Question: The next few questions will be based on the same table and statistics that follow. To save you re-reading everything again in these subsequent questions,

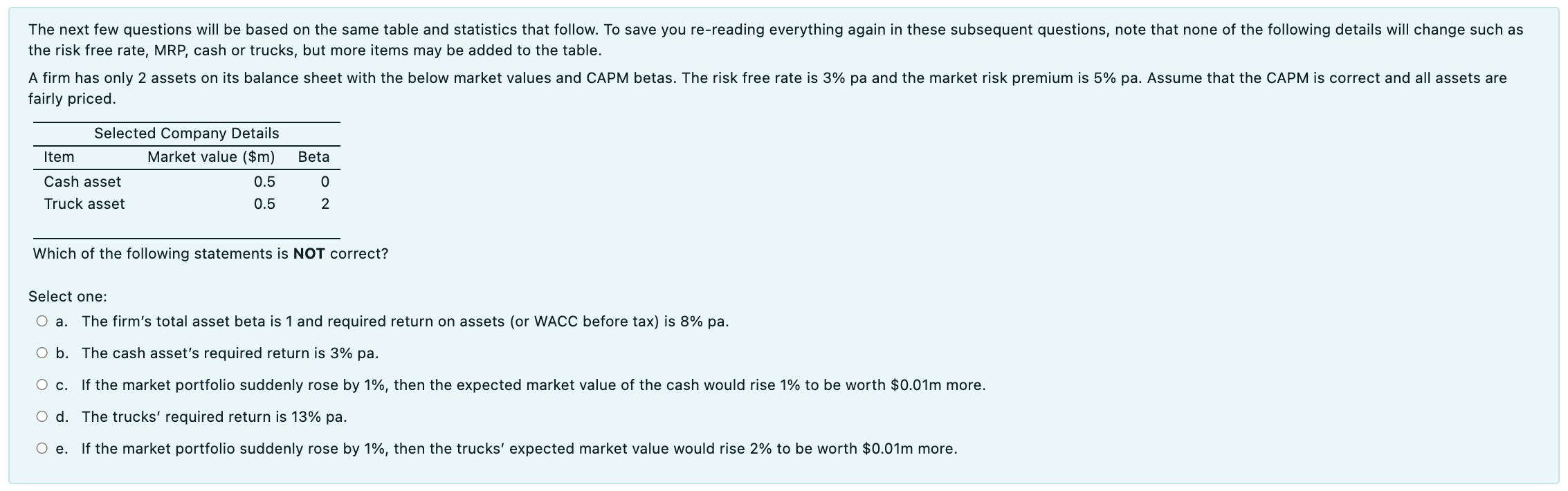

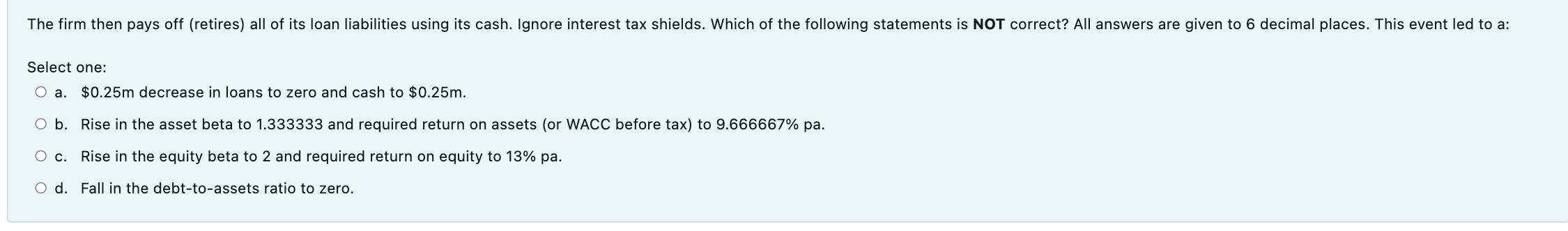

The next few questions will be based on the same table and statistics that follow. To save you re-reading everything again in these subsequent questions, note that none of the following details will change such as the risk free rate, MRP, cash or trucks, but more items may be added to the table. A firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced. Selected Company Details Market value ($m) Item Beta Cash asset 0.5 0 Truck asset 0.5 2 Which of the following statements is NOT correct? Select one: O a. The firm's total asset beta is 1 and required return on assets (or WACC before tax) is 8% pa. O b. The cash asset's required return is 3% pa. O c. If the market portfolio suddenly rose by 1%, then the expected market value of the cash would rise 1% to be worth $0.01m more. O d. The trucks' required return is 13% pa. O e. If the market portfolio suddenly rose by 1%, then the trucks' expected market value would rise 2% to be worth $0.01m more. The firm then pays off (retires) all of its loan liabilities using its cash. Ignore interest tax shields. Which of the following statements is NOT correct? All answers are given to 6 decimal places. This event led to a: Select one: O a. $0.25m decrease in loans to zero and cash to $0.25m. O b. Rise in the asset beta to 1.333333 and required return on assets (or WACC before tax) to 9.666667% pa. O c. Rise in the equity beta to 2 and required return on equity to 13% pa. O d. Fall in the debt-to-assets ratio to zero. The next few questions will be based on the same table and statistics that follow. To save you re-reading everything again in these subsequent questions, note that none of the following details will change such as the risk free rate, MRP, cash or trucks, but more items may be added to the table. A firm has only 2 assets on its balance sheet with the below market values and CAPM betas. The risk free rate is 3% pa and the market risk premium is 5% pa. Assume that the CAPM is correct and all assets are fairly priced. Selected Company Details Market value ($m) Item Beta Cash asset 0.5 0 Truck asset 0.5 2 Which of the following statements is NOT correct? Select one: O a. The firm's total asset beta is 1 and required return on assets (or WACC before tax) is 8% pa. O b. The cash asset's required return is 3% pa. O c. If the market portfolio suddenly rose by 1%, then the expected market value of the cash would rise 1% to be worth $0.01m more. O d. The trucks' required return is 13% pa. O e. If the market portfolio suddenly rose by 1%, then the trucks' expected market value would rise 2% to be worth $0.01m more. The firm then pays off (retires) all of its loan liabilities using its cash. Ignore interest tax shields. Which of the following statements is NOT correct? All answers are given to 6 decimal places. This event led to a: Select one: O a. $0.25m decrease in loans to zero and cash to $0.25m. O b. Rise in the asset beta to 1.333333 and required return on assets (or WACC before tax) to 9.666667% pa. O c. Rise in the equity beta to 2 and required return on equity to 13% pa. O d. Fall in the debt-to-assets ratio to zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts