Question: The most recent financial statements for Burnaby Co . are shown here: table [ [ Statement of Co , ive Incon,Statement of Financial Position

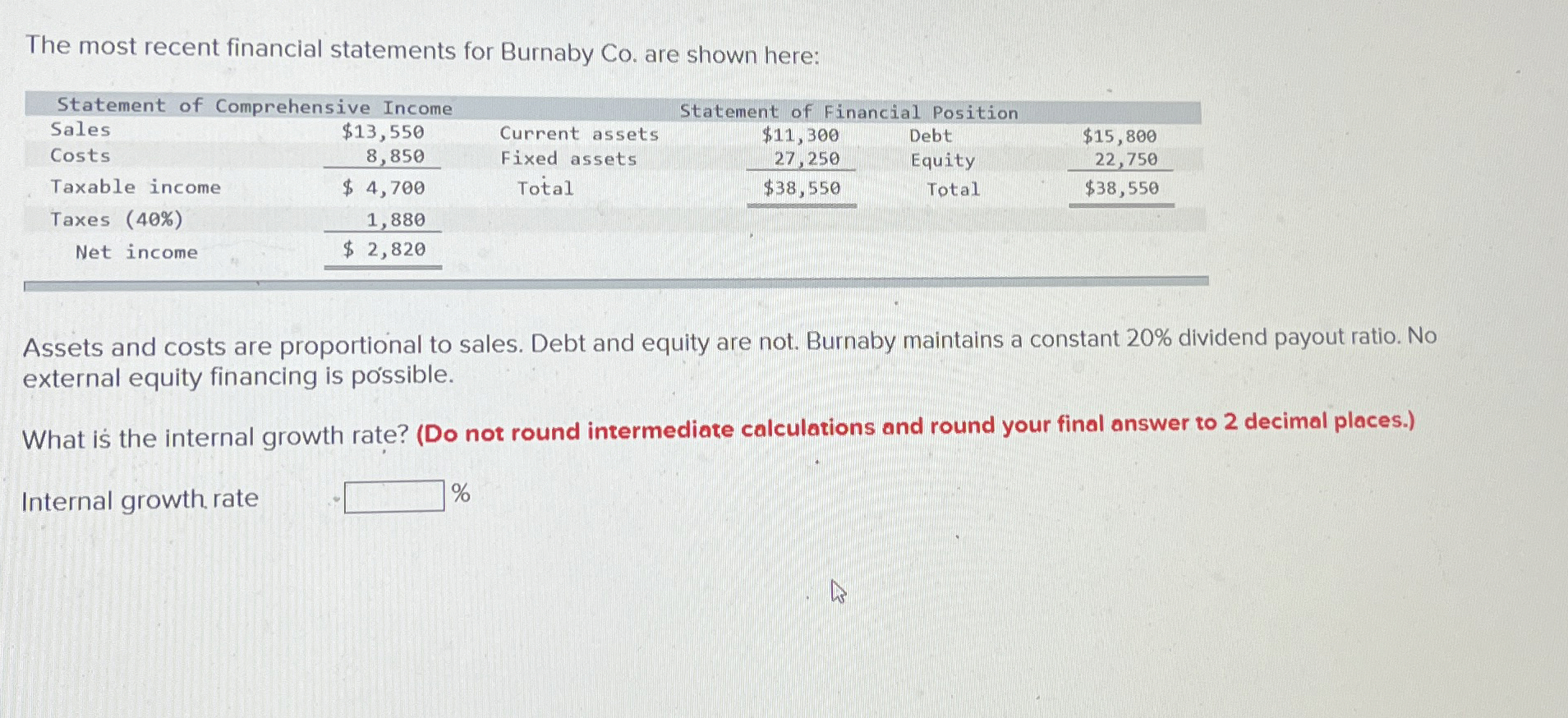

The most recent financial statements for Burnaby Co are shown here:

tableStatement of Coive Incon,Statement of Financial PositionSales$Current assets,$Debt,$CostsFixed assets,Equity,Taxable income,$ Total,$Total,$Taxes Net income,$

Assets and costs are proportional to sales. Debt and equity are not. Burnaby maintains a constant dividend payout ratio. No external equity financing is possible.

What is the internal growth rate? Do not round intermediate calculations and round your final answer to decimal places. Internal growth rate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock