Question: The next three problems refer to Roadrunner Enterprises. Roadrunner Enterprises is expected to grow its dividends and earnings at various rates. The company just paid

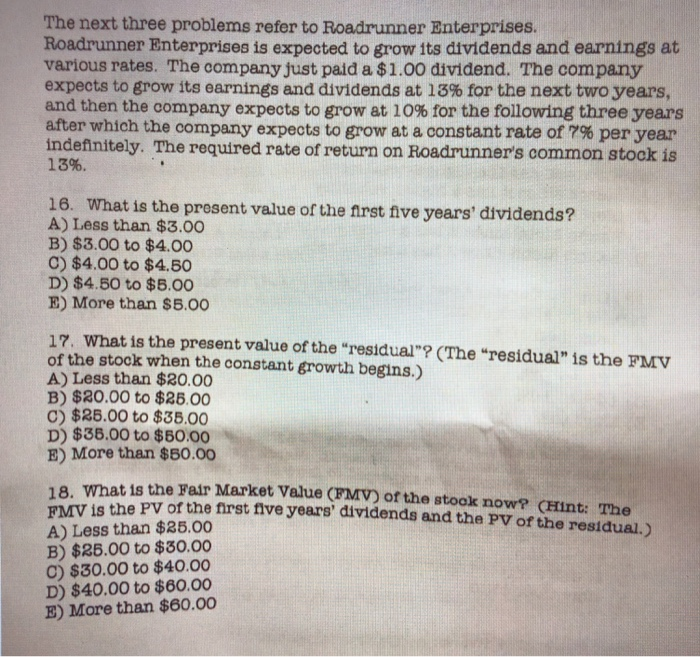

The next three problems refer to Roadrunner Enterprises. Roadrunner Enterprises is expected to grow its dividends and earnings at various rates. The company just paid a $1.00 dividend. The company expects to grow its earnings and dividends at 13% for the next two years, and then the company expects to grow at 10% for the following three years after which the company expects to grow at a constant rate of 7% per year indefinitely. The required rate of return on Roadrunner's common stock is 13% 16What is the present value of the first five years, dividends? A) Less than $3.00 B) $3.00 to $4.00 C) $4.00 to $4.50 D) $4.50 to $5.00 E) More than $5.00 17, what is the present value of the "residual"? (The residual" is the FMV of the stock when the constant growth begins.) A) Less than $20.00 B) $20.00 to $26.00 C) $25.00 to $35.00 D) $36.00 to $60.00 E) More than50.00 a what is the Fair Market Velue (FMV) of the stook now? (Hint: The is the Pv of the first five years' dividends and the PV of the residual.) A) Less than $35.00 B) $26.00 to $30.00 C) $30.00 to $40.00 D) $40.00 to $60.00 E) More than $60.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts