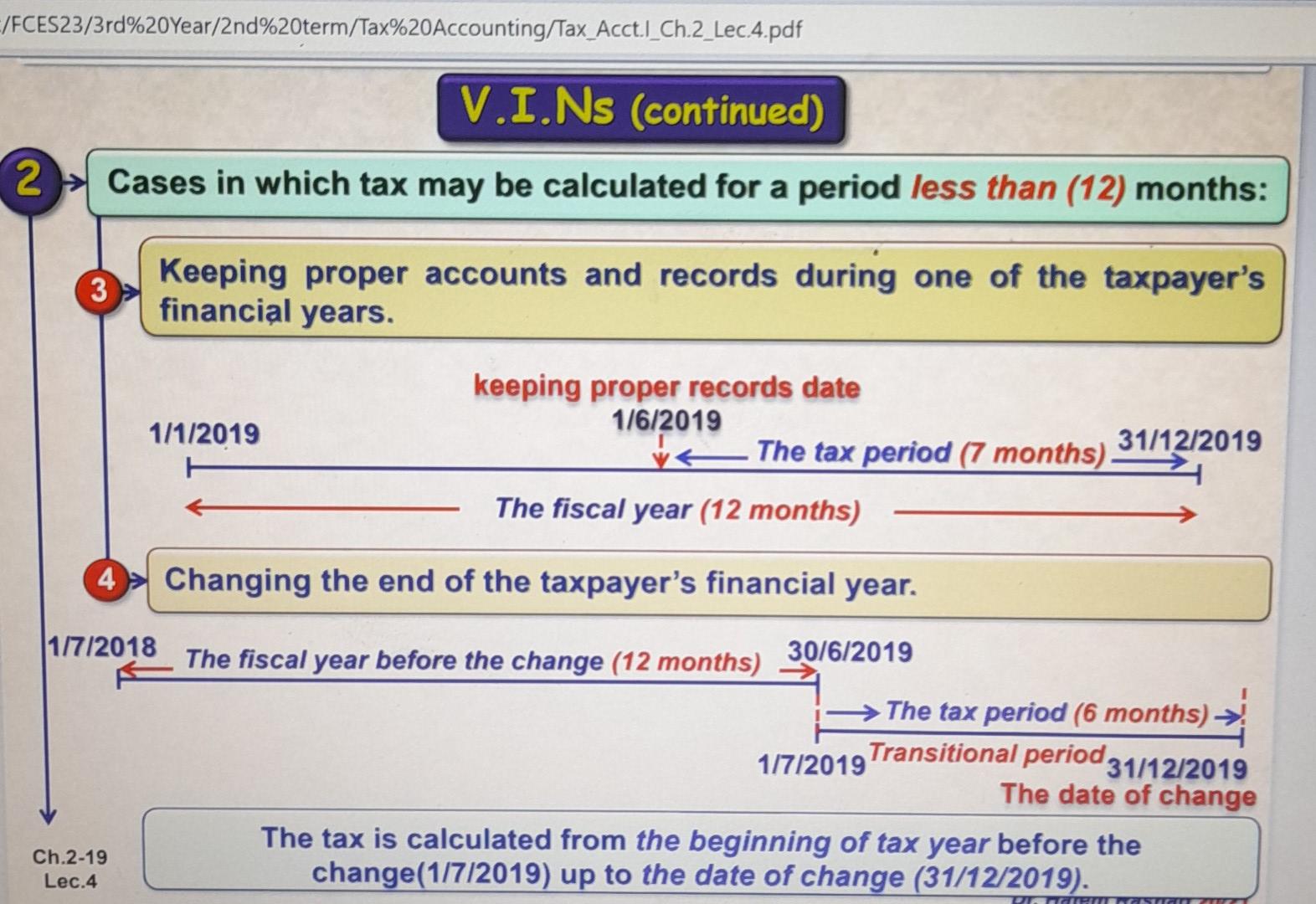

Question: The note says that tax should be calculated for a period less than 12 months if they are changing the end of the financial year,

The note says that tax should be calculated for a period less than 12 months if they are changing the end of the financial year, and if that's the case why should we calculate the tax from " the beginning of the tax year" before change up to" the date of change". If we did so would it not be more than 12 months?

E/FCES23/3rd%20Year/2nd%20term/Tax%20Accounting/Tax_Acct.l_Ch.2_Lec.4.pdf V.I.Ns (continued) 2 Cases in which tax may be calculated for a period less than (12) months: 3 Keeping proper accounts and records during one of the taxpayer's financial years. keeping proper records date 1/6/2019 1/1/2019 31/12/2019 The tax period (7 months). The fiscal year (12 months) 4 Changing the end of the taxpayer's financial year. 1/7/2018 The fiscal year before the change (12 months) 30/6/2019 The tax period (6 months) 1/7/2019 Transitional period. 31/12/2019 The date of change The tax is calculated from the beginning of tax year before the change(1/7/2019) up to the date of change (31/12/2019). Ch.2-19 Lec.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts