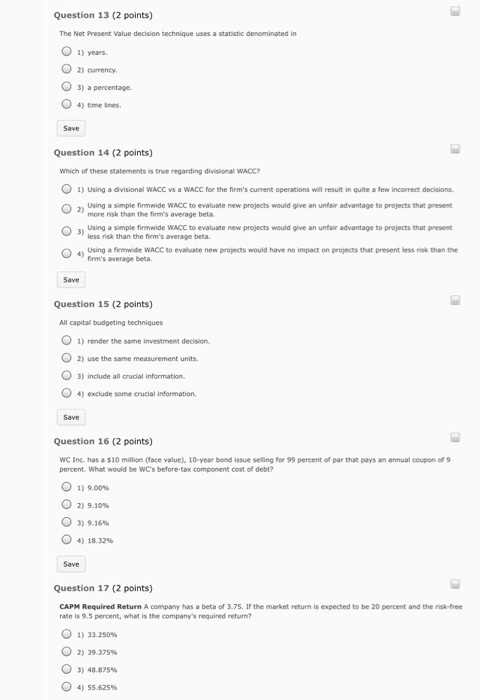

Question: The Net Present Value decision technique uses a statistic denominated in years. currency a percentage time lines Which of these statements is true regarding divisional

The Net Present Value decision technique uses a statistic denominated in years. currency a percentage time lines Which of these statements is true regarding divisional WACC? Using a divisional WACC vs a WACC for the firm's current operations will result in quite a few incorrect decisions. Using a simple firmwide WACC to evaluate new projects would give an unfair advantage to projects that present more risk than the firm's average beta. Using a sample firmwide WACC to evaluate new projects would give an unfair advantage to projects that present less risk than the firm's average beta. Using a firmwide WACC to evaluate new projects would have no impact on projects that present less risk than the firm's average beta. All capital budgeting techniques render the same investment decision use the same measurement units. include all crucial information. exclude some crucial information. WC Inc. has a $10 million (face value). 10 year bond issue selling for 99 percent of par that pays an annual coupon of 9 percent. What would be WC's before-tax component cost of debt? 9.00% 9.10% 9.16% 18.32% A company has a beta of 3.75. If the market return is expected to be 20 percent and the risk-free rate is 9.5 percent, what is the company's required return? 33.250% 39.375% 48.875% 55.625%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts