Question: The mortgage on your house is five years old. It required monthly payments of $2105, had an original term of 30 years, and had an

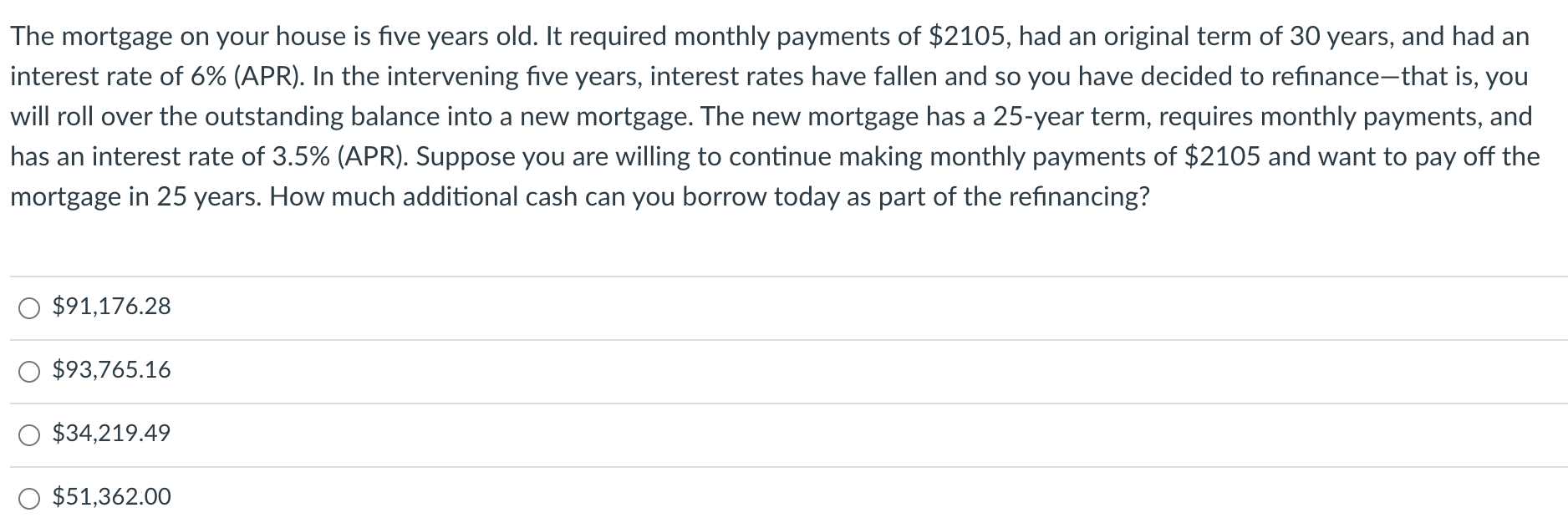

The mortgage on your house is five years old. It required monthly payments of $2105, had an original term of 30 years, and had an interest rate of 6% (APR). In the intervening five years, interest rates have fallen and so you have decided to refinance-that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 25-year term, requires monthly payments, and has an interest rate of 3.5% (APR). Suppose you are willing to continue making monthly payments of $2105 and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the refinancing? $91,176.28 $93,765.16 $34,219.49 $51,362.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts