Question: The MTN Group Limited ( MTN ) is a South African - based multinational corporation and mobile telecommunications provider. The company is listed

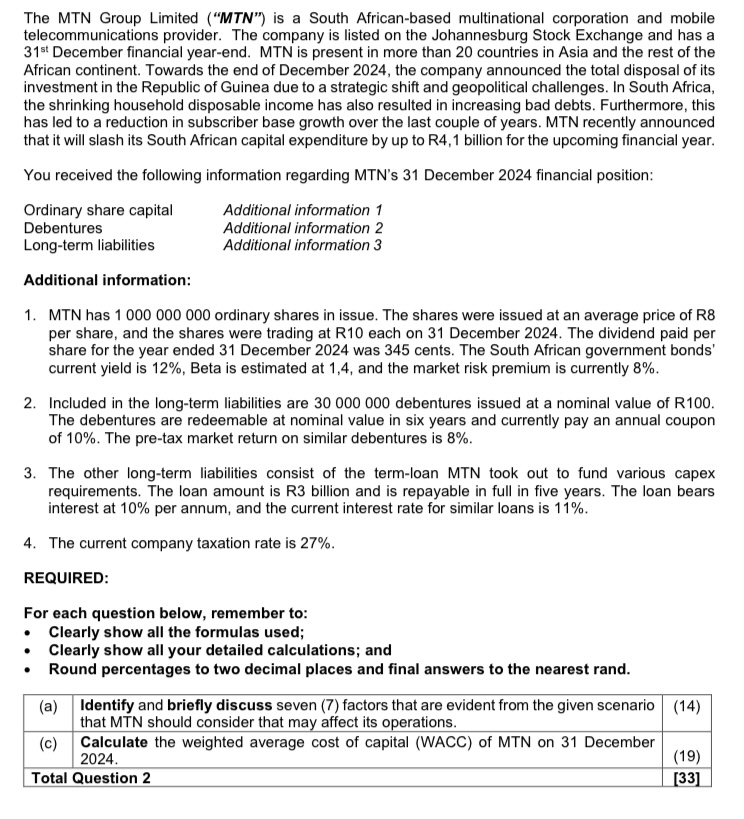

The MTN Group Limited MTN is a South Africanbased multinational corporation and mobile telecommunications provider. The company is listed on the Johannesburg Stock Exchange and has a text st December financial yearend. MTN is present in more than countries in Asia and the rest of the African continent. Towards the end of December the company announced the total disposal of its investment in the Republic of Guinea due to a strategic shift and geopolitical challenges. In South Africa, the shrinking household disposable income has also resulted in increasing bad debts. Furthermore, this has led to a reduction in subscriber base growth over the last couple of years. MTN recently announced that it will slash its South African capital expenditure by up to mathrmR billion for the upcoming financial year. You received the following information regarding MTNs December financial position: Ordinary share capital Debentures Longterm liabilities Additional information Additional information Additional information Additional information: MTN has ordinary shares in issue. The shares were issued at an average price of R per share, and the shares were trading at R each on December The dividend paid per share for the year ended December was cents. The South African government bonds' current yield is Beta is estimated at and the market risk premium is currently Included in the longterm liabilities are debentures issued at a nominal value of R The debentures are redeemable at nominal value in six years and currently pay an annual coupon of The pretax market return on similar debentures is The other longterm liabilities consist of the termloan MTN took out to fund various capex requirements. The loan amount is R billion and is repayable in full in five years. The loan bears interest at per annum, and the current interest rate for similar loans is The current company taxation rate is REQUIRED: For each question below, remember to: Clearly show all the formulas used; Clearly show all your detailed calculations; and Round percentages to two decimal places and final answers to the nearest rand.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock