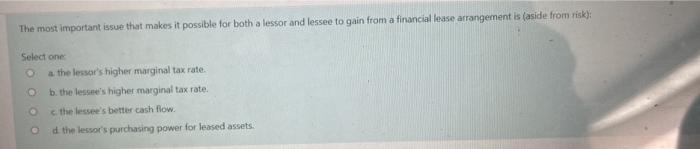

Question: The most important issue that makes it possible for both a lessor and lessee to gain from a financial lease arrangement is (aside from risk);

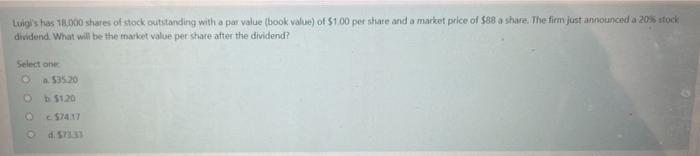

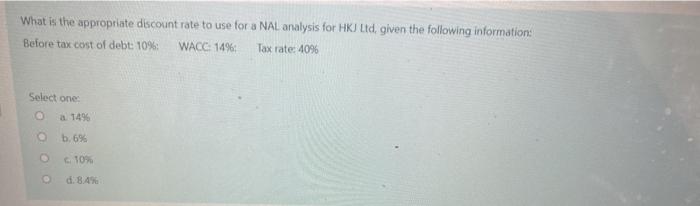

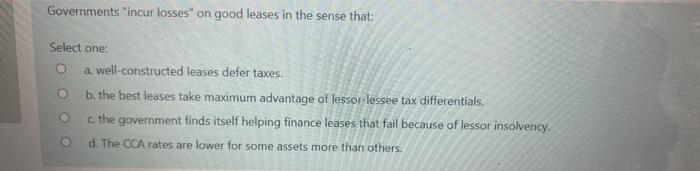

The most important issue that makes it possible for both a lessor and lessee to gain from a financial lease arrangement is (aside from risk); Select one a the lessor's higher marginal tax rate. b. the lessee's higher marginal tax rate. the lessee's better cash flow. d the lessor's purchasing power for leased assets. Luigi's has 16.000 shares of stock outstanding with a par value (book value) of $1.00 per share and a market price of $88 a sture. The firm just announced a 20% stock dividend What will be the market value per share after the dividend? Select one 053520 5120 c57417 distan What is the appropriate discount rate to use for a NAL analysis for HKJ Ltd, given the following information: Before tax cost of debt: 10% WACC 1496 Tax rate: 4096 Select one a 1496 b.6% 10% d. 8.4% Governments "incur losses" on good leases in the sense that: Select one: a. well-constructed leases defer taxes. O b. the best leases take maximum advantage of lessor-lessee tax differentials. c the government finds itself helping finance leases that fail because of lessor insolvency. d. The CCA rates are lower for some assets more than others

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts