Question: The next two problems use this information. One year ago you purchased a bond that paid a coupon rate of 7.5 percent. The bond's price

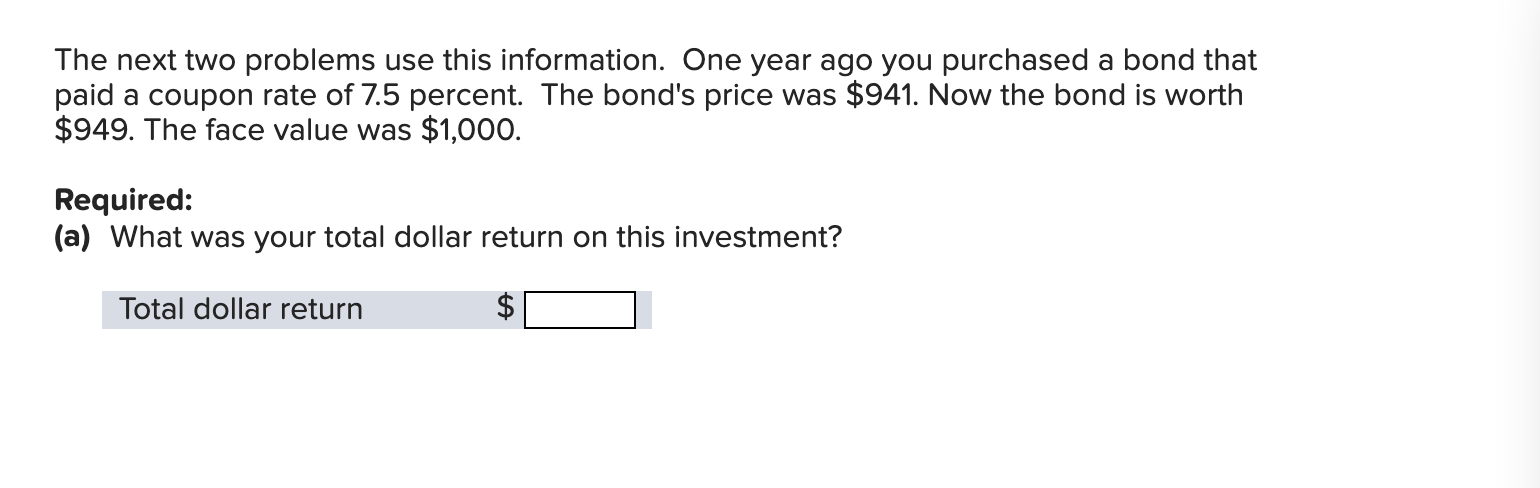

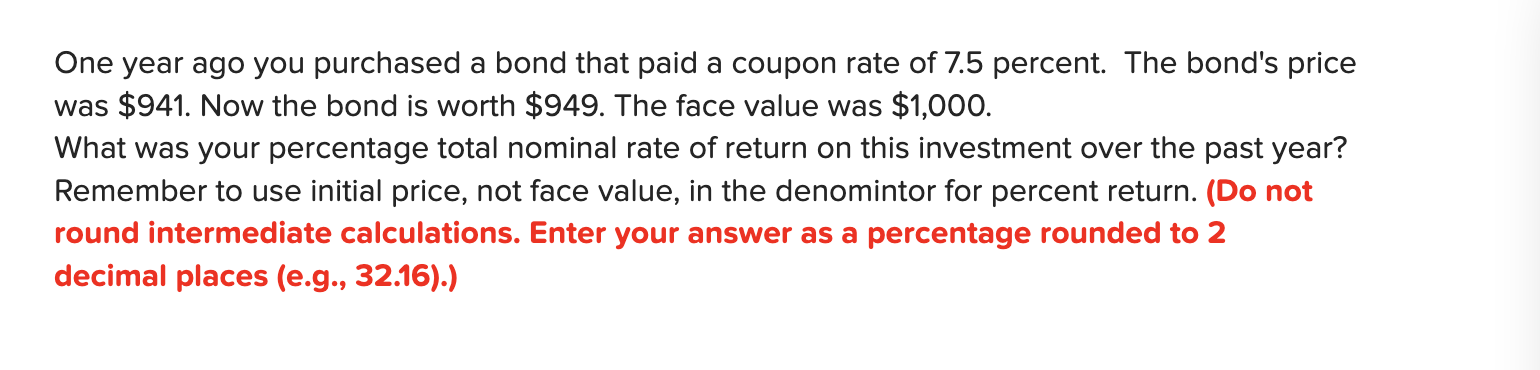

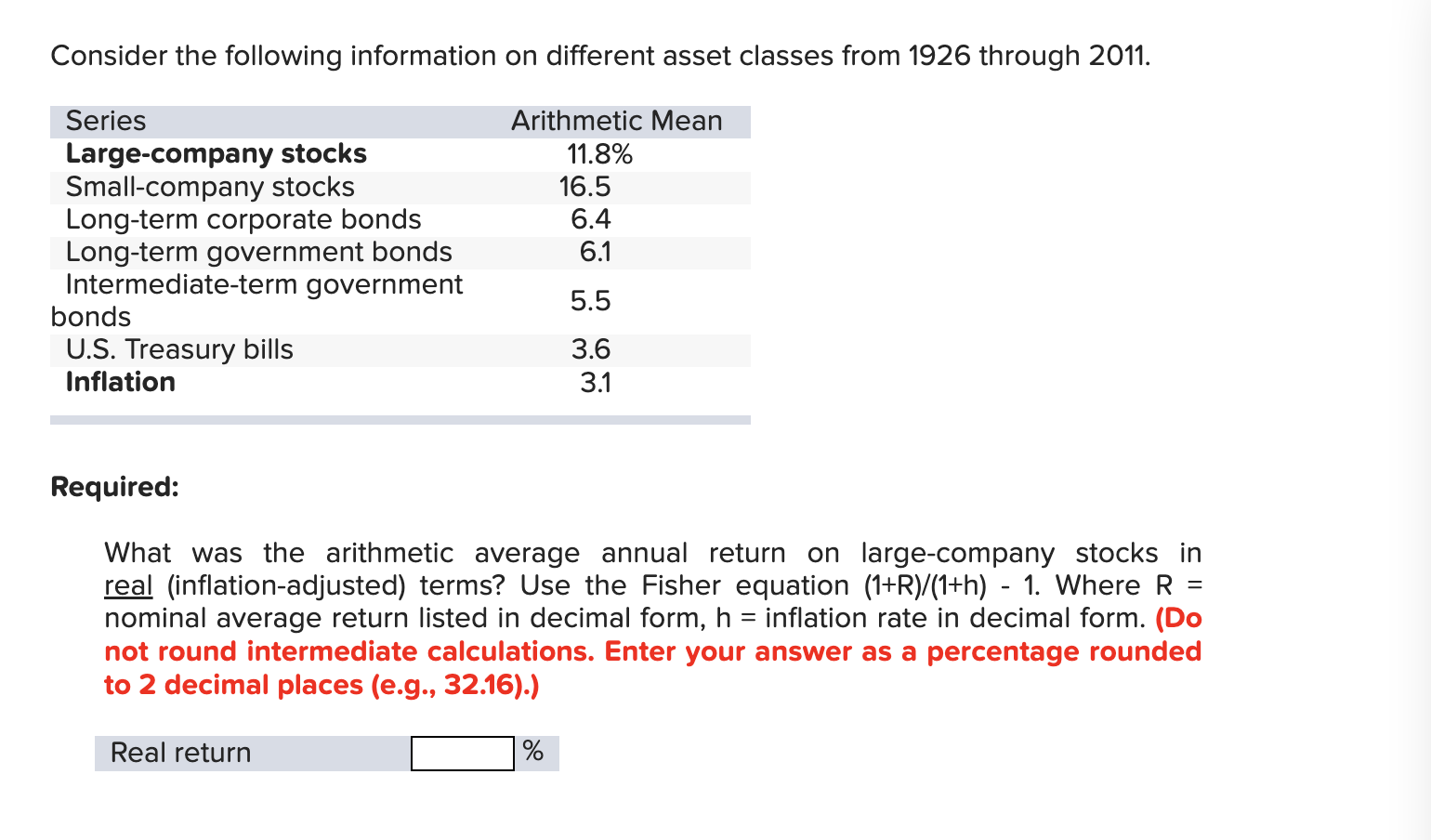

The next two problems use this information. One year ago you purchased a bond that paid a coupon rate of 7.5 percent. The bond's price was $941. Now the bond is worth $949. The face value was $1,000. Required: (a) What was your total dollar return on this investment? Total dollar return $ One year ago you purchased a bond that paid a coupon rate of 7.5 percent. The bond's price was $941. Now the bond is worth $949. The face value was $1,000. What was your percentage total nominal rate of return on this investment over the past year? Remember to use initial price, not face value, in the denomintor for percent return. (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16).) Consider the following information on different asset classes from 1926 through 2011. Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation Arithmetic Mean 11.8% 16.5 6.4 6.1 5.5 3.6 3.1 Required: What was the arithmetic average annual return on large-company stocks in real (inflation-adjusted) terms? Use the Fisher equation (1+R)/(1+h) - 1. Where R = nominal average return listed in decimal form, h inflation rate in decimal form. (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16).) Real return 1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts