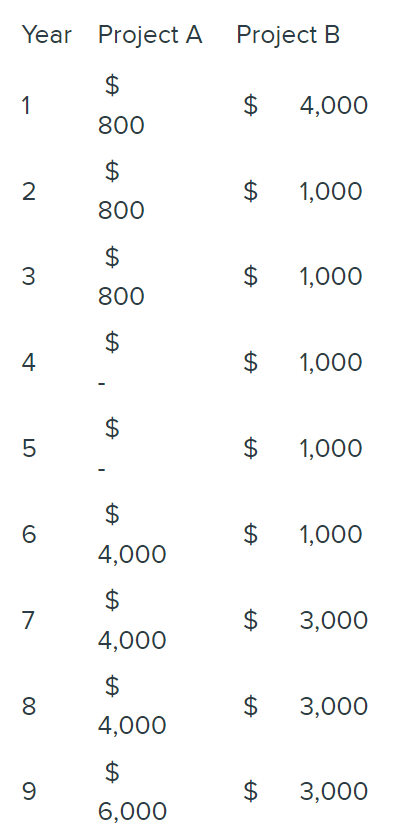

Question: (The next 5 questions will be based on this problem) A firm has two $10,000 (initial investment), Mutually Exclusive investment alternatives with the following cash

(The next 5 questions will be based on this problem) A firm has two $10,000 (initial investment), Mutually Exclusive investment alternatives with the following cash inflows. The WACC is 6 %. Please answer in excel

1. Calculate the NPV for Project A.

2. what is the NPV for Project B?

3. since these are MUTUALLY EXCLUSIVE and using the NPV criteria, should you accept Project A, Project B, both, or none?

4. what is the IRR for Project A? (enter as percentage xx.xx%)

5. what is the IRR for Project B? (enter as percentage xx.xx%)

6. since these are MUTUALLY EXCLUSIVE and using the IRR criteria, should you accept Project A, Project B, both, or none?

Year Project A Project B $ 1 $ 4,000 800 $ 2 $ 1,000 800 3 3 $ 800 $ 1,000 $ 4. $ 1,000 $ 5 5 $ 1,000 $ 6 6 $ $ 1,000 4,000 $ 7 $ 3,000 4,000 00 8 $ 4,000 $ 3,000 9 $ 6,000 $ 3,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts