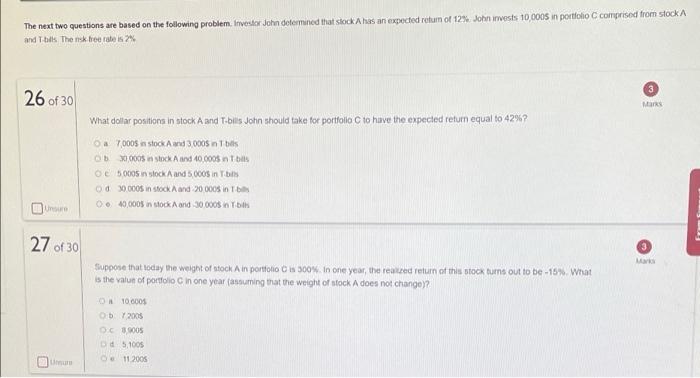

Question: The next two questions are based on the following problem. Investor John determined that slock A has an expected retun of 12 John invests 10,000

The next two questions are based on the following problem. Investor John determined that slock A has an expected retun of 12 John invests 10,000 in portfolio C comprised from stock and Tbils The nk free risteis % 26 of 30 Mars What dollar positions in stock A and Tbilis John should take for portfolio C to have the expected return equal to 42%? 6a 7,000 en stock and 3.000 nTbilis OBX7000n stock and 40.0005 Tbilis O 5000S in stock and 5,000$ in Tbs Od 30.0005 in stock and 20 000 in 040.0005 in stock and 30.0003 n. U 27 of 30 Suppose that today the weight of stock A in portfolio Ois 300%. In one year, the reared return of this stock turns out to be -15%. What is the value of portfolio in one year (assuming that the weight of stock A does not change? O 10.0005 OD Y 2005 COS D51005 11.2005

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts