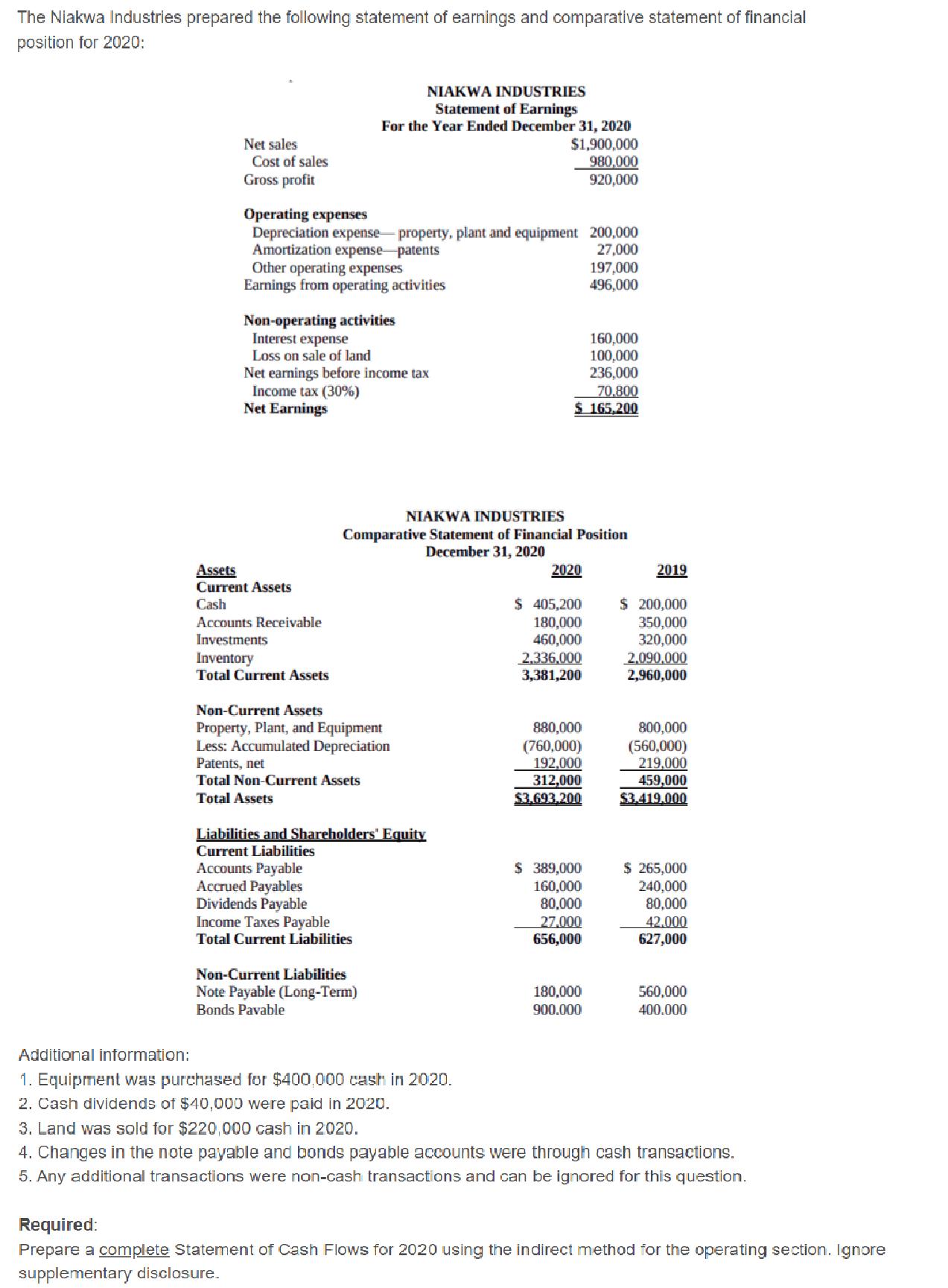

The Niakwa Industries prepared the following statement of earnings and comparative statement of financial position for 2020:

Fantastic news! We've Found the answer you've been seeking!

Question:

The Niakwa Industries prepared the following statement of earnings and comparative statement of financial position for 2020:

Transcribed Image Text:

The Niakwa Industries prepared the following statement of earnings and comparative statement of financial position for 2020: NIAKWA INDUSTRIES Statement of Earnings Net sales Cost of sales Gross profit For the Year Ended December 31, 2020 $1,900,000 980,000 920,000 Operating expenses Depreciation expense property, plant and equipment 200,000 Amortization expense patents Other operating expenses Earnings from operating activities 27,000 197,000 496,000 Non-operating activities Interest expense Loss on sale of land Net earnings before income tax Income tax (30%) Net Earnings 160,000 100,000 236,000 70,800 $ 165.200 NIAKWA INDUSTRIES Comparative Statement of Financial Position December 31, 2020 2020 Assets Current Assets 2019 $ 200,000 $ 405,200 180,000 460,000 Cash Accounts Receivable 350,000 320,000 Investments Inventory Total Current Assets 2,336,000 3,381,200 2.090,000 2,960,000 Non-Current Assets Property, Plant, and Equipment Less: Accumulated Depreciation Patents, net Total Non-Current Assets Total Assets 880,000 (760,000) 192,000 312,000 $3.693.200 800,000 (560,000) 219,000 459,000 $3.419.000 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Accrued Payables Dividends Payable Income Taxes Payable $ 389,000 160,000 80,000 27,000 656,000 $ 265,000 240,000 80,000 42.000 627,000 Total Current Liabilities Non-Current Liabilities 180,000 900.000 Note Payable (Long-Term) 560,000 Bonds Pavable 400.000 Additional information: 1. Equipment was purchased for $400,000 cash in 2020. 2. Cash dividends of $40,000 were paid in 2020. 3. Land was sold for $220,000 cash in 2020. 4. Changes in the note payable and bonds payable accounts were through cash transactions. 5. Any additional transactions were non-cash transactions and can be ignored for this question. Required: Prepare a complete Statement of Cash Flows for 2020 using the indirect method for the operating section. Ignore supplementary disclosure. The Niakwa Industries prepared the following statement of earnings and comparative statement of financial position for 2020: NIAKWA INDUSTRIES Statement of Earnings Net sales Cost of sales Gross profit For the Year Ended December 31, 2020 $1,900,000 980,000 920,000 Operating expenses Depreciation expense property, plant and equipment 200,000 Amortization expense patents Other operating expenses Earnings from operating activities 27,000 197,000 496,000 Non-operating activities Interest expense Loss on sale of land Net earnings before income tax Income tax (30%) Net Earnings 160,000 100,000 236,000 70,800 $ 165.200 NIAKWA INDUSTRIES Comparative Statement of Financial Position December 31, 2020 2020 Assets Current Assets 2019 $ 200,000 $ 405,200 180,000 460,000 Cash Accounts Receivable 350,000 320,000 Investments Inventory Total Current Assets 2,336,000 3,381,200 2.090,000 2,960,000 Non-Current Assets Property, Plant, and Equipment Less: Accumulated Depreciation Patents, net Total Non-Current Assets Total Assets 880,000 (760,000) 192,000 312,000 $3.693.200 800,000 (560,000) 219,000 459,000 $3.419.000 Liabilities and Shareholders' Equity Current Liabilities Accounts Payable Accrued Payables Dividends Payable Income Taxes Payable $ 389,000 160,000 80,000 27,000 656,000 $ 265,000 240,000 80,000 42.000 627,000 Total Current Liabilities Non-Current Liabilities 180,000 900.000 Note Payable (Long-Term) 560,000 Bonds Pavable 400.000 Additional information: 1. Equipment was purchased for $400,000 cash in 2020. 2. Cash dividends of $40,000 were paid in 2020. 3. Land was sold for $220,000 cash in 2020. 4. Changes in the note payable and bonds payable accounts were through cash transactions. 5. Any additional transactions were non-cash transactions and can be ignored for this question. Required: Prepare a complete Statement of Cash Flows for 2020 using the indirect method for the operating section. Ignore supplementary disclosure.

Expert Answer:

Answer rating: 100% (QA)

Nikawa industries comparative STATEMENT analysis assets 2020 2019 increase decrease current assets c... View the full answer

Posted Date:

Students also viewed these finance questions

-

Comparative statements of financial position for Eddie Murphy Company are presented below. Additional information: 1. Net income for 2011 was $125,000. 2. Cash dividends of $60,000 were declared and...

-

The bookkeeper for Concord Corp. has prepared the following statement of financial position as at July 31, 2017: CONCORD CORP. Statement of Financial Position As at July 31, 2017 Cash $78,000...

-

Comparative statements of financial position for Erisa Magambo A/S are presented on the next page. Additional information: 1. Net income for 2017 was 120,000. 2. Cash dividends of 70,000 were...

-

Torres Investments acquired $160,000 of Murphy Corp., 5% bonds at their face amount on October 1, Year 1. The bonds pay interest on October 1 and April 1. On April 1, Year 2, Torres sold $60,000 of...

-

An escalator brings four people of total 300 kg, 25 m up in a building. Explain what happens with respect to energy transfer and stored energy.

-

(a) Consider the AF 3 molecules in Exercise 9.27. Which of these will have a nonzero dipole moment? (b) Which of the AF 4 molecules in Exercise 9.28 will have a zero dipole moment?

-

Why is it important to have a budget?

-

On December 31, 2012, Grando Company sells production equipment to Fargo Inc. for $50,000. Grando includes a 1-year warranty service with the sale of all its equipment. The customer receives and pays...

-

evaluate electrolux' syrategy in light of its vision and global yrends in the household appliance industry orEvaluate dtrategy in light of

-

If the indirect costs for each duration are $1,200 for 16 weeks, $1,130 for 15 weeks, $1,000 for 14 weeks, $900 for 13 weeks, $860 for 12 weeks, $820 for 11 weeks, and $790 for 10 weeks, compute the...

-

PepsiCo's financial summary for the year 2023: Description Amount ($) Revenue 70,372,000 Cost of Revenue 33,650,000 Operating Expenses 25,420,000 Interest Expense 1,850,000 Tax Rate 24% Requirements:...

-

15.5 please help will give like if answers r correct Exercise 15-8 (Static) Sales-type lease with selling profit; lessor; calculate lease payments [LO15-3] Manufacturers Southern leased high-tech...

-

When my son was young, he had 8 different plastic dinosaurs to arrange. How many ways could he arrange his 8 dinos? He had favorite dinos, so placing them in proper order was very important. How many...

-

Process P1 init (mutEx); num = 0; loop1 = 0; while (loop1 < 3) wait (mutEx); num num + 1; signal (mutEX); loop1 loop1 + 1; Process P2 loop2 = 0; while (loop2 < 2) wait (mutEx); num num + 10;...

-

PROBLEM 3-5B Following is the chart of accounts of Smith Financial Services: Assets 111 Cash 113 Accounts Receivable 115 Supplies 117 Prepaid Insurance 124 Office Furniture Liabilities 221 Accounts...

-

4. Identify a service you could refer Casey to and write a referral for her (up to 300 words).

-

Question 7 of 16 View Policies Current Attempt in Progress Condensed net income and cash flow information follow for three companies operating in the same indust Company A $76,000 105,000 Net income...

-

Subprime loans have higher loss rates than many other types of loans. Explain why lenders offer subprime loans. Describe the characteristics of the typical borrower in a subprime consumer loan.

-

What are the ways in which organizations adapt to environmental uncertainty (e.g., positions and departments, buffering and boundary spanning)? LO.1

-

How do Wamsley and Zald employ ownership and funding in making a distinction between public and private organizations? LO.1

-

What are differentiation and integration? LO.1

Study smarter with the SolutionInn App