Question: The next two problems use the tables below. Partial Data on 20 foreign funds is given (Mutual Funds, March 2016). We develop an estimated regression

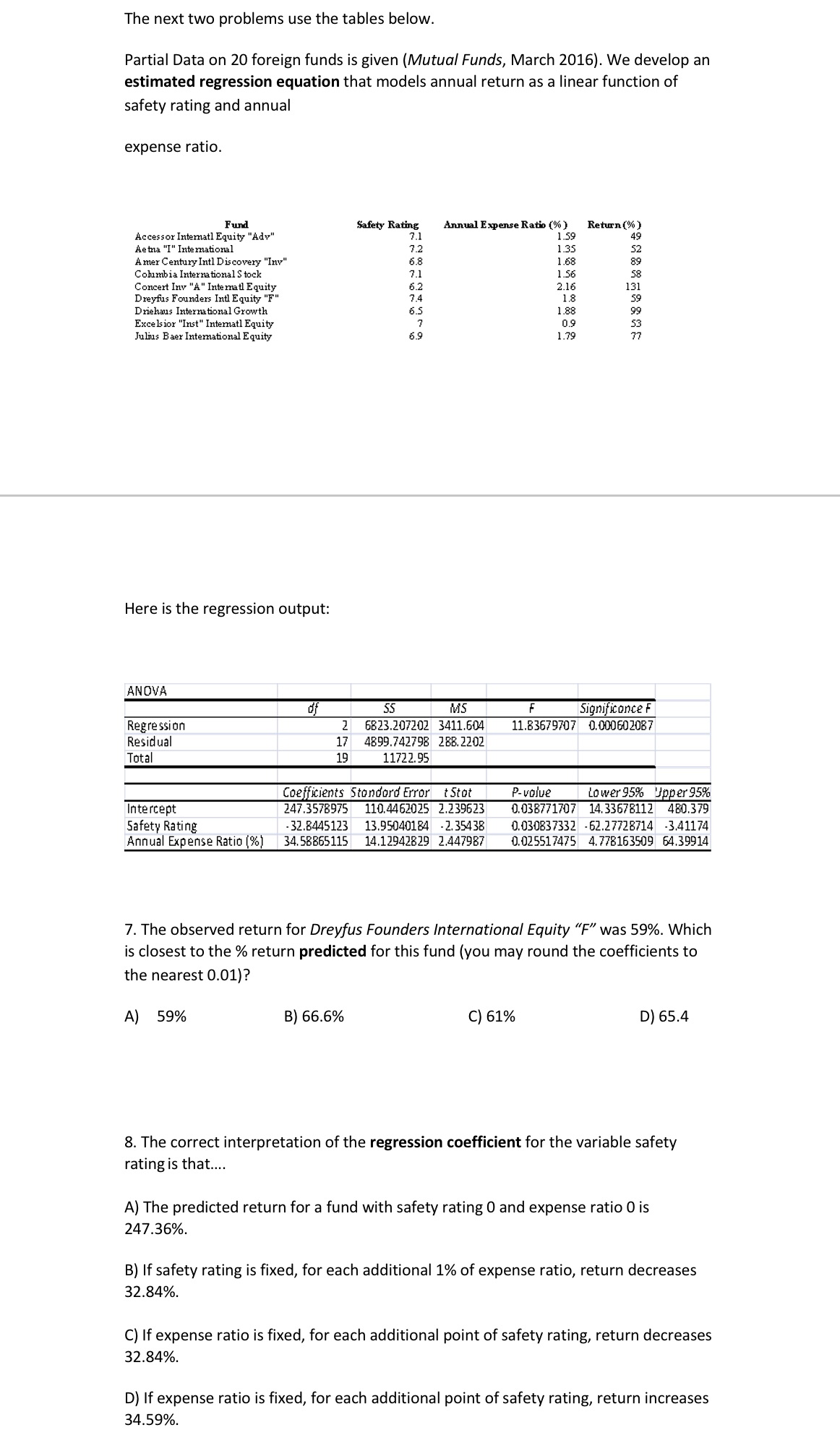

The next two problems use the tables below. Partial Data on 20 foreign funds is given (Mutual Funds, March 2016). We develop an estimated regression equation that models annual return as a linear function of safety rating and annual expense ratio. Fund Safety Rating Annual Expense Ratio (%) Return (% ) Accessor Internatl Equity "Adv" 7.1 1.59 49 Aetna "I" International 7.2 1.3 52 A mer Century Intl Discovery "Inv" 6.8 1.68 89 Columbia International Stock 7.1 1.56 58 Concert Inv "A" Internatl Equity 6.2 2.16 Dreyfus Founders Intl Equity "F 7.4 1.8 Driehaus International Growth 6.5 1.88 Excelsior "Inst" Internatl Equity ? 0.9 Julius Baer Intern 69 1.79 Here is the regression output: ANOVA of MS Significance F Regression 2 6823.207202 3411.604 11.83679707 0.000602087 Residual 17 4899.742798 288. 2202 Tota 19 11722.95 Coefficients Stondord Error t Stot P-volve Lower 95% Upper 95% Intercept 247.3578975 110.4462025 2.239623 0.038771707 14.33678112 480.379 Safety Rating - 32.8445123 13.95040184 -2.35438 0.030837332 - 62.27728714 -3.41174 Annual Expense Ratio (%) 34.58865115 14.12942829 2.447987 0.025517475 4. 778163509 64.39914 7. The observed return for Dreyfus Founders International Equity "F" was 59%. Which is closest to the % return predicted for this fund (you may round the coefficients to the nearest 0.01)? A) 59% B) 66.6% C) 61% D) 65.4 8. The correct interpretation of the regression coefficient for the variable safety rating is that.... A) The predicted return for a fund with safety rating 0 and expense ratio O is 247.36%. B) If safety rating is fixed, for each additional 1% of expense ratio, return decreases 32.84%. C) If expense ratio is fixed, for each additional point of safety rating, return decreases 32.84%. D) If expense ratio is fixed, for each additional point of safety rating, return increases 34.59%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts