Question: The net present value (NPV) rule can be best stated as: A) An investment should be accepted if, and only if, the NPV is exactly

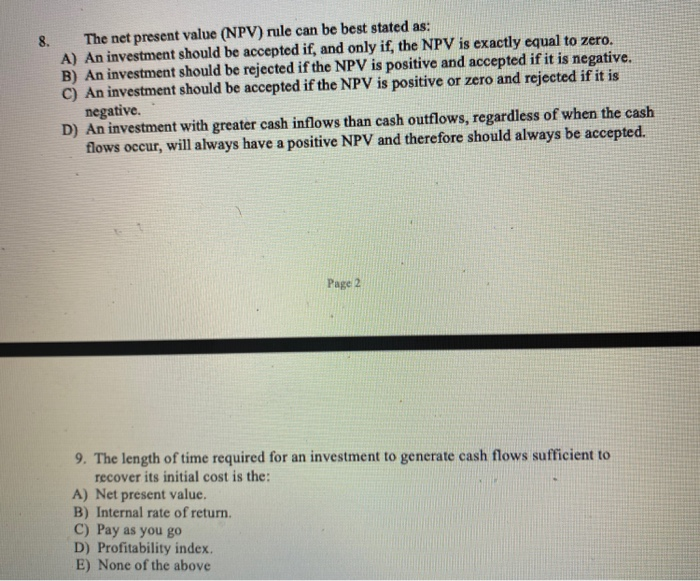

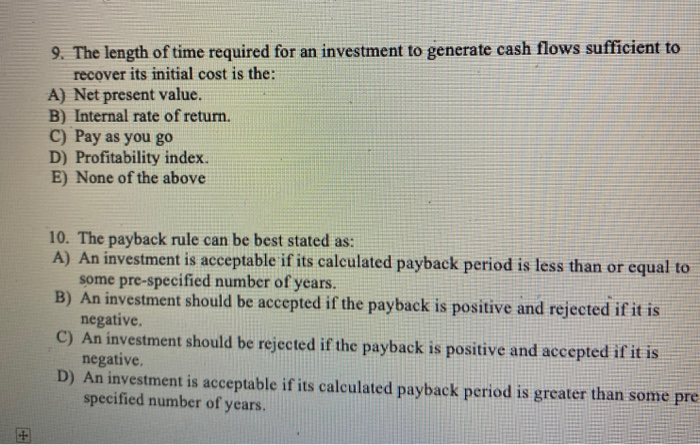

The net present value (NPV) rule can be best stated as: A) An investment should be accepted if, and only if, the NPV is exactly equal to zero. B) An investment should be rejected if the NPV is positive and accepted if it is negative. C) An investment should be accepted if the NPV is positive or zero and rejected if it is negative. D) An investment with greater cash inflows than cash outflows, regardless of when the cash flows occur, will always have a positive NPV and therefore should always be accepted. Page 2 9. The length of time required for an investment to generate cash flows sufficient to recover its initial cost is the: A) Net present value. B) Internal rate of return. C) Pay as you go D) Profitability index. E) None of the above 9. The length of time required for an investment to generate cash flows sufficient to recover its initial cost is the: A) Net present value. B) Internal rate of return. C) Pay as you go D) Profitability index. E) None of the above 10. The payback rule can be best stated as: A) An investment is acceptable if its calculated payback period is less than or equal to some pre-specified number of years. B) An investment should be accepted if the payback is positive and rejected if it is negative. C) An investment should be rejected if the payback is positive and accepted if it is negative. D) An investment is acceptable if its calculated payback period is greater than some pre specified number of years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts