet its expenses easily. It is an unavoidable risk. Business risk can't be eliminated completely By minimizing the production and operational cost can be handled systematically What factors influence a firm's business risk? Demand for the des products and its capacity to produce and sell The price for its products its vanable costs its fixed costs Consumer preference Technology Government regullions Natural disasters Puctuation in foreign exchange rates and enterest rates (2) What is operating leverage, and how does it affect a firm's business risk? Show the operating break-even point if a company has fixed costs of S200, a sales price of $15, and variable costs of $10. Operating leverage arises due to the presence of fixed operating costs in the firm cost dructure with the rest that for a given change in sales, the operating profit or EBIT varios more than Operating leverage demonstrates the use of sets having fixed costs in magnitying the change in operating profits for a given change in sales As it can operate in Bon direction itoters to ne risposed by fixed costs for given cost structure, it is part of business risk OPERATING BREAK-EVEN POINT Operating BEP Fixed costs CM petunt =200015-10)=4 mits Mini Case 6 Assume you have just been hired as a business manager of Pizza Palace, a regional pizza restaurant chain. The company's EBIT was $120 million last year and is not expected to grow. Pizza Palace is in the 25% state-plus- federal tax bracket, the risk-free rate is 6 percent, and the market risk premium is 6 percent. The firm is currently financed with all equity, and it has 10 million shares outstanding. When you took your corporate finance course, your instructor stated that most firms' owners would be financially better off if the firms used some debt. When you suggested this to your new boss, he encouraged you to pursue the idea. If the company were to recapitalize, then debt would be issued, and the funds received would be used to repurchase stock. As a first step. assume that you obtained from the firm's investment banker the following estimated costs of debt for the firm at different capital structures: www A) Using the free cash flow valuation model, show the only avenues by which capital structure can affect value. As indicated by the Free Cash Flow Model, the worth of the firm is determined as: Value FCF La (1 + WACC) 0 Where: FCF = Free Cash Flow for the year WACC = Weighted Average Cost of Capital WACC is calculated using the following formula: WACC = Weke + WdKd" (1 - Tax%) Ke and Kd are costs of equity and debt respectively We and Wd are the weights of equity and debt The capital construction of the firm would affect the free incomes accessible and WACC. Subsequently, from the recipe, we can presume that when the worth of WACC and Free Cash Flow changes, the worth of the firm changes. B) (1) What is business risk? Risk is the chance or probability of occurring a loss. It is the potential for uncontrolled loss of something of value. Business risk is the probability that a firm is not able to cover its operating expenses. It is the uncertainty of unexpected return on an asset if the company does not use the debt. It is a risk related to the operations of the business. Risk of not being able to make the operations profitable so that the company can meet its expenses easily. It is an unavoidable risk. Business risk can't be eliminated completely. By minimizing the production and operational cost it can be handled systematically. What factors influence a firm's business risk? Demand for the firm's products and its capacity to produce and sell The price for its products Its variable costs Its fixed costs Consumer preference Technology Government regulations Natural disasters Fluctuation in foreign exchange rates and interest rates. (2) What is operating leverage, and how does it affect a firm's business risk? Show the operating break-even point if a company has fixed costs of S200, a sales price of $15, and variable costs of S10. Operating leverage arises due to the presence of fixed operating costs in the firms cost structure, with the result that for a given % change in sales, the operating profit or EBIT varies more than proportionately, that is, the % change in operating profit is more than the % change in sales. Operating leverage demonstrates the use of assets Operating leverage arises due to the presence of fixed operating costs in the firms cost structure, with the result that for a given % change in sales, the operating profit or EBIT varies more than proportionately, that is, the % change in operating profit is more than the % change in sales. Operating leverage demonstrates the use of assets having fixed costs in magnifying the change in operating profits for a given change in sales. As it can operate in both directions it refers to the risk posed by fixed costs for any given cost structure. It is part of business risk. OPERATING BREAK-EVEN POINT: : Operating BEP = Fixed costs/CM per unit = 200/(15-10) = 40 Units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts