Question: (The next question has the same problem statement.) You are evaluating the acquisition of a new ski machine. Its price is $200,000, and it costs

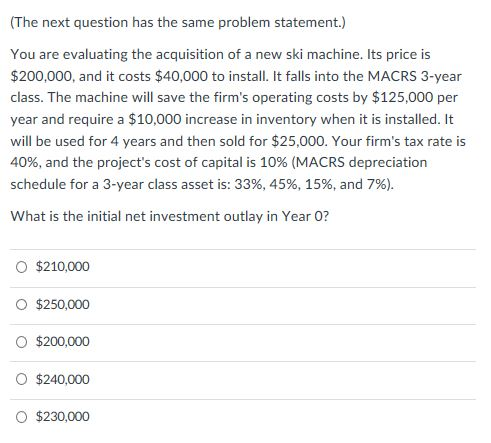

(The next question has the same problem statement.) You are evaluating the acquisition of a new ski machine. Its price is $200,000, and it costs $40,000 to install. It falls into the MACRS 3-year class. The machine will save the firm's operating costs by $125,000 per year and require a $10,000 increase in inventory when it is installed. It will be used for 4 years and then sold for $25,000. Your firm's tax rate is 40%, and the project's cost of capital is 10% (MACRS depreciation schedule for a 3-year class asset is: 33%, 45%, 15%, and 7%) What is the initial net investment outlay in Year 0? O $210,000 O $250,000 O $200,000 O $240,000 O $230,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts