Question: The multi step problem is shown in the first image. I was given the financial statement check figures shown below. I completed the work but

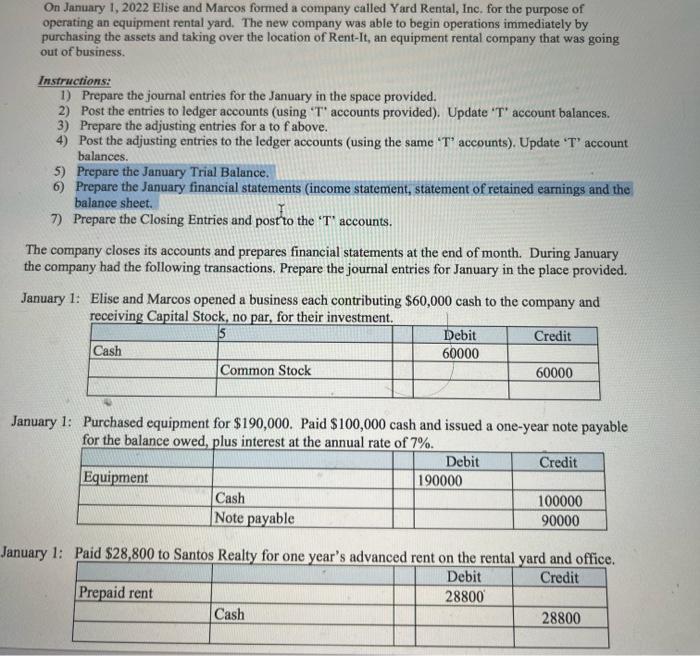

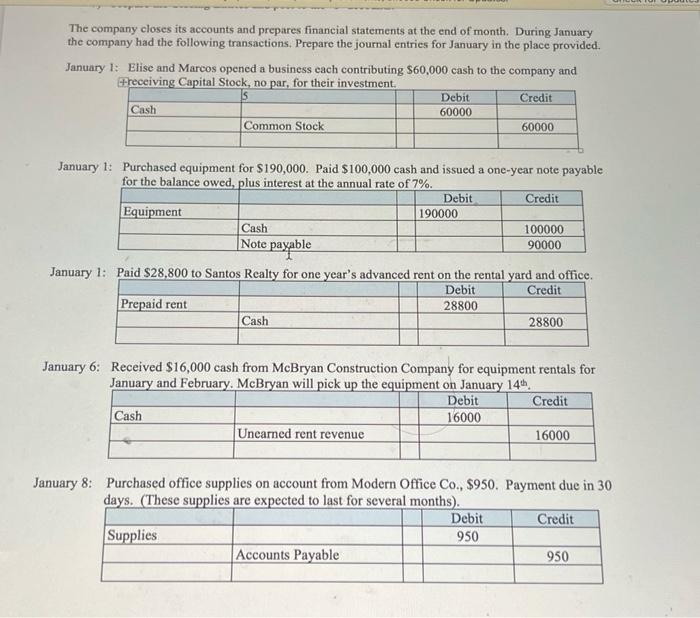

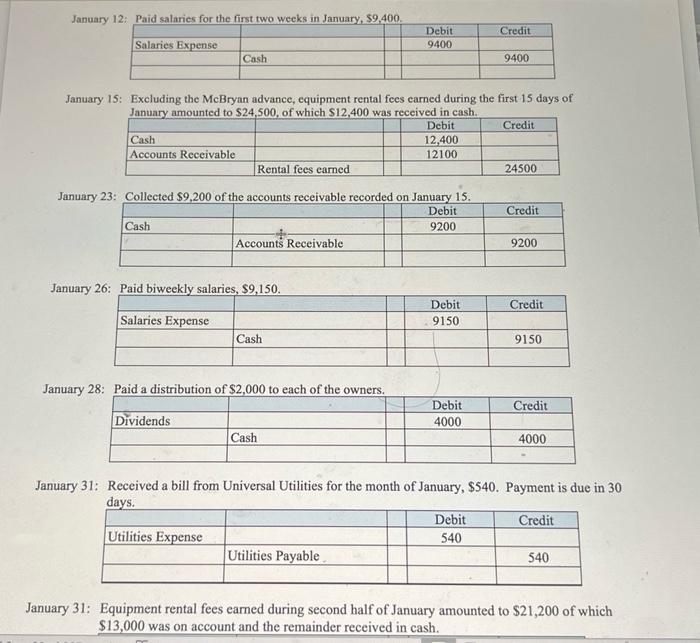

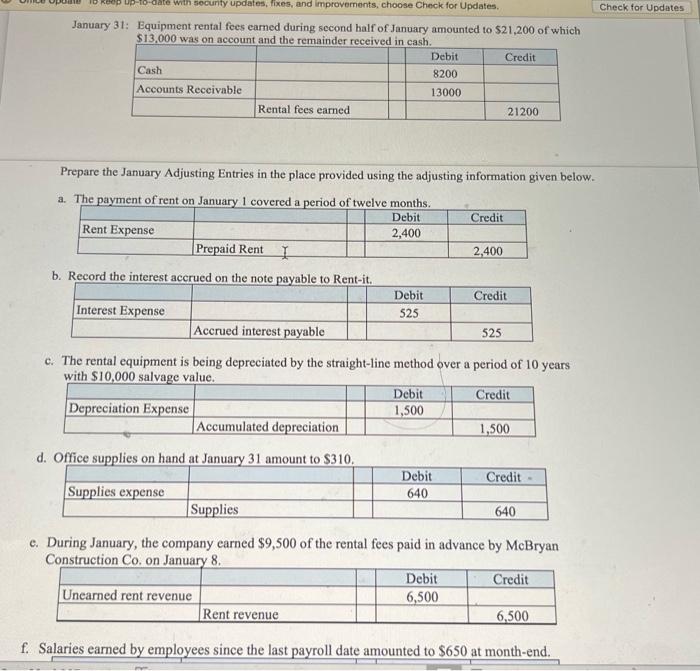

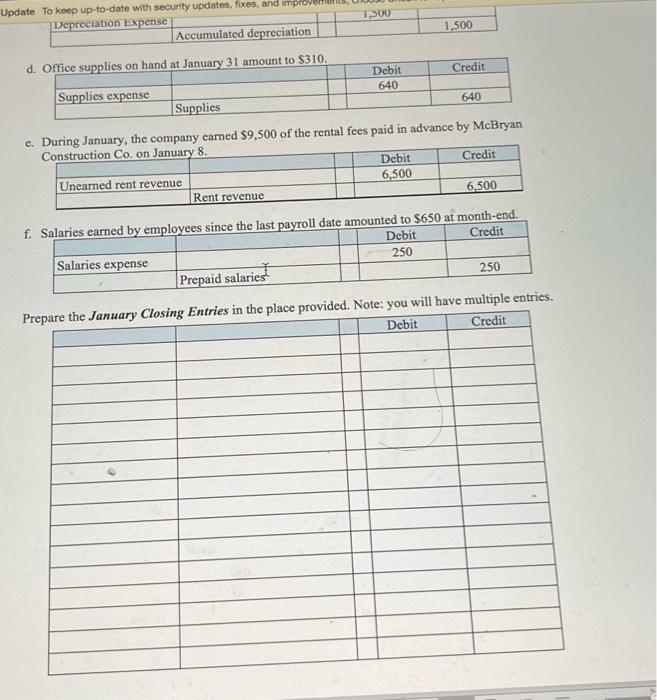

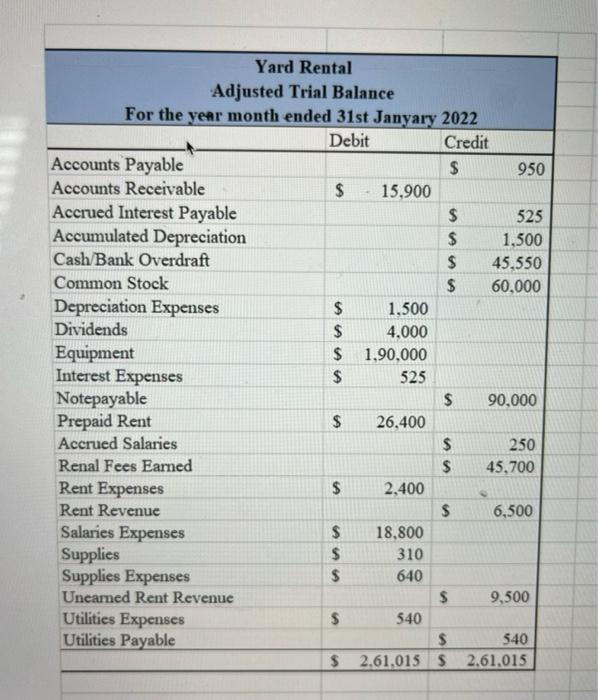

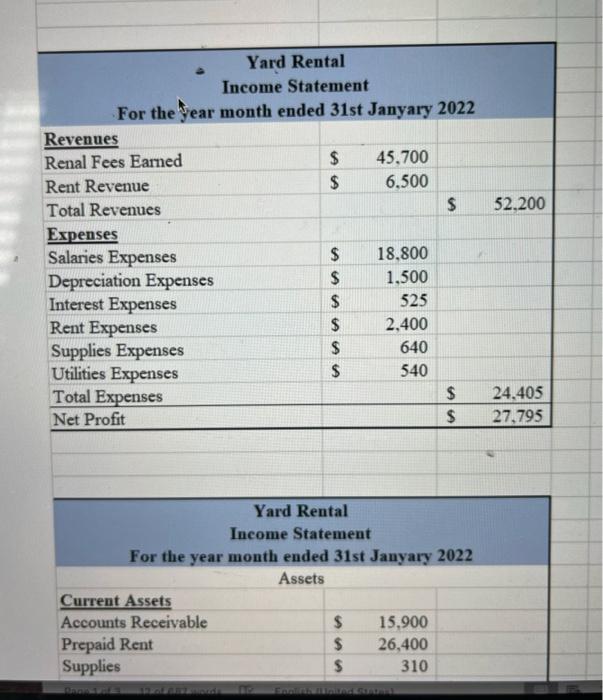

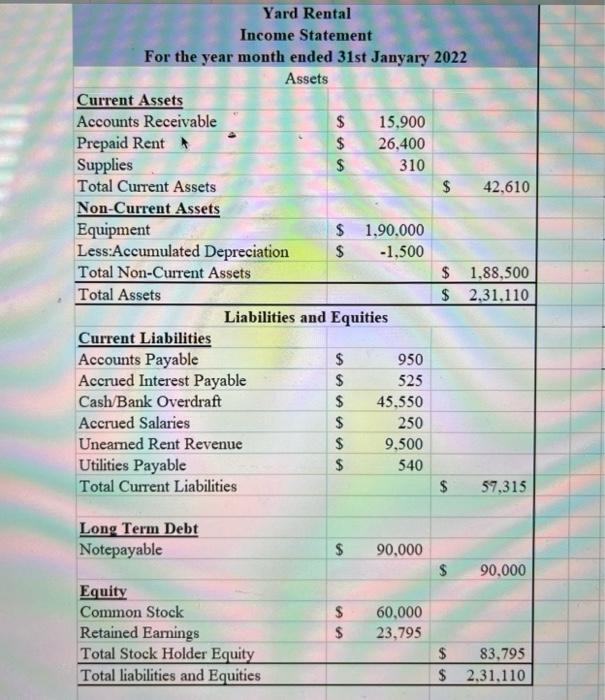

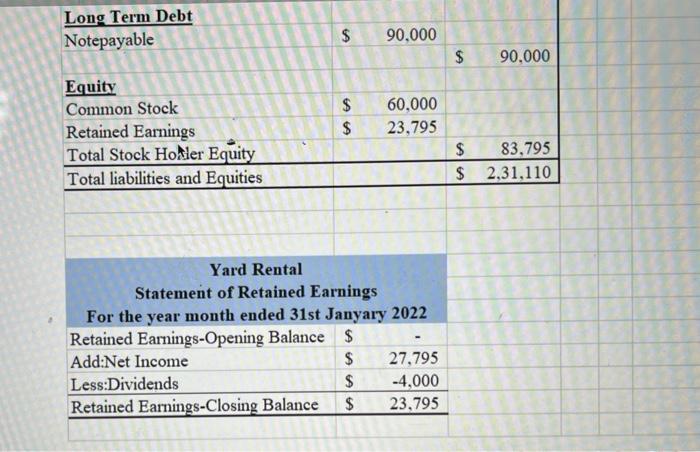

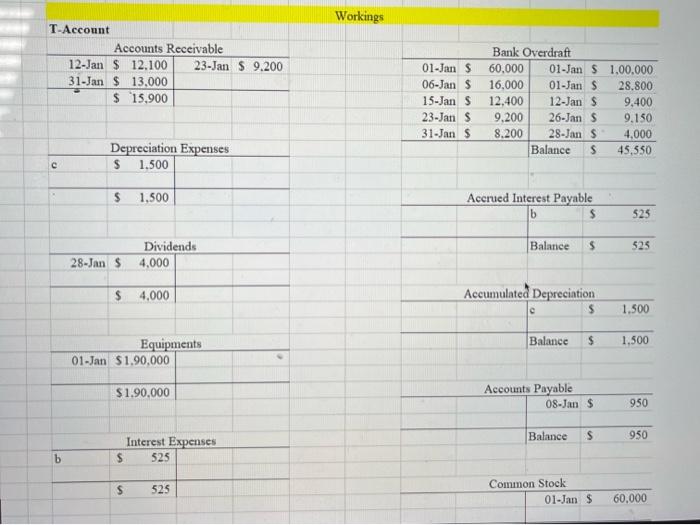

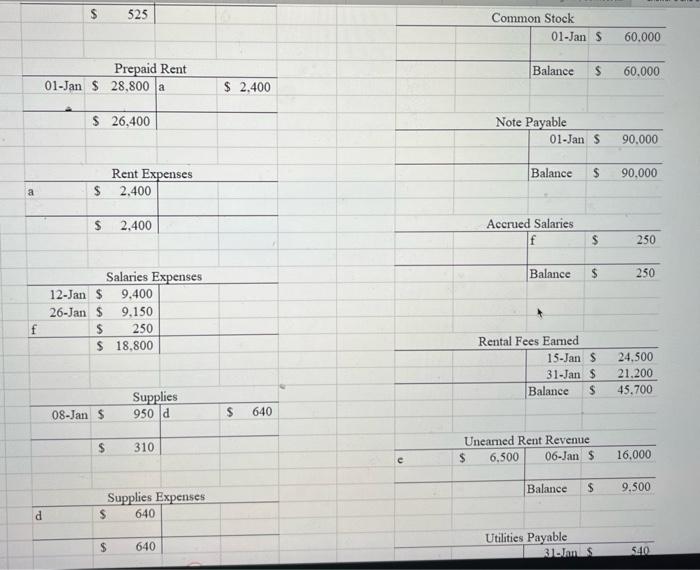

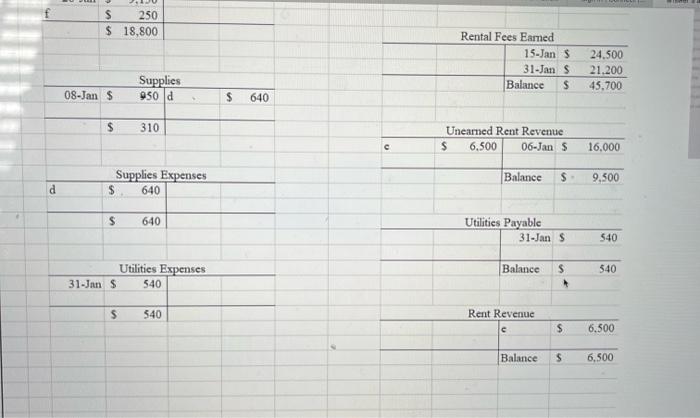

operating an equipment rental yard. The new company was able to begin operations immediately by purchasing the assets and taking over the location of Rent-It, an equipment rental company that was going out of business. Instructions: 1) Prepare the journal entries for the January in the space provided. 2) Post the entries to ledger accounts (using ' T ' accounts provided). Update ' T ' account balances. 3) Prepare the adjusting entries for a to f above. 4) Post the adjusting entries to the ledger accounts (using the same ' T ' accounts). Update ' T ' account balances. 5) Prepare the January Trial Balance. 6) Prepare the January financial statements (income statement, statement of retained earnings and the balance sheet. 7) Prepare the Closing Entries and post'to the ' T ' accounts. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions. Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and receiving Capital Stock, no par. for their investment. nuary 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. uary 1: Paid \$28,800 to Santos Realty for one year's advanced rent on the rental vard and office. The company closes its accounts and prepares financial statements at the end of month. During January the company had the following transactions, Prepare the journal entries for January in the place provided. January 1: Elise and Marcos opened a business each contributing $60,000 cash to the company and +receivine Canital Stock no nar for their invaetmant. January 1: Purchased equipment for $190,000. Paid $100,000 cash and issued a one-year note payable for the balance owed. plus interest at the annual rate of 7%. anuary 1: Paid \$28,800 to Santos Realty for one vear's advanced rent on the rental vard and office. nuary 6: Received $16,000 cash from McBryan Construction Company for equipment rentals for January and February. McBryan will pick up the equipment on Januarv 14th. uary 8: Purchased office supplies on account from Modern Office Co., $950. Payment due in 30 days. (These supplies are expected to last for several months). January 15: Excluding the McBryan advance, equipment rental fees earned during the first 15 days of Januarv amounted to $24.500. of which $12.400 was received in cash. January 23: January 26: January 28: Paid a distrihution of 8 nnn to aach af tha swnare January 31: Received a bill from Universal Utilities for the month of January, $540. Payment is due in 30 dave anuary 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13,000 was on account and the remainder received in cash. January 31: Equipment rental fees earned during second half of January amounted to $21,200 of which $13.000 was on account and the remainder received in eash Prepare the January Adjusting Entries in the place provided using the adjusting information given below. a. The payment of rent on Januarv 1 covered a neriod of twelva monthe b. Record the interest accrued on the nnte naunhia to Dant.it c. The rental equipment is being depreciated by the straight-line method over a period of 10 years with $10.000 salvage value. d. Offiee eunnliae in hand at Ianuaru 21 amnunt to 8210 c. During January, the company earned $9,500 of the rental fees paid in advance by McBryan Conetruntion CA an Ianuan, Q Salaries earned by employees since the last payroll date amounted to $650 at month-end. d. e. Puring January, the company earned $9,500 of the rental fees paid in advance by McBryan f. P \begin{tabular}{|l|ccc} \hline \multicolumn{4}{|c}{ Rental Fees Eamed } \\ \hline & 15-Jan $ & 24.500 \\ & 31-Jan $ & 21,200 \\ \hline & Balance & $ & 45,700 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts