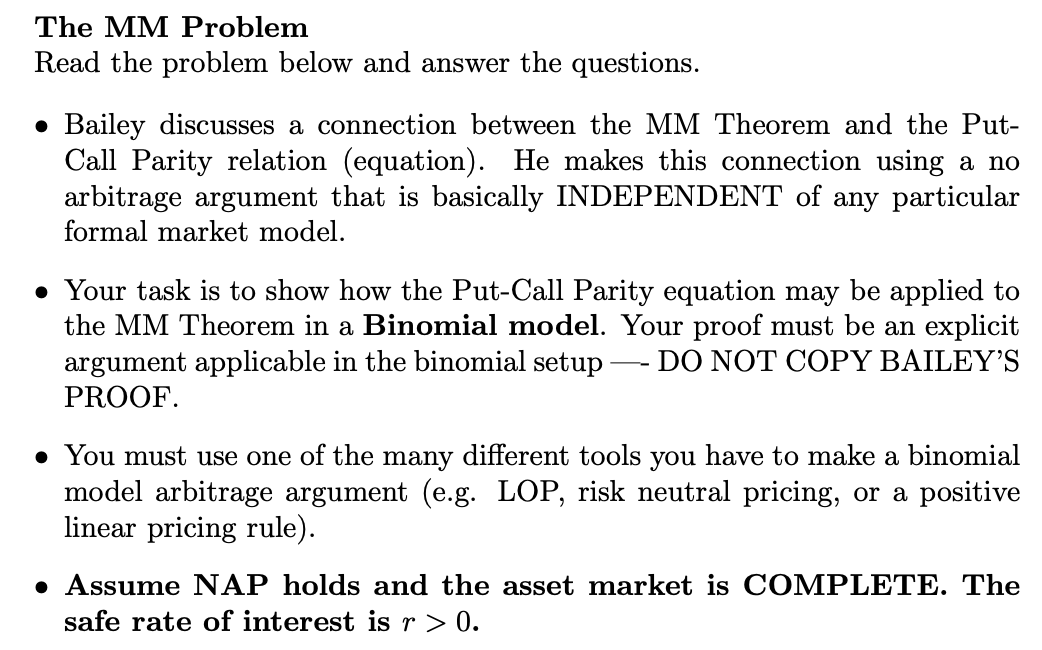

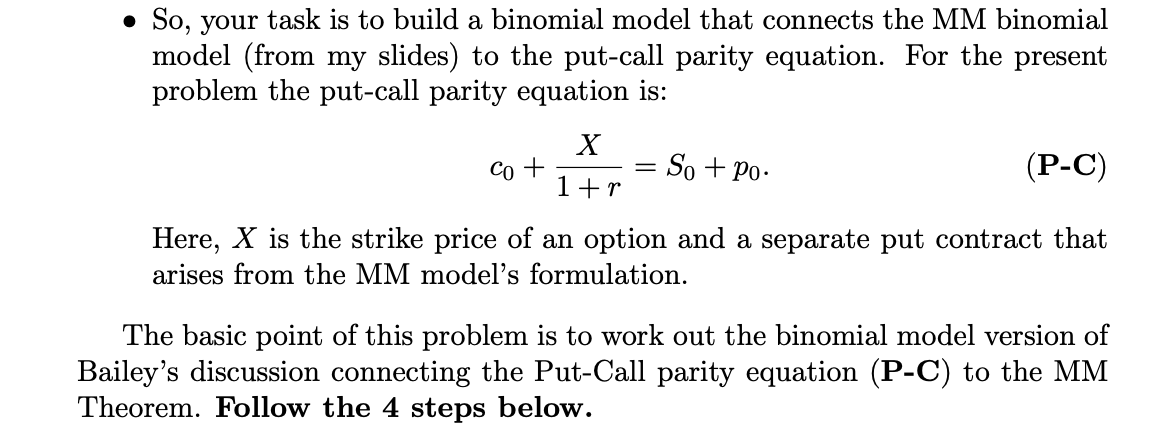

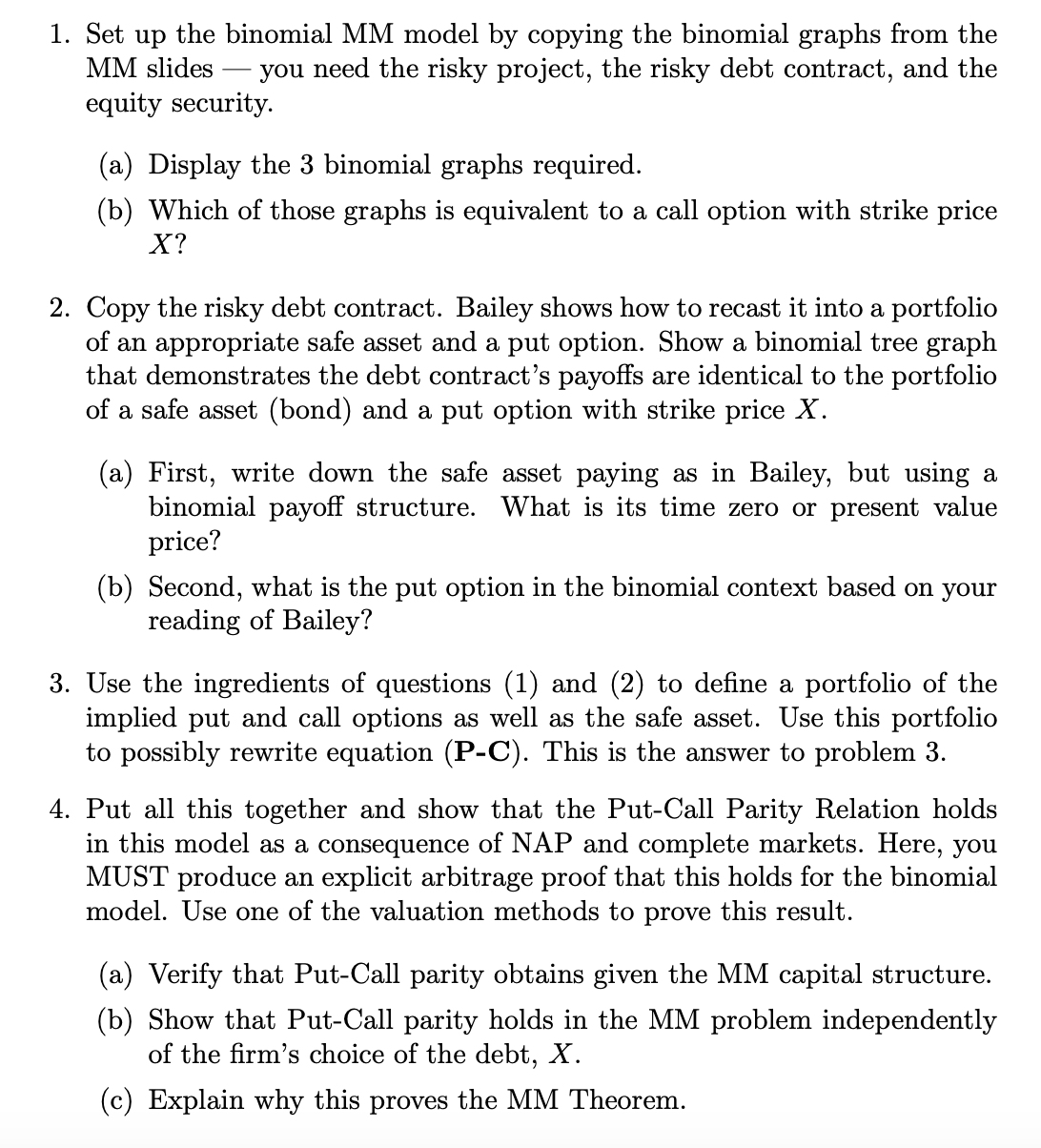

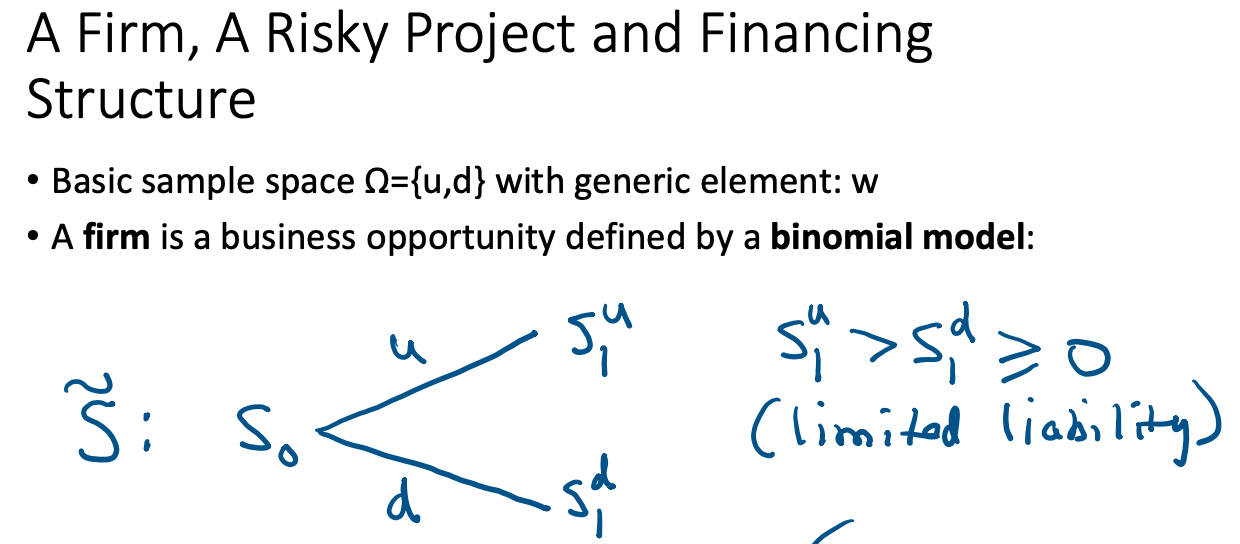

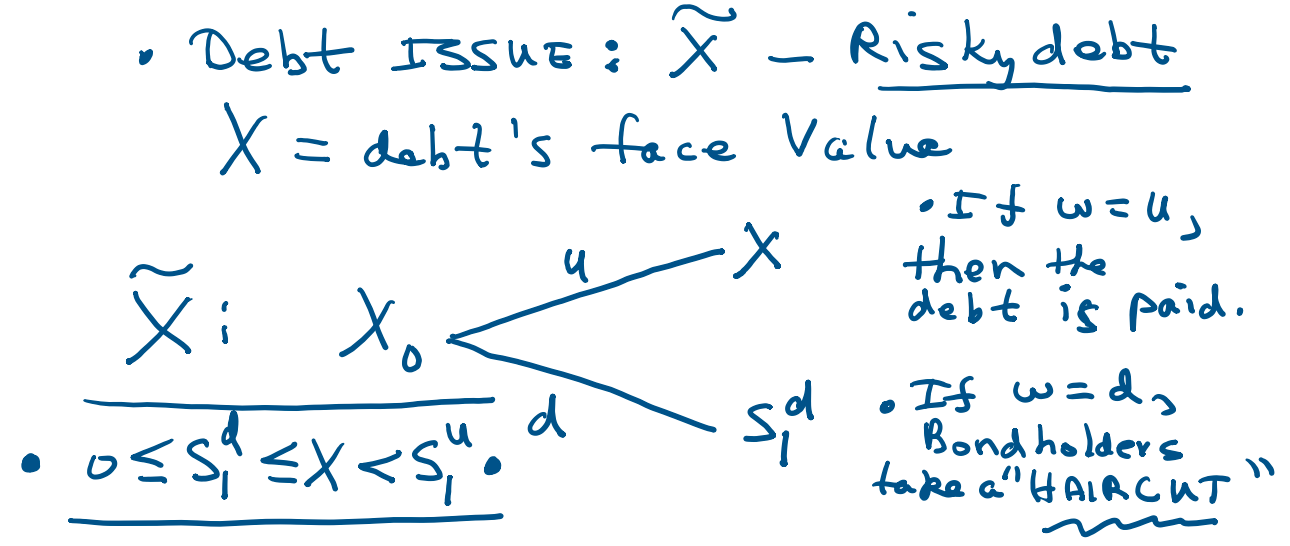

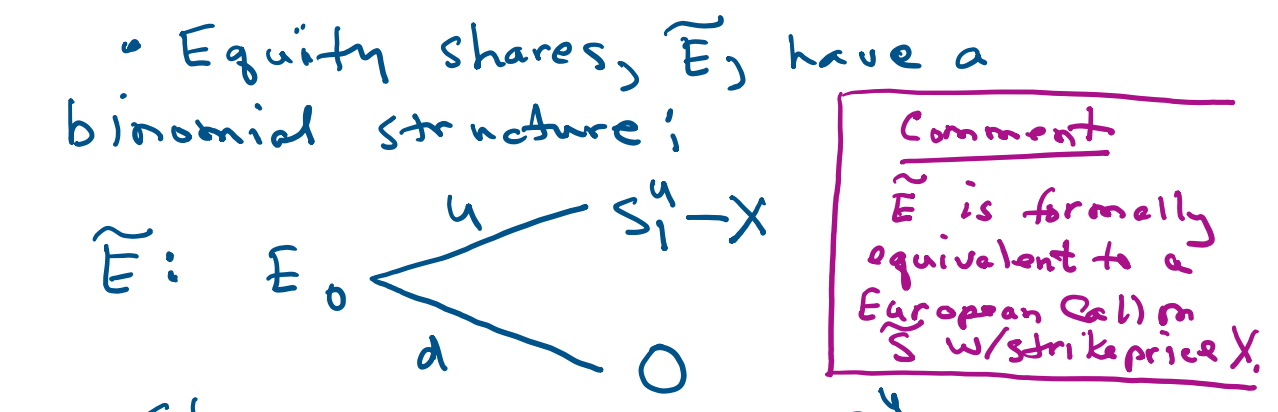

Question: The MM Problem Read the problem below and answer the questions. Bailey discusses a connection between the MM Theorem and the Put- Call Parity relation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock