Question: The multiple distillates can we hedge it ? If so tactical or strategy Options Problem 1 Mia is a sophisticated investor who has inherited a

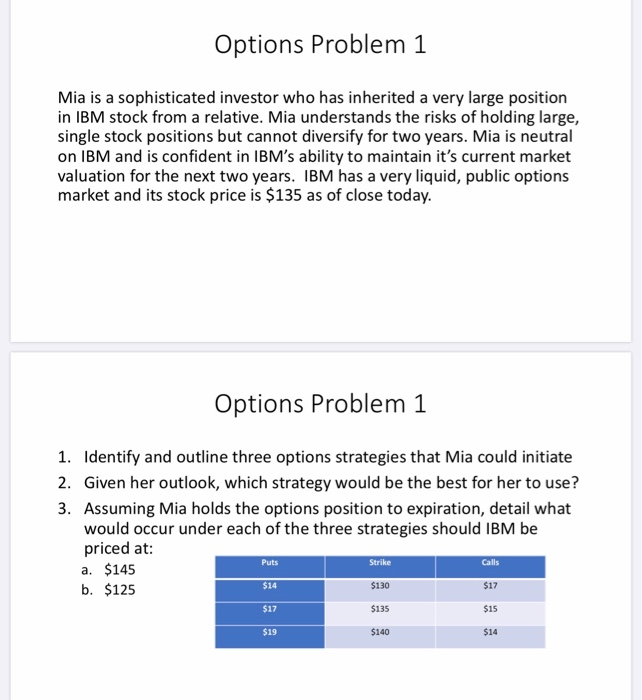

Options Problem 1 Mia is a sophisticated investor who has inherited a very large position in IBM stock from a relative. Mia understands the risks of holding large, single stock positions but cannot diversify for two years. Mia is neutral on IBM and is confident in IBM's ability to maintain it's current market valuation for the next two years. IBM has a very liquid, public options market and its stock price is $135 as of close today. Options Problem 1 1. Identify and outline three options strategies that Mia could initiate 2. Given her outlook, which strategy would be the best for her to use? 3. Assuming Mia holds the options position to expiration, detail what would occur under each of the three strategies should IBM be priced at: Puts a. $145 b. $125 $14 $17 $135 $140 Strike Calls $130 $15 519 $14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts