Question: The next dividend payment by Hoffman, Inc., will be $2.50 per share. The dividends are anticipated to maintain a growth rate of 575 percent forever.

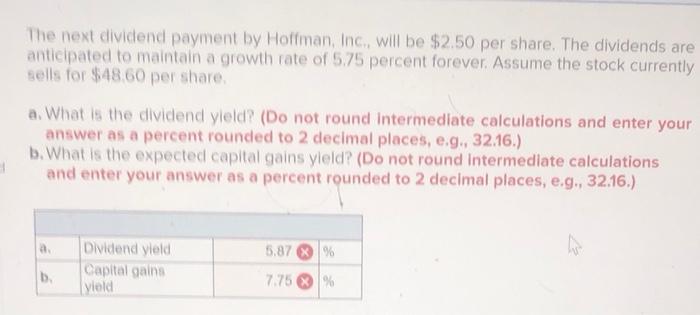

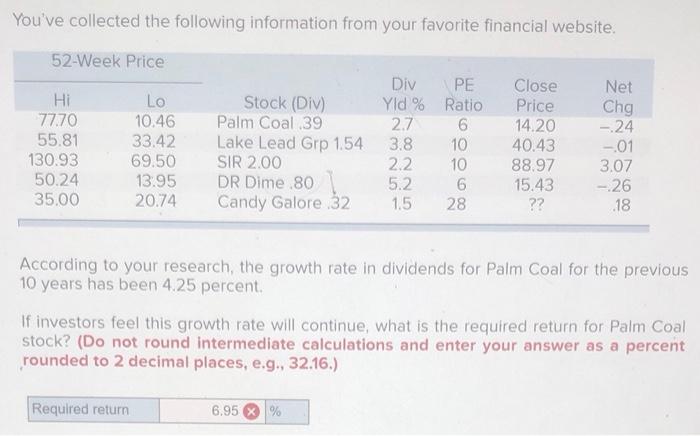

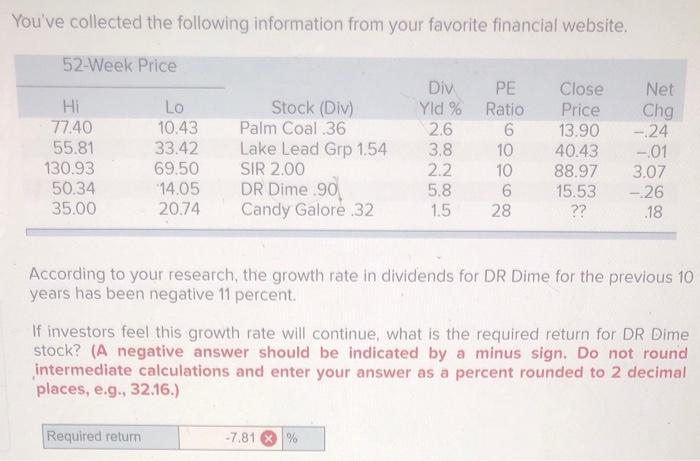

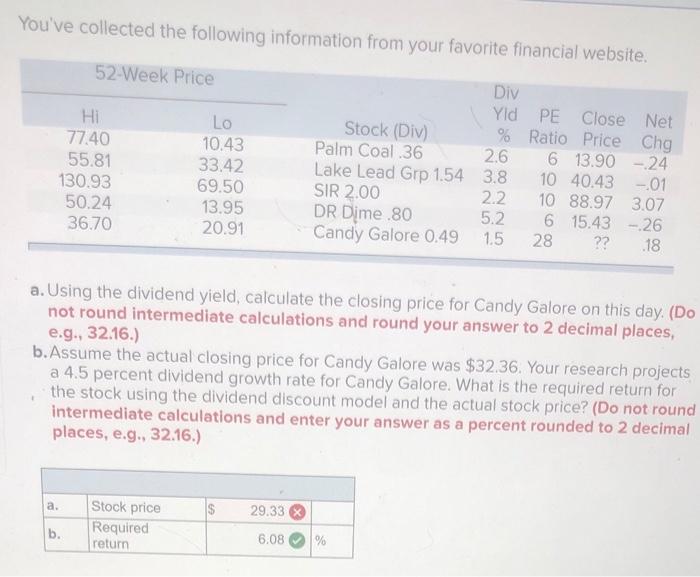

The next dividend payment by Hoffman, Inc., will be $2.50 per share. The dividends are anticipated to maintain a growth rate of 575 percent forever. Assume the stock currently sells for $48.60 per share a. What is the dividend yield? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, eg, 32.16.) b. What is the expected capital gains yleld? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) 5.87 X % Dividend yield Capital gains yield b. 7.75 % You've collected the following information from your favorite financial website. 52-Week Price Hi 77.70 55.81 130.93 50.24 35.00 Lo 10.46 33.42 69.50 13.95 20.74 Stock (Div) Palm Coal.39 Lake Lead Grp 1.54 SIR 2.00 DR Dime .80 Candy Galore 32 Div PE Yld % Ratio 2.7 6 3.8 10 2.2 10 5.2 6 1.5 28 Close Price 14.20 40.43 88.97 15.43 ?? Net Chg -24 --01 3.07 - 26 .18 According to your research, the growth rate in dividends for Palm Coal for the previous 10 years has been 4.25 percent. If investors feel this growth rate will continue, what is the required return for Palm Coal stock? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Required return 6.95 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts