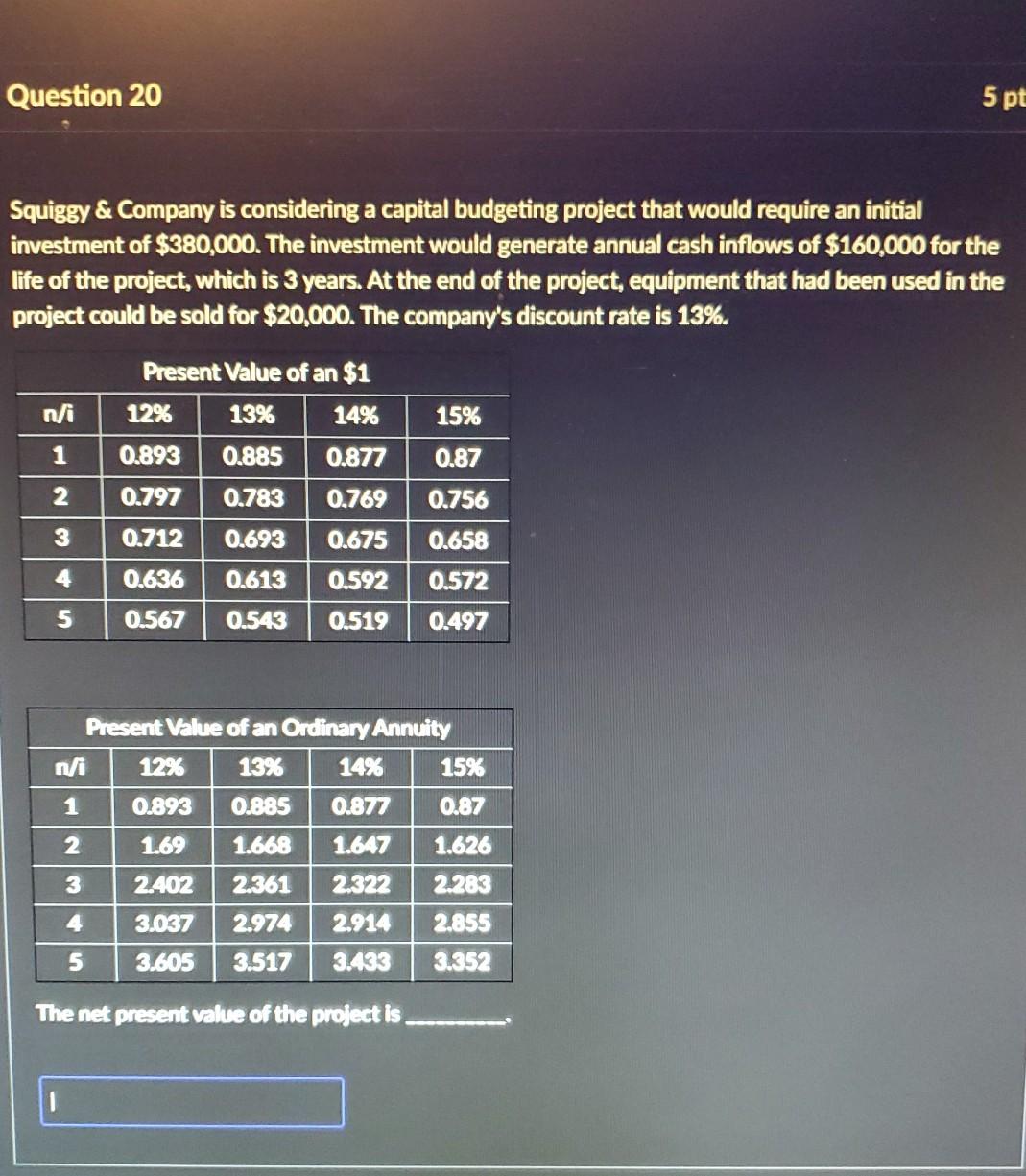

Question: the net present value of the project is ________. Question 20 5 pt Squiggy & Company is considering a capital budgeting project that would require

the net present value of the project is ________.

Question 20 5 pt Squiggy & Company is considering a capital budgeting project that would require an initial investment of $380,000. The investment would generate annual cash inflows of $160,000 for the life of the project, which is 3 years. At the end of the project, equipment that had been used in the project could be sold for $20,000. The company's discount rate is 13%. 1 Present Value of an $1 12% 13% 14% 0.893 0.885 0.877 0.797 0.783 0.769 0.712 0.693 0.675 0.636 0.613 0.592 0.567 0.543 0.519 15% 0.87 0.756 0.658 2 3 4 0.572 5 0.497 Present Value of an Ordinary Annuity 12% 13% 14% 15% 0.893 0.885 0.87 WN - 1.69 2.402 1.668 2.361 2.974 0.877 1.647 2.322 2.914 3.433 1.626 2.283 2.855 3.352 3.037 5 3.605 3.517 The net present value of the project is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts