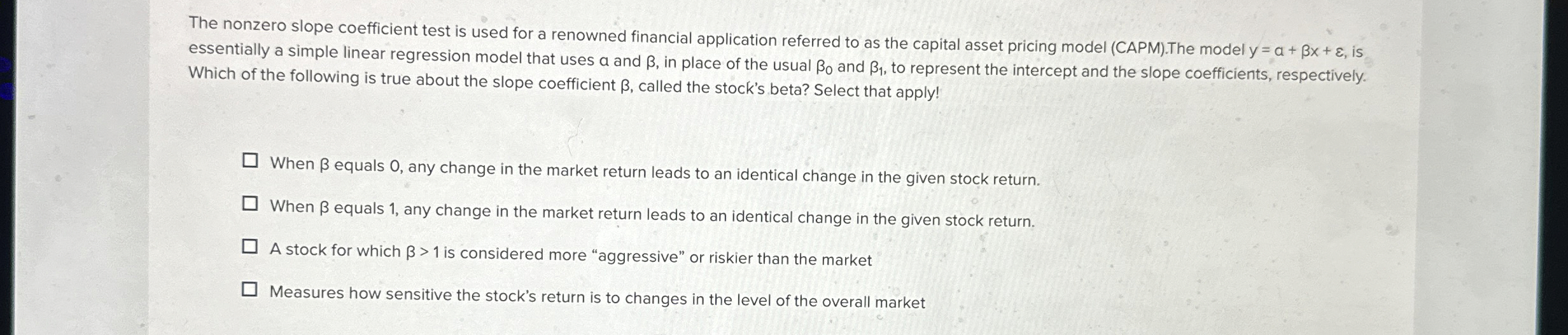

Question: The nonzero slope coefficient test is used for a renowned financial application referred to as the capital asset pricing model ( CAPM ) . The

The nonzero slope coefficient test is used for a renowned financial application referred to as the capital asset pricing model CAPMThe model is

essentially a simple linear regression model that uses and in place of the usual and to represent the intercept and the slope coefficients, respectively.

Which of the following is true about the slope coefficient called the stock's beta? Select that apply!

When equals any change in the market return leads to an identical change in the given stock return.

When equals any change in the market return leads to an identical change in the given stock return.

A stock for which is considered more "aggressive" or riskier than the market

Measures how sensitive the stock's return is to changes in the level of the overall market

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock