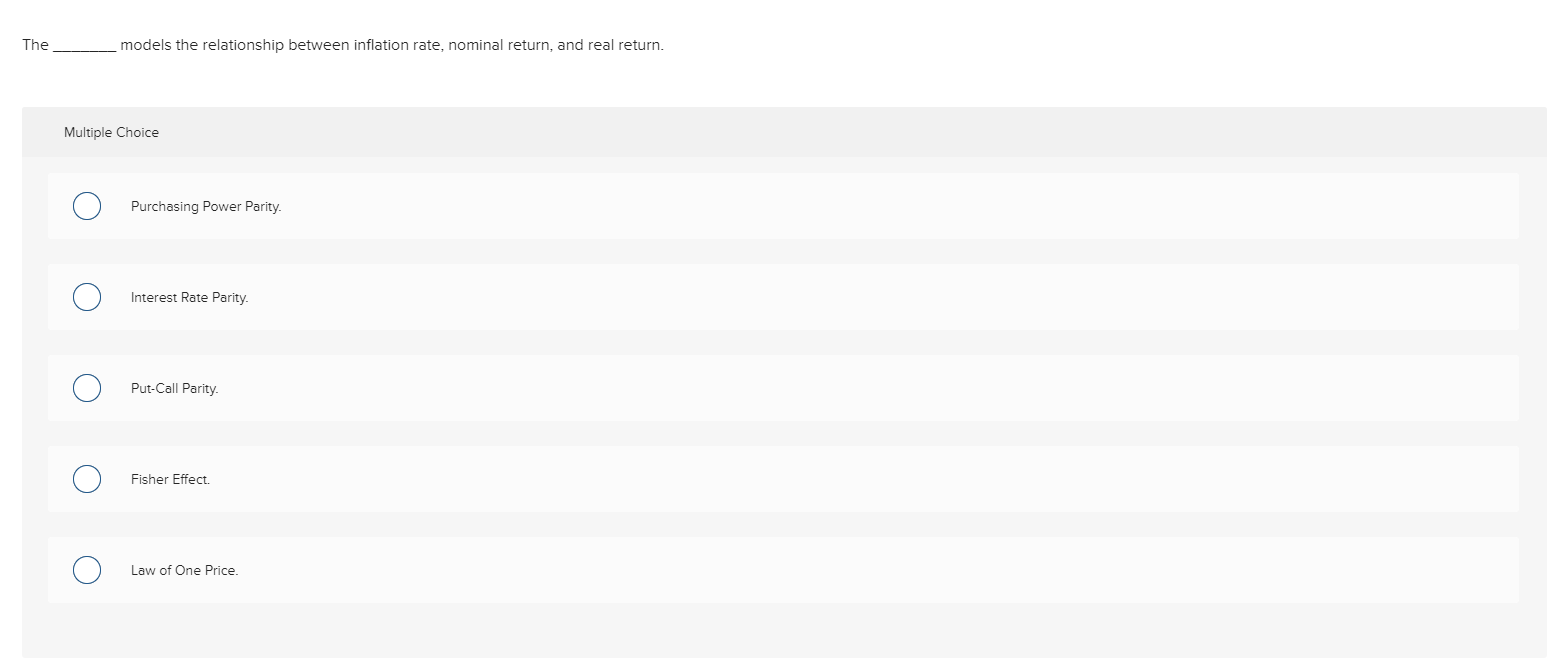

Question: The models the relationship between inflation rate, nominal return, and real return. Multiple Choice Purchasing Power Parity. O Interest Rate Parity. Put-Call Parity o Fisher

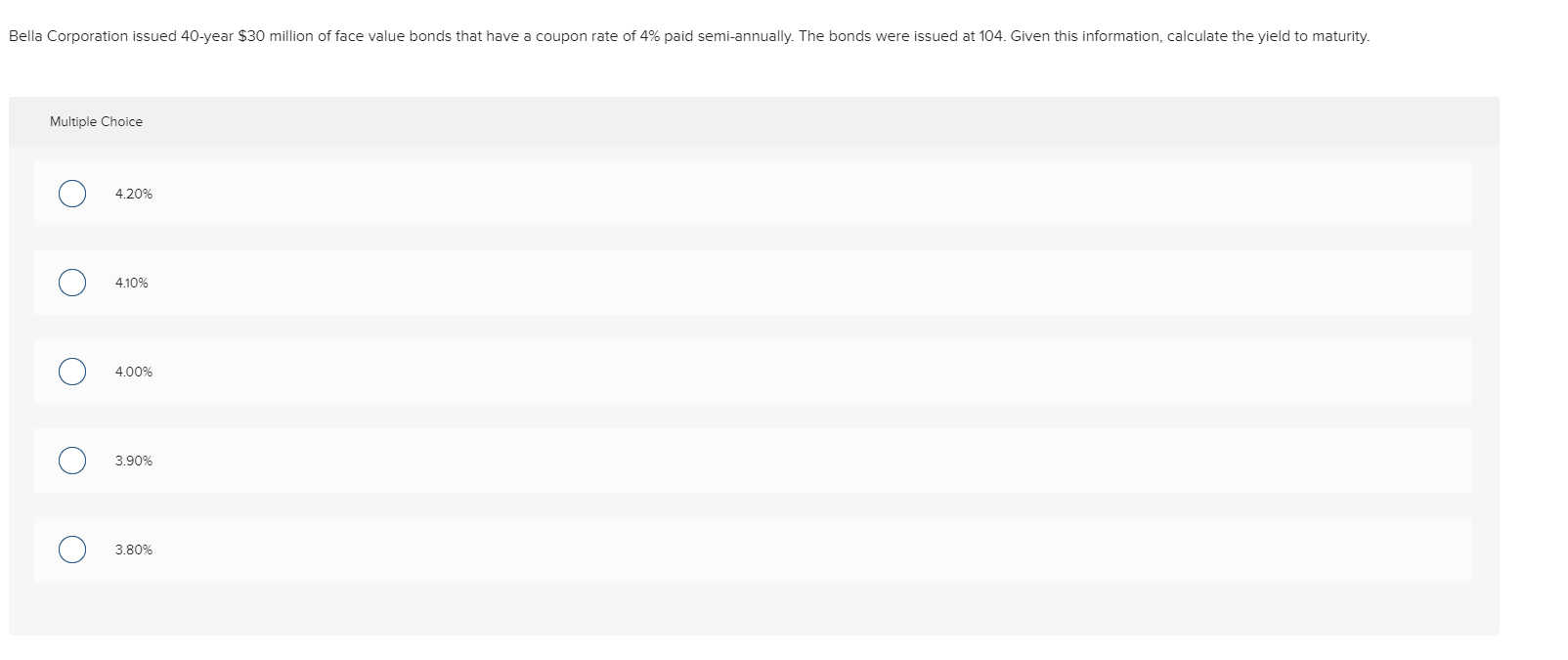

The models the relationship between inflation rate, nominal return, and real return. Multiple Choice Purchasing Power Parity. O Interest Rate Parity. Put-Call Parity o Fisher Effect. Law of One Price. Bella Corporation issued 40-year $30 million of face value bonds that have a coupon rate of 4% paid semi-annually. The bonds were issued at 104. Given this information, calculate the yield to maturity. Multiple Choice 4.20% O 4.10% O O 4.00% 3.90% O O 3.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts