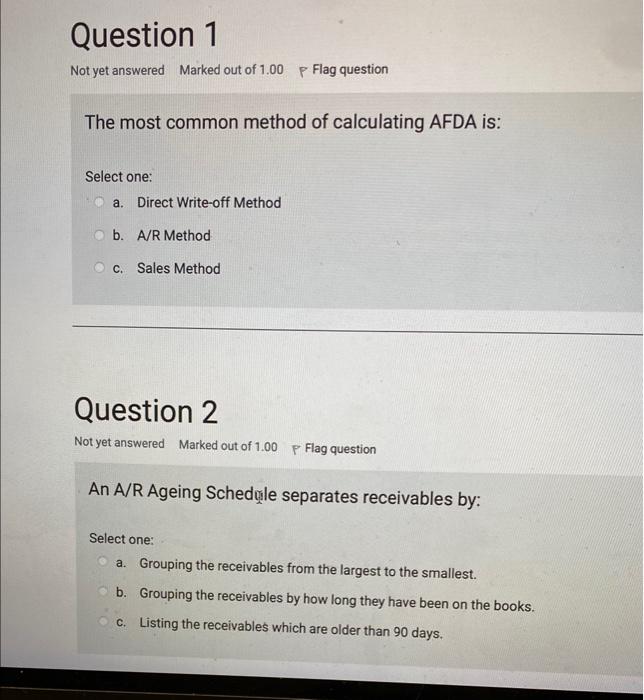

Question: The most common method of calculating AFDA is: Select one: a. Direct Write-off Method b. A/R Method c. Sales Method Question 2 Not yet answered

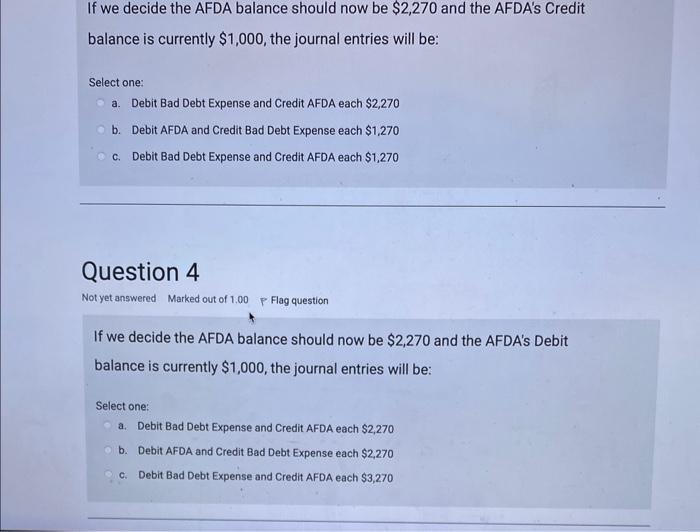

The most common method of calculating AFDA is: Select one: a. Direct Write-off Method b. A/R Method c. Sales Method Question 2 Not yet answered Marked out of 1.00 P Flag question An A/R Ageing Schednile separates receivables by: Select one: a. Grouping the receivables from the largest to the smallest. b. Grouping the receivables by how long they have been on the books. c. Listing the receivables which are older than 90 days. If we decide the AFDA balance should now be $2,270 and the AFDA's Credit balance is currently $1,000, the journal entries will be: Select one: a. Debit Bad Debt Expense and Credit AFDA each $2,270 b. Debit AFDA and Credit Bad Debt Expense each $1,270 c. Debit Bad Debt Expense and Credit AFDA each $1,270 Question 4 Not yet answered Marked out of 1.00 F Flag question If we decide the AFDA balance should now be $2,270 and the AFDA's Debit balance is currently $1,000, the journal entries will be: Select one: a. Debit Bad Debt Expense and Credit AFDA each \$2,270 b. Debit AFDA and Credit Bad Debt Expense each \$2,270 c. Debit Bad Debt Expense and Credit AFDA each $3,270

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts